2014-15 Departmental Performance Report

The Honourable Jane Philpott

Minister of Health

Catalogue number: H79-2E-PDF

ISSN: 2368-1063

Table of Contents

Chairperson's Message

Section I: Organizational Expenditure Overview

Section II: Analysis of Program(s) by Strategic Outcome

Section III: Supplementary Information

Section IV: Organizational Contact Information

Appendix: Definitions

Endnotes

Chairperson's Message

I am pleased to present the 2014-15 Departmental Report for the Patented Medicine Prices Review Board (PMPRB).

The PMPRB is a consumer protection agency with a dual regulatory and reporting mandate. The PMPRB ensures that the prices of patented medicines sold in Canada are not excessive and it provides stakeholders with information on the latest trends in pharmaceutical sales and pricing and on pharmaceutical research and development (R&D) spending in Canada.

In terms of its regulatory mandate, in 2014-15, the PMPRB entered into Voluntary Compliance Undertakings in respect of five patented medicines, resulting in $2.8 million in excess revenues being paid to the Government of Canada by pharmaceutical patentees. The PMPRB also commenced a public hearing into the price of the patented medicine Soliris, the first such proceeding since 2012.

Over the past fiscal year the PMPRB has been focused on its four organizational priorities: the anticipated impact of recent and pending changes to foreign and domestic regulatory regimes; the continued implementation of the Management Action Plan for the program evaluation; decreasing regulatory burden; and aligning internal operations with Central Agency requirements.

To this end, we have deepened our knowledge of domestic and international pricing and reimbursement issues as well as continued to enhance reporting on foreign and Canadian drug price trends. In terms of the later, in December 2014, the PMPRB released Generic Drugs in Canada, 2013 which provides information on foreign-to-Canadian price ratios for generic drugs sold in Canada. In March 2015, the PMPRB published the NPDUIS CompassRx report which provides a comprehensive cost driver analysis of prescription drug expenditures for a select number of Canadian public drug plans. Looking ahead, in the autumn of 2015, we will release our International Price Comparison Study, 2015. The information contained in these reports, along with other NPDUIS studies, will assist pharmaceutical payers and policy makers in making informed reimbursement and policy choices.

Through our continued implementation of the Management Action Plan related to the Program Evaluation we have made strides in simplifying the Guidelines by establishing a new foreign price verification methodology and a decision-tree to provide patentees with greater certainty and transparency in determining what foreign price sources are acceptable for filing with PMPRB regulatory staff for Block 5 purposes. Similarly, the release of our Interpretation Policy in January 2015 reflects our continuing commitment to engaging our stakeholders and to expanding plain language offerings in PMPRB communications.

Over the past year, we continued to pursue opportunities to dialogue and share information with public and private payers to help them make more cost effective choices. As a result of these efforts, we obtained observer status with both the Drug Policy Advisory Committee (DPAC) and the Non-Insured Health Benefits (NIHB) Drugs and Therapeutics Advisory Committee. These partnerships will allow the PMPRB to share knowledge and best practices and provide ever more timely and relevant market intelligence.

Finally, in 2014, we initiated a year-long strategic planning process in an effort to chart a fresh course for the next quarter century which will see the PMPRB reaffirm its commitment to its consumer protection origins. The strategic priorities that emerged from this process are set out in the PMPRB’s 2015–2018 Strategic Plan. I am confident that the careful execution of these priorities in the coming years will enable the PMPRB to build on its prior successes and emerge from this period stronger and more effective than any time in its almost three decade long history.

Mary Catherine Lindberg

Section I: Organizational Expenditure Overview

Organizational Profile

Appropriate Minister: The Honorable Jane Philpott

Institutional Head: Mary Catherine Lindberg, Chairperson

Ministerial Portfolio: Health

Enabling Instrument(s): Patent Act i and Patented Medicines Regulations ii

Year of Incorporation / Commencement: 1987

Other:The Minister of Health is responsible for the pharmaceutical provisions of the Patent Act (Act) set out in sections 79 to 103. Although the Patented Medicine Prices Review Board (PMPRB) is part of the Health Portfolio, because of its quasi-judicial responsibilities the PMPRB carries out its mandate at arm's length from the Minister. It also operates independently of Health Canada, which approves drugs for safety and efficacy and quality; other Health Portfolio members, such as the Public Health Agency of Canada, the Canadian Institutes of Health Research and the Canadian Food Inspection Agency; and federal, provincial and territorial (F/P/T) public drug plans, which approve the listing of drugs on their respective formularies for reimbursement purposes; and the Common Drug Review, administered by the Canadian Agency for Drugs and Technologies in Health (CADTH), which recommends drugs that should qualify for reimbursement by participating public drug plans.

