Rapport final – Recommandations sur la mise en oeuvre de la méthodologie de la majoration

Groupe de travail technique sur la méthodologie de la majoration

mars 2011

Introduction

La méthodologie de la majoration a été intégrée aux Lignes directrices qui sont entrées en vigueur le 1er janvier 2010 afin d'aborder les cas de réduction ou de cessation d'avantages aux clients. Lors de l'entrée en vigueur de ces Lignes directrices, le CEPMB a remarqué qu'il surveillerait et évaluerait leur application sur une base régulière afin d'examiner la nécessité d'y apporter des modifications supplémentaires.

Puisque l'examen des prix de produits médicamenteux brevetés existantsNote de bas de page 1 est effectué en fonction des données pour l'année complète, la méthodologie de la majoration n'a été appliquée dans aucun cas en 2010. Des discussions tenues avec les brevetés dans le cadre de certaines enquêtes en cours ont permis au CEPMB d'obtenir un aperçu préliminaire de l'application de la méthodologie de la majoration.

Le groupe de travail technique sur la méthodologie de la majoration (GTMM) a été établi afin de préciser les difficultés relatives à l'application de la méthodologie de la majoration en vertu des Lignes directrices et d'élaborer des solutions utiles pour s'assurer que le Conseil respecte l'objectif visé par cette méthodologie. Le GTMM a élaboré le présent rapport pour examiner les difficultés d'ordre pratique auxquelles font face l'industrie et le personnel du Conseil dans l'application de la méthodologie de la majoration et présenter des options au Conseil relativement à la mise en œuvre efficace de cette méthodologie.

But de la méthodologie de la majoration

Afin d'éviter de freiner l'offre d'« avantages » aux clients, le Conseil a adopté la méthodologie de la majoration en tant que solution de rechange relativement à l'application de la méthodologie de rajustement du prix selon l'IPC dans certaines situations précises. À l'appendice 10 des Lignes directrices, un avantage est défini comme suit : « des réductions accordées à titre de promotion ou sous forme de rabais, escompte, remboursement, biens ou services gratuits, cadeaux ou autres avantages semblables ».Note de bas de page 2

Disposition relative à la méthodologie de la majoration dans les lignes directrices

Selon la méthodologie de la majoration :

Lorsque le breveté soutient que le prix de son produit médicamenteux a augmenté dans une mesure plus grande que ne le permet la méthodologie du prix rajusté selon l'IPC parce qu'il a réduit ou cessé d'offrir des avantages à ses clients et qu'il présente des éléments de preuve à l'appui, le Prix moyen non excessif national du produit et (ou) les Prix moyens non excessifs du marché pourront augmenter dans une mesure plus grande que celle autorisée en vertu de la méthodologie de rajustement du prix selon l'IPC.

Bien que la forme exacte des éléments de preuve requis pour invoquer la méthodologie de la majoration varie selon le cas, l'appendice 10 des Lignes directrices fournit des directives générales aux brevetés et indique qu'ils doivent présenter les éléments suivants :

- Élément démontrant que, avant même de bénéficier de l'avantage, les clients étaient conscients que l'avantage qui leur était offert n'était pas offert à tous les clients;

- Le type et la valeur de l'avantage, le moment ou il a été offert ainsi que la façon dont il a été offert;

- Éléments prouvant la réduction ou la cessation de l'avantage ;

- Déclaration à savoir si le même client reçoit encore ou non d'autres avantages.

Lorsqu'un Prix de transaction moyen du marché d'un produit médicamenteux augmente dans une mesure plus grande que celle autorisée avec la méthodologie de rajustement du prix selon l'IPC et que le breveté présente les éléments de preuve exigés, le prix du produit médicamenteux peut augmenter jusqu'au Prix moyen non excessif le plus élevé d'une autre catégorie de client (province et territoire) sans être considéré excessif, pourvu que le prix ne dépasse pas la comparaison du prix au Canada avec le prix international.

La capacité de rebondissement d'un prix pour atteindre le Prix moyen non excessif le plus élevé d'un autre marché dépend de preuves selon lesquelles les avantages ne sont plus offerts sur le marché au moyen de la méthodologie de la majoration. Dans les marchés où des avantages sont continus, la méthodologie de la majoration restreint le rebondissement d'un prix à un prix qui est proportionnel à l'avantage restant. On entend par marché comparable le marché d'un hôpital, d'un grossiste et d'une pharmacie ainsi que chaque province et chaque territoire.