Organizational Context

Raison d’être

The PMPRB is an independent, quasi-judicial body created by Parliament in 1987. Its mandate is two-fold:

- Regulatory – to ensure that prices charged by patentees for patented medicines sold in Canada are not excessive; and

- Reporting – to report on pharmaceutical trends of all medicines and on research and development (R&D) spending by pharmaceutical patentees.

In carrying out its mandate, the PMPRB ensures that Canadians are protected from excessive prices for patented medicines sold in Canada and that stakeholders are informed on pharmaceutical trends.

Responsibilities

The PMPRB was created as a result of amendments to the Patent Act (Act) in 1987 (Bill C-22), and its remedial powers were strengthened by further amendments in 1993 (Bill C-91). These amendments were part of policy reforms intended to balance the PMPRB’s consumer protection mandate with patent protection measures intended to encourage the research and development efforts of pharmaceutical patentees.

The PMPRB has a dual mandate:

Patented Medicine Price Regulation

The PMPRB regulates “factory-gate” ceiling prices that patentees charge for prescription and non-prescription patented medicines sold in Canada to wholesalers, hospitals, pharmacies or others, for human and veterinary use, to ensure they are not excessive. The Board's mandate also includes medicines that are available under the Special Access Programme; through a Clinical Trial Application; and Investigational New Drug Products. Over-the-counter (OTC) patented medicines and patented medicines for veterinary use are regulated by the Board on a complaints basis.

If Staff determines that the price of a patented medicine appears to be excessive, and cannot reach a consensual resolution of the issue with the patentee, the Chairperson may hold a hearing on the matter if she is of the view that it is in the public interest.

The PMPRB’s adjudicative functions are carried out by Board Members. At a hearing, a panel composed of Board members acts as a neutral arbiter between Board Staff and the patentee. The Chairperson decides the composition of members on a panel. Provincial and territorial ministers of health have a statutory right to appear before the panel as parties, and other interested persons or groups may seek leave to participate as interveners.

In the event that a panel finds that the price of a patented medicine is in fact excessive, it can order a reduction of the price to a non-excessive level. It can also order a patentee to offset any excess revenues and, in cases where the panel determines there has been a policy of excessive pricing, it can double the amount to be offset.

Pharmaceutical Trends Reporting

The PMPRB reports annually to Parliament through the Minister of Health on its price review activities, the prices of patented medicines and price trends of all prescription drugs, and on the R&D expenditures reported by pharmaceutical patentees. In addition, as a result of the establishment of the National Prescription Drug Utilization Information System (NPDUIS) iii by F/P/T ministers of health in September 2001, the PMPRB conducts critical analysis of price, utilization, and cost trends for patented and non-patented prescription drugs so that key participants in Canada’s health care system have more comprehensive, accurate information on how all prescription drugs are being used and on the sources of cost pressures. This function is aimed at providing F/P/T governments and other interested stakeholders with a centralized credible source of information on pharmaceutical trends.

Strategic Outcome and Program Alignment Architecture

1. Strategic Outcome: Canadians are protected from excessive prices for patented medicines sold in Canada and stakeholders are informed on pharmaceutical trends.

1.1 Program: Patented Medicine Prices Review Program

1.2 Program: Pharmaceutical Trends Program

Internal Services

Organizational Priorities

| Priority |

Type1 |

Strategic Outcome [and/or] Program(s) |

| Assess the impact of recent and pending changes to foreign and domestic pharmaceutical regulatory systems on the work of the PMPRB |

New |

The PMPRB has only one SO and all risks are linked to that SO. This priority is linked to Programs 1.1 and 1.2. |

| Summary of Progress |

|

What progress has been made toward this priority?

Examine foreign to Canadian price trends.

- PMPRB Annual Report provides a comparison of Canadian patented drug prices to foreign patented drug prices and provides information on Canadian drug expenditures in the global context

- Generic Drugs in Canada, 2013 iv – published in December 2014, provides information on foreign-to-Canadian price ratios for generic drugs sold in Canada

- Released first edition of its flagship publication, NPDUIS CompassRx, March 2015

- In the autumn of 2015, the PMPRB will release its International Price Comparison Study, 2015, which will include information on the median international list price-to-Canadian price ratios for patented drugs

Study international developments related to pricing and reimbursement regimes and their significance to Canada

- Internal seminars on changes to international pricing regimes were held for policy and regulatory staff

- PMPRB obtained membership in the Pharmaceutical Pricing and Reimbursement Information (PPRI)v network and has strengthened ties and opened line of communication with international counterparts, including face-to-face meetings with visiting Australian and Chinese delegations.

Raise awareness in relevant federal departments (i.e., Industry Canada and Health Canada) on domestic and international pricing and R&D trends

- Briefed senior officials at Industry and Health Canada on domestic and international pricing and R&D trends and their implications for Canada’s pharmaceutical price regulation regime

- The PMPRB obtained observer status with both the Drug Policy Advisory Committee (DPAC) and the Non-Insured Health Benefits (NIHB) Drugs and Therapeutics Advisory Committee

Engage with industry, public and private drug plan managers, and other stakeholders, on identifying potential improvements to the price review process

- Continued dialogue with Working Group with Canada’s Research-Based Pharmaceutical Companies (Rx&D) to discuss potential improvements to the price review process

- Continued outreach sessions with industry and non-industry stakeholders on various aspects of the price review process (e.g., Researchers Forum, Townhall panel)

- Increased presentations and participation at various fora

- Increased formal and informal briefings to private sector stakeholders such as the Canadian Pharmaceutical Generic Association (CPGA) and the Canadian Health and Life Insurance Association (CHLIA) on issues of mutual interest

|

| Priority |

Type |

Strategic Outcome(s) [and/or] Program(s) |

| Continue implementation of the Management Action Plan in response to the PMPRB Program Evaluation Report |

Previously committed to |

The PMPRB has only one SO and all risks are linked to that SO. This priority is linked to Programs 1.1 and 1.2. |

| Summary of Progress |

What progress has been made toward this priority?

Expedite all PMPRB processes

Further simplify the Guidelines

- Monitoring and Evaluation Plan for the Major Changes in the Guidelines (GMEP 2014) ix assessment for 2014 completed and published on PMPRB website

- Established a new foreign price verification methodology to validate foreign prices patentees submit for each of the seven comparator countries listed in the Regulations

- Developed a decision-tree for use by patentees when an ex-factory price is not available in the recognized sources

Expand plain language offerings throughout all PMPRB communications

- Continued use of “In Brief” section of Annual Report

- Inclusion of Executive Summary in all NPDUIS reports

- Publication of the PMPRB Interpretation Policy x

- Publication of quarterly NEWSletter

Expand the target audience for outreach efforts

- Information sessions provided to public drug plan managers

- Fielded an increased number of requests from lead provinces in the pan-Canadian Pharmaceutical Alliance (pCPA) xi negotiations for international pricing information on patented drugs

- Increased formal and informal briefings to representatives of the private sector (CPGA and CHLIA) on issues of mutual interest

- More proactive communications strategy

|

| Priority |

Type |

Strategic Outcome [and/or] Program(s) |

| Decrease regulatory burden and make effective use of Board Staff and resources |

Previously committed to |

The PMPRB has only one SO and all risks are linked to that SO. This priority is linked to Programs 1.1 and 1.2. |

| Summary of Progress |

What progress has been made toward this priority?

Continue work on changing from two to one regulatory filing of price and sales data

- This initiative is on-going.