Groupe de travail technique sur la méthodologie de la majoration (GTMM)

Le GTMM était composé de trois représentants du l'industrie pharmaceutique novatrice, deux représentants de l'industrie biotechnologique, un représentant de l'industrie pharmaceutique générique, et quatre membres du personnel du Conseil, dont la présidente du groupe (voir l'annexe A pour une liste des membres du groupe). La directrice exécutive du CEPMB, Michelle Boudreau, a présidé les réunions et le personnel du Conseil a assuré les services de secrétariat. Quatre réunions du GTMM ont été tenues entre le 20 janvier 2011 et le 23 février 2011.

Le mandat du GTMM consistait à élaborer des conseils et des options relativement à la mise en œuvre efficace de la méthodologie de la majoration du CEPMB aux fins d'examen par le Conseil. Le GTMM était chargé de relever toute difficulté importante dans la mise en œuvre de la méthodologie de la majoration et de définir des options afin de résoudre ces difficultés. Toutefois, il était reconnu qu'il revenait au Conseil de prendre toute décision finale en ce qui concerne la méthodologie de la majoration et les Lignes directrices.

Questions et difficultés

À la lumière de discussions entre les brevetés et le personnel du Conseil dans le cadre d'enquêtes en cours, on a précisé les difficultés suivantes relativement à la mise en œuvre de la méthodologie de la majoration.

Éléments de preuve requis trop exigeants

Selon les brevetés, les éléments de preuve actuellement requis pour la mise en œuvre efficace de la méthodologie de la majoration sont trop exigeants. En effet, il est difficile pour les brevetés d'avoir recours aux ressources nécessaires afin de produire les éléments de preuve puisque les données ne sont pas toujours aisément disponibles, notamment pour des raisons d'ordre technique, comme la méthode d'enregistrement des données, ou en raison de fusions ou d'acquisitions.

Dans certains cas, il n'existe pas de contrat distinct pour chaque acheteur dans une catégorie (p. ex. achats groupés), ce qui rend difficile la tâche de prouver que, avant même de bénéficier de l'avantage, les clients étaient conscients que l'avantage qui leur était offert n'était pas offert à tous les clients. En outre, il se peut que plusieurs contrats soient attribués au sein d'une catégorie de client, ce qui engendre un travail complexe nécessitant de nombreux documents administratifs et ressources pour examiner les preuves relatives aux catégories de clients « sur un marché canadien ». Par conséquent, il faudrait repérer les données au niveau de chaque acheteur ou même au niveau de chaque transaction.

« Sur un marché canadien »

Une autre difficulté que pose l'application de la méthodologie de la majoration concerne l'examen des prix des produits médicamenteux brevetés existants sur chaque marché. Les Lignes directrices prévoient que lorsque le Prix de transaction moyen national (PTM-N) excède le Prix moyen non excessif national (PMNE-N) d'un montant qui déclenche les critères d'enquête, un examen soit réalisé pour chaque catégorie de client et chaque province ou territoire. Chaque catégorie de client et chaque province ou territoire possède un Prix moyen non excessif (PMNE); le prix sur chacun de ces marchés est également limité par la méthodologie de rajustement du prix selon l'IPC et, sauf dans le cas des grossistes, la Comparaison du prix au Canada avec le prix international le plus élevé. Par conséquent, si un breveté souhaite invoquer la méthodologie de la majoration dans le cadre d'une enquête, ce dernier doit tenir compte de tous les sous-marchés dont les prix semblent excessifs avant de pouvoir invoquer la méthodologie de la majoration et fermer l'enquête. En effet, l'exigence de tenir compte de tous les sous-marchés augmente de façon considérable le nombre d'éléments de preuve requis, et le temps que le personnel du Conseil doit consacrer à l'examen de ces renseignements résulte en un processus d'enquête de très longue haleine.

Questions connexes

Dans un communiqué envoyé aux brevetés en décembre 2010, le CEPMB a affirmé qu'il ne mettrait pas en œuvre actuellement les mesures concernant l'examen des prix de produits médicamenteux brevetés existants qui se rapportent à l'examen des prix sur un marché canadien et à la méthodologie de la majoration.