Implementation of the new Consumer Price Index (CPI) Adjustment methodology

- CPI methodology has been implemented

- Assist with efficiency by supporting other governments (i.e., Alberta in the adoption of the PMPRB’s Consumer Price Index (CPI) Adjustment methodology

Improved clarity and transparency through new decision tree policy on international price sources

|

| Priority |

Type |

Strategic Outcome [and/or] Program(s) |

| Align internal operational framework of the PMPRB with Central Agency requirements. |

New |

The PMPRB has only one SO and all risks are linked to that SO. This priority is linked to Programs 1.1 and 1.2. |

| Summary of Progress |

|

What progress has been made toward this priority?

Examine the PMPRB’s financial and human resources forecasting process for ways to improve the effectiveness of forecasts for decision making

- The PMPRB has developed an integrated financial and human resources forecasting process which is supported by a staffing plan and an Integrated HR and Salary Forecast Report

Assess the practices and processes in place to manage security

- Departmental Security Plan was approved and implementation began in the first quarter of 2015-16

- Established Departmental Security Committee which meets regularly

Complete the development and implementation of an electronic records and information management system to provide relevant and timely information to support decision making

- Records and Information Management System (RIMS) rolled out to all branches; widely used by PMPRB employees

- All records are housed in an Relational Data Base Management System

|

Risk Analysis

Key Risks

| Risk |

Risk Response Strategy |

Link to Program Alignment Architecture |

| Non-compliance with the Board's new Guidelines |

The PMPRB approved and published the GMEP assessment for 2014

The PMPRB communicates regularly with its stakeholders through a variety of means to facilitate the development of guidance documentation, and more broadly to ensure awareness of regulatory compliance requirements, including regular “outreach sessions” with stakeholders to provide guidance and advice. Guidance documents and other relevant information can be accessed on the PMPRB’s website at: www.pmprb-cepmb.gc.ca |

The PMPRB has only one SO and all risks are linked to that SO. This risk is linked to Program 1.1. |

| The rapid pace of change in the pharmaceutical environment, both internationally and domestically, poses an ongoing challenge to the PMPRB’s ability to carry out its mandate effectively. |

The PMPRB is committed to engaging with its stakeholders as appropriate when developing, reviewing and/or refining practices and materials for providing information and guidance on regulatory compliance and answering questions, as appropriate. For addition information on Stakeholder Engagement see the PMPRB Interpretation Policy, and the PMPRB’s Consultation Policy xii

In its Interpretation Policy, the PMPRB committed to expand plain language offerings throughout all PMPRB communications through the continued inclusion of an “In Brief” section in the Annual Report, the continued use of Executive Summaries in all NPDUIS reports and the continued use of research briefs to highlight findings and policy implications of analytical studies.

PMPRB funds continue to be committed to holding face-to-face outreach sessions with patentees and other relevant stakeholders, and to improving the accessibility and usefulness of material on the Board's website.

The PMPRB’s forthcoming Strategic Plan sets out a comprehensive action plan for addressing this risk.

|

The PMPRB has only one SO and all risks are linked to that SO. This risk is linked to Programs 1.1 and 1.2. |

| Changes respecting the pricing and reimbursement of patented medicines in the seven comparator countries listed in the Regulations may require the PMPRB to make adjustments to how international reference pricing is applied. |

Using public information, the PMPRB established a foreign price verification methodology xiii to validate foreign prices patentees submit for each of the seven comparator countries listed in the Regulations.xiv

In the event that an ex-factory price is not available in the PMPRB recognized sources xv the PMPRB will use a consistent approach in determining whether an alternate source is acceptable. A decision-tree xvi has been developed by Board Staff to provide patentees with greater certainty and transparency regarding these case-specific assessments.

Extensive analytical work on possible adjustments and their impact has been undertaken.

The PMPRB’s forthcoming Strategic Plan sets out a comprehensive action plan for addressing this risk.

|

The PMPRB has only one SO and all risks are linked to that SO. This risk is linked to Programs 1.1 and 1.2. |

| Use of Product Listing Agreements by public payers and, in the future, perhaps private payers, challenges the PMPRB's ability to ascertain the true price of a drug when used for reference purposes. |

As announced in the January 2015 issue of the PMPRB NEWSletter, the PMPRB will be switching its recognized foreign price source for Germany xvii from the Rote Liste to the Lauer-Taxe effective January 2016. Based on an internal review of current price sources, the PMPRB concluded that the Lauer-Taxe is a better and more reliable, publicly available, and comprehensive source of ex-factory prices in Germany.