Le GTMM a soulevé deux questions supplémentaires concernant l'application de la méthodologie de la majoration, notamment :

(1) Une augmentation du Prix de transaction moyen (PTM) n'est pas forcément due à une augmentation de prix; elle peut résulter de conditions économiques indépendantes de la volonté des brevetés, telles que les variations des volumes en raison de la variabilité de l'application des avantages, le fait que certains marchés optent d'adhérer à certains avantages, la perte de contrats, etc. Par conséquent, il n'est pas juste de considérer toute variation du PTM comme une augmentation du prix.

(2) Les remboursements et les retours peuvent également avoir une incidence sur le calcul du PTM. Le PTM peut sembler révéler une inflation si les retours sont déclarés en termes d'unités et de recettes nettes. En raison des emplacements des entrepôts, il se peut que les retours soient crédités à un marché dans un autre province ou territoire que la transaction de vente initiale. Ceci fausse les ventes déclarées pour chaque marché et a une incidence sur le PTM au niveau national. Lorsque des retours d'un produit médicamenteux donnent lieu à des variations du PTM, le personnel du Conseil avise les brevetés de déclarer les données relatives aux retours sur une ligne distincte.

Principes Directeurs pour l'élaboration d'une solution

Les principes directeurs suivants ont été élaborés afin de déterminer les critères qui serviraient à évaluer les solutions proposées en vue d'améliorer l'application de la méthodologie de la majoration.

- Pratique : La méthodologie de la majoration doit être réalisable du point de vue technique et facile à gérer par le CEPMB et le breveté.

- Transparente : Une méthode de présentation des preuves normalisée et simplifiée est nécessaire.

- Prévisible et uniforme : La méthodologie de la majoration doit être universelle, c'est-à-dire qu'elle doit s'appliquer dans tous les cas, peu importe la grandeur de l'entreprise, le volume de produits vendus ou le type de produit. Elle doit également être aisée pour le breveté.

- Ne doit pas être fondée sur l'augmentation des prix : La méthodologie de la majoration doit être fondée sur l'ajustement des prix ou le rebondissement des prix plutôt que sur l'augmentation des prix.

- Vue d'ensemble : Une vue d'ensemble doit être primée afin de tenir compte des conditions sur le marché auxquelles dont face actuellement les brevetés.

- Aucune enquête ne doit être réalisée pour les années où le PTM a déjà été jugé conforme par le CEPMB : Dans le cadre d'une discussion relative à la méthodologie de la majoration, tout examen des données d'une année antérieure jugée conforme ne doit être réalisé qu'à titre informatif. Ainsi, en application des Lignes directrices du Conseil, toute enquête entamée par le CEPMB doit porter seulement sur l'année qui a déclenché les critères d'enquête.

- Terminologie appropriée : La terminologie ne doit pas être trop restreinte ou normative, ni si générale que les directives fournies sont imprécises.

Recommandations

Après avoir discuté de diverses options, y compris le statu quo, le groupe a convenu que la méthode actuellement utilisée pour appliquer la méthodologie de la majoration n'est pas efficace, et qu'elle ne respecte pas l'objectif visé par le Conseil à ce sujet. Le statu quo ne respecte donc pas les principes directeurs susmentionnés.

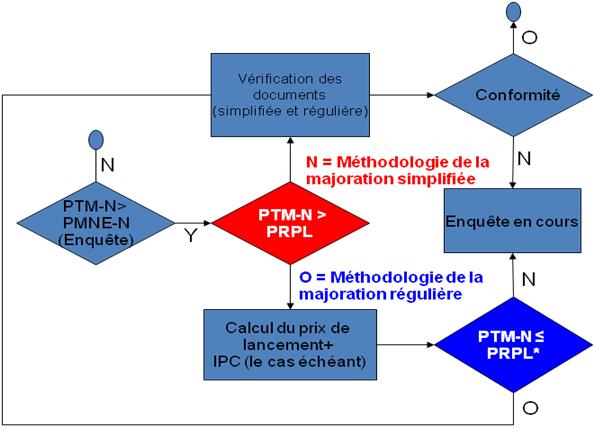

Afin de simplifier la présentation de rapports, le GTMM propose de diviser la méthodologie de la majoration en deux processus : la méthodologie de la majoration simplifiée et la méthodologie de la majoration régulière, tel qu'illustré au graphique 1.