In September 2014, the PMPRB hosted a webinar for NPDUIS participating jurisdictions to walk them through the highlights of the PMPRB 2013 Annual Report and the details of the NPDUIS cost driver model used for calculating prescription drug expenditures.

In 2014, the PMPRB was accepted as a member of the World Health Organization (WHO) for PPRI, and is actively exchanging information and sharing best practices with its international counterparts on issues linked to price transparency.

The PMPRB’s forthcoming Strategic Plan sets out a comprehensive action plan for addressing this risk.

|

The PMPRB has only one SO and all risks are linked to that SO. This risk is linked to Programs 1.1 and 1.2. |

| Changes to Canadian intellectual property policy, as a result of international trade negotiations and treaties, declining R&D activity and increasing prices. |

The PMPRB consults with stakeholders on the impact of these developments.

The Patent Act mandates the PMPRB to monitor and report on pharmaceutical R&D spending. Information on patentee spending on R&D can be found in the PMPRB’s Annual Report.

The PMPRB’s forthcoming Strategic Plan sets out a comprehensive action plan for addressing this risk.

|

The PMPRB has only one SO and all risks are linked to that SO. This risk is linked to Programs 1.1 and 1.2. |

The PMPRB communicates regularly with its stakeholders through a variety of means to facilitate the development of guidance documentation, and more broadly to promote compliance with the Excessive Price Guidelines. PMPRB Staff hosted outreach sessions for patentees in both Montreal and Toronto in June and December 2014 on how to file Form 2 data online and the latest information on the Guidelines and pharmaceutical trends. In addition, PMPRB Staff provided five one-on-one introductory information sessions to various patentees on its price regulation framework. Finally, the PMPRB posted an instructional video on its website entitled, Acquisition of DIN(s) From a Former Patentee 2 explaining how to complete a Form 1 in the event that a patentee has acquired a patented drug product from another patentee.

In January 2015, in continuation of its commitment to expand the use of plain language in all its public documents the PMPRB published its Interpretation Policy. The PMPRB remains committed to including an “In Brief” section in the Annual Report, Executive Summaries in all NPDUIS reports, and producing research briefs to highlight findings and policy implications of analytical studies.

Canada, like many countries, is facing escalating health care costs, as payer everywhere are struggling to reconcile finite drug budgets with patient access to promising but costly new health technologies. Between 2010 and 2012 alone, 23 European countries began planning or executed significant reforms to their pharmaceutical price regulatory framework to achieve greater cost savings.

At the same time as there reforms have been unfolding in Europe, patented drug prices in Canada have been rising relative to the European countries in the PMPRB7.

The PMPRB’s forthcoming Strategic Plan proposes a comprehensive action plan for addressing these developments. This includes more consumer focused reporting and regulation and framework modernization.

Actual Expenditures

Budgetary Financial Resources (dollars)

2014–15

Main Estimates |

2014–15

Planned Spending |

2014–15

Total Authorities

Available for Use |

2014–15

Actual Spending

(authorities used) |

Difference

(actual minus planned) |

| 10,927,030 |

10,927,030 |

11,197,168 |

7,930,280 |

(2,996,750) |

Human Resources (Full-Time Equivalents [FTEs])

2014–15

Planned |

2014–15

Actual |

2014–15

Difference

(actual minus planned)

|

| 73.0 |

56.2 |

(16.8) |

Budgetary Performance Summary for Strategic Outcome and Programs (dollars)

| Strategic Outcome, Programs and Internal Services |

2014–15 Main Estimates |

2014–15 Planned Spending |

2015–16 Planned Spending |

2016–17 Planned Spending |

2014–15 Total Authorities Available for Use |

2014–15 Actual Spending (authorities used) |

2013–14 Actual Spending (authorities used) |

2012–13 Actual Spending (authorities used) |

| Strategic Outcome 1: Canadians are protected from excessive prices for patented medicines sold in Canada and stakeholders are informed on pharmaceutical trends. |

| Patented Medicine Price Review Program |

6,827,010 |

6,827,010 |

6,834,096 |

6,834,096 |

7,004,647 |

3,543,891 |

6,395,602 |

3,888,795 |

| Pharmaceutical Trends Program |

1,267,557 |

1,267,557 |

1,506,994 |

1,506,994 |

1,292,325 |

1,301,871 |

1,146,790 |

983,279 |

| Subtotal |

8,094,567 |

8,094,567 |

8,341,090 |

8,341,090 |

8,296,972 |

4,845,762 |

7,542,392 |

4,872,074 |

| Internal Services Subtotal |

2,832,463 |

2,832,463 |

2,604,091 |

2,604,091 |

2,900,196 |

3,084,518 |

2,998,175 |

3,184,729 |

| Total |

10,927,030 |

10,927,030 |

10,945,181 |

10,945,181 |

11,197,168 |

7,930,280 |

10,540,567 |

8,056,803 |

The 2014-15 Estimates amount includes funding for a Special Purpose Allotment (SPA) in the amount of $2,470,000. The SPA is for conducting Public Hearings and can only be used to cover costs such as external legal counsel, expert witnesses, etc. Planned Spending for 2014-15 through to 2016-17 is based on the assumption the PMPRB will spend the all funds held in the SPA. This is done because these expenditures are dependent on the number of hearings, and the length and complexity of the hearings held, which are difficult to predict.

Actual spending in 2013-14 was considerably higher than actual spending in 2012-13 largely due to a Federal Court decision which directed that a payment of excess revenues in the sum of $2,801,285 be returned by the PMPRB to the patentee with appropriate interest and specified costs.

Alignment of Spending With the Whole-of-Government Framework

Alignment of 2014-15 Actual Spending With the Whole-of-Government Framework xviii (dollars)

| Strategic Outcome |

Program |

Spending Area |

Government of Canada Outcome |

2014–15

Actual Spending |

| Canadians are protected from excessive prices for patented medicines sold in Canada and stakeholders are informed on pharmaceutical trends. |

Patented Medicine Prices Regulation Program |

Social Affairs |

Healthy Canadians |

3,543,891 |

| Pharmaceutical Trends Program |

Social Affairs |

Healthy Canadians |

1,301,871 |

Total Spending by Spending Area (dollars)

| Spending Area |

Total Planned Spending |

Total Actual Spending |

| Economic Affairs |

|

|

| Social Affairs |

8,094,567 |

4,845,762 |

| International Affairs |

|

|

| Government Affairs |

|

|

Departmental Spending Trend

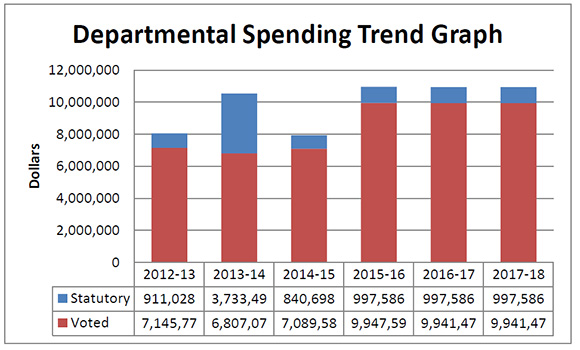

Figure description

This graph shows the PMPRB's spending trend. It illustrates on a bar graph the actual statutory and voted spending for 2012-13, 2013-14 and 2014-15, and planned statutory and voted spending in 2015-16, 2016-17 and 2017-18.

Statutory spending in 2013-14 was significantly higher than statutory spending in 2012-13 largely due to additional funding received through an adjustment warrant to cover the amount the PMPRB was ordered by the Federal Court to refund a patentee. The Federal Court quashed a Board Order and directed in its judgement that a payment of excess revenues in the sum of $2,801,285 be returned by the PMPRB to the patentee with appropriate interest and specified costs.

Expenditures by Vote

For information on PMPRB’s organizational voted and statutory expenditures, consult the Public Accounts of Canada 2015 xix, which is available on the Public Works and Government Services Canada website xx.