Graphique 1: Diagramme du processus pour la méthodologie de la majoration simplifiée et régulière

Méthodologie de la majoration simplifiée

La méthodologie de la majoration simplifiée est une approche abrégée pour appliquer la méthodologie de la majoration dans les cas où le Prix de transaction moyen national (PTM-N) du produit médicamenteux breveté est inférieur ou égal au prix de référence pour la période de lancement (PRPL) du produit médicamenteux breveté en question.

Méthodologie de la majoration simplifiée lorsque : PTM-N = PRPL

Cela suit la logique que si le prix est inférieur à un niveau que le CEPMB a jugé non-excessif lors du lancement, moins d'éléments de preuve devraient être requis pour justifier un changement du PTM à la suite d'une variation des avantages.

Un formulaire comprenant les renseignements suivants devrait constituer le seul élément de preuve requis pour invoquer la méthodologie de la majoration simplifiée pour un produit médicamenteux breveté :

- Nom du produit

- DIN

- Période d'examen (devrait être la même que la période qui fait l'objet d'une enquête)

- Renseignements de base, y compris une description de la situation

- Courte description de l'avantage, notamment les dates d'entrée en vigueur et de cessation de l'avantage, le type et la valeur de l'avantage

- Paragraphe de certification avec texte standard, conformément au Formulaire 2 (le signataire doit être le même que sur le Formulaire 2).

Les données ci-dessus doivent satisfaire aux critèresNote de bas de page 3 établis dans les Lignes directrices pour invoquer la méthodologie de la majoration. Si un breveté présente les éléments de preuve susmentionnés, le personnel du Conseil doit en venir à la conclusion que les exigences relatives à la méthodologie de la majoration simplifiée ont été respectées et que le PTM du produit médicamenteux en question est conforme aux Lignes directrices. Par conséquent, l'enquête doit être fermée.

Méthodologie de la majoration régulière

La méthodologie de la majoration régulière est une version augmentée de la méthodologie de la majoration simplifiée, exigeant des preuves supplémentaires de la part des brevetés. On fait appel à la méthodologie de la majoration régulière lorsque le Prix de transaction moyen national (PTM-N) d'un produit médicamenteux breveté est supérieur au prix de référence pour la période de lancement, mais égal ou inférieur au prix de référence pour la période de lancement rajusté en fonction des augmentations de prix réels effectués par un breveté, c'est-à-dire les prix courants pour lesquels les augmentations de prix sont conformes aux Lignes directrices (PRPL* au graphique 1).

Méthodologie de la majoration régulière lorsque : PRPL < PTM-N = PRPL*

La méthodologie de la majoration ne s'appliquerait pas par défaut dans les cas où le Prix de transaction moyen national est supérieur au PRPL*. De plus amples enquêtes seraient requises.

De plus amples preuves seraient requises pour invoquer la méthodologie de la majoration régulière. Le GTMM recommande que les éléments de preuve suivants soient requis :

- Un formulaire rempli pour invoquer la méthodologie de la majoration simplifiée

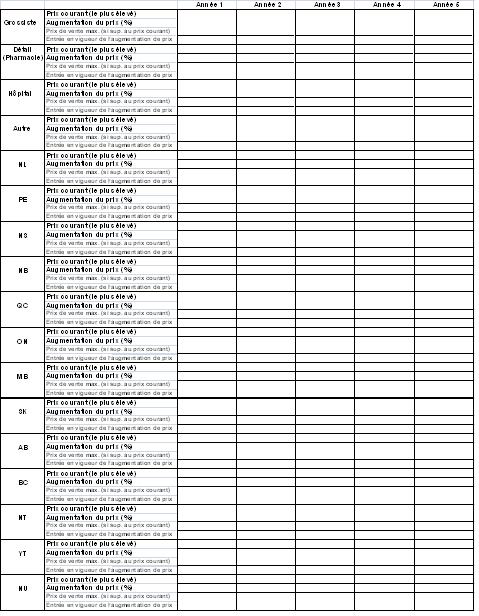

- Un tableau des augmentations de prix, conformément à l'annexe B (le personnel du Conseil vérifiera les données dans le tableau afin de s'assurer qu'il s'agit de prix qui ont été payés, selon les données des sections 4 et 5 ainsi que toute autre source pertinente)

- Des données doivent être présentées pour toutes les années à l'étude. À tout le moins, le nombre d'années pour lesquelles des données sont présentées doit correspondre à la durée du contrat ou de l'avantage.

- Le personnel du Conseil peut demander des factures, notamment dans les cas où les données de la section 4 ne correspondent pas aux renseignements sur les prix inclus dans le tableau.

- Le personnel du Conseil peut demander de plus amples preuves et données à l'appui, selon le cas.

Si on conclut qu'un breveté répond aux exigences de la méthodologie de la majoration régulière, le personnel du Conseil doit en venir à la conclusion que le PTM du produit médicamenteux en question est conforme aux Lignes directrices. Par conséquent, l'enquête doit être fermée.

On a également traité des incidences éventuelles des retours sur l'application de la méthodologie de la majoration. Lorsque des retours d'un produit médicamenteux donnent lieu à des variations du PTM, le personnel du Conseil avise les brevetés de déclarer les données relatives aux retours sur une ligne distincte.

Même si le mandat du GTMM se limitait à présenter des recommandations relativement à la méthodologie de la majoration, les membres étaient de l'avis que les dispositions actuelles dans les Lignes directrices concernant l'examen des prix au niveau des ventes « sur un marché canadien » ainsi que la méthodologie de rajustement du prix selon l'IPC ne sont pas propices à la mise en œuvre efficace de la solution proposée. Le GTMM soulève ces questions auprès du Conseil aux fins d'examen ultérieur. Néanmoins, la méthodologie de la majoration simplifiée et régulière donnent à entendre qu'aucun examen du prix ne sera effectué au niveau des ventes « sur un marché canadien ». En ce qui a trait aux éventuelles conséquences involontaires de la méthodologie de rajustement du prix selon l'IPC, le GTMM propose une solution provisoire fondée sur la pratique courante du personnel du Conseil dans le cas d'une modification de l'ensemble des ventes.

Conclusion

Peu importe la manière dont le Conseil décide de modifier la méthodologie de la majoration, l'objectif devrait être essentiellement de montrer de façon raisonnable et avec des preuves statistiquement valables qu'il y a eu modification des avantages. La recommandation mise de l'avant dans le présent rapport permet de respecter cet objectif, et satisfait également aux principes directeurs établis par le GTMM.

Outre les recommandations présentées relativement à la méthodologie de la majoration, un certain nombre d'autres questions ont été soulevées dans le présent rapport, mais ces dernières dépassaient le mandat du GTMM. Le Conseil est dont invité à examiner et à aborder ces questions supplémentaires dans le cadre de ses efforts continus visant à surveiller et évaluer la mise en œuvre des Lignes directrices.

Annexe A

Membres du groupe de travail technique sur la méthodologie de la majoration

(en ordre alphabétique)

| Member |

Title |

|

Matthew Bondy

|

Directeur intérimaire, Politiques et analyse économique

Conseil d'examen du prix des médicaments brevetés

|

|

Michelle Boudreau

Présidente

|

Directrice exécutive

Conseil d'examen du prix des médicaments brevetés

|

|

Leonor Ferreira

Représentant de l'industrie pharmaceutique générique

|

Directeur, Relations gouvernementales

Sandoz Canada Inc.

|

|

Peter Giakoumatos

Représentant de l'industrie pharmaceutique de marque

|

Gestionnaire, Stratégie de prix et contrats

Merck

|

|

Claudia Neuber

Représentante de l'industrie pharmaceutique de marque

|

Directrice, Établissement des prix et contrats

Astra Zeneca

|

|

Salma Pardhan

Secrétaire

|

Analyste principale des politiques

Conseil d'examen du prix des médicaments brevetés

|

|

Steve Popp

Représentant de l'industrie pharmaceutique de marque

|

Directeur, Établissement des prix et gestion des comptes

GlaxoSmithKline Inc.

|

|

Laurene Redding

Représentante de l'industrie biotechnologique

|

Directrice, Affaires gouvernementales et économiques

Takeda Canada Inc.

|

|

Kimberly Robinson

Représentante de l'industrie pharmaceutique de marque subsidiaire

|

Directrice, Stratégie de prix

Janssen Inc.

|

|

Janet Thompson Mar

Représentante de l'industrie biotechnologique

|

Directrice, Opérations contractuelles

Talecris Biotherapeutics

|

|

Ginette Tognet

|

Directrice, Réglementation et liaison auprès des brevetés

Conseil d'examen du prix des médicaments brevetés

|

Annexe B

Tableau des augmentations de prix