Section II: Analysis of Program(s) by Strategic Outcome

Strategic Outcome:

Canadians are protected from excessive prices for patented medicines sold in Canada and stakeholders are informed on pharmaceutical trends.

Program 1.1: Patented Medicine Prices Review Program

Description

The PMPRB is an independent quasi-judicial body that is responsible for ensuring that the prices that patentees charge for patented medicines sold in Canada are not excessive based on the price review factors in the Patent Act (Act). To make this determination the Board must consider each of the following factors: prices at which the medicine and other medicines in the same therapeutic class have been sold in Canada and in the seven comparator countries listed in the Patented Medicines Regulations (Regulations); changes in the Consumer Price Index (CPI); and in accordance with the Act, such other factors as may be specified in any regulations made for the purposes of the price review.xxi Under the Act, and as per the Regulations, patentees are required to file price and sales information for each patented medicine sold in Canada, for the duration of the patent(s). Board Staff reviews the introductory and ongoing information filed by patentees, for all patented medicines sold in Canada. When it finds that the price of a patented medicine appears to be excessive, Board Staff will conduct an investigation into the price. An investigation could result in: its closure where it is concluded that the price was non-excessive; a Voluntary Compliance Undertaking (VCU) by the patentee to reduce the price and offset excess revenues obtained as a result of excessive prices through a payment and/or a price reduction of another patented drug product; or a public hearing to determine if the price is excessive, including any remedial order determined by the Board. In the event that the Board Hearing Panel finds, after a public hearing, that a price is or was excessive, it may order the patentee to reduce the price and take measures to offset any excess revenues. This program, by reviewing the prices charged by patentees for patented medicines sold in Canada, protects Canadians and the health care system from excessive prices.

Budgetary Financial Resources (dollars)

| 2014–15 Main Estimates |

2014–15 Planned Spending |

2014–15 Total Authorities Available for Use |

2014–15 Actual Spending (authorities used) |

2014–15 Difference (actual minus planned) |

| 6,827,010 |

6,827,010 |

7,004,647 |

3,543,891 |

(3,283,119) |

Human Resources (Full-Time Equivalents [FTEs])

| 2014–15 Planned |

2014–15 Actual |

2014–15 Difference(actual minus planned) |

| 44.0 |

24.7 |

(19.3) |

Performance Results

| Expected Results |

Performance Indicators |

Targets |

Actual Results |

| Patentees comply with the Patent Act, the Regulations and the Excessive Price Guidelines (Guidelines) |

Percentage of patented medicines that are priced, as a result of voluntary compliance, within the Guidelines or at a price which does not trigger the investigation criteria |

95% |

95.3% xxii |

| Percentage of compliance with Board Orders related to price and/or jurisdiction and with Voluntary Compliance Undertakings (VCUs) |

100% |

100% |

| Canadian prices for patented medicines are on average in line with prices in the seven comparator countries listed in the Regulations |

Canadian prices for new patented medicines are on average at or below the median of international prices |

100% |

as in previous years, Canadian prices were typically within the range of prices observed among the comparator countries |

| Canadian prices for existing patented medicines are on average at or below the median of international prices |

100% |

as in previous years, Canadian prices were typically within the range of prices observed among the comparator countries, although they have been steadily rising relative to these countries since 2005. |

Performance Analysis and Lessons Learned

Detailed information on the results of price reviews for 2014 can be found in the PMPRB Annual Report 2014, (Regulating Prices of Patented Medicines).

Prior to the establishment of the PMPRB, Canadian patented drug prices were outpacing the general rate of inflation as measured by the Consumer Price Index (CPI) and were 23% above the median of foreign prices, second only to the United States (US) among the PMPRB7. Since that time, annual price increases have remained well below CPI almost without exception, whereas prices overall have been at or below the international median following important revisions to the PMPRB’s guidelines in 1994. xxiii

More recently, however, Canadian patented drug prices have been steadily rising relative to prices in the PMPRB7. Whereas in 2005 Canadian prices were third lowest of these seven countries, in 2013 they were third highest, nearly at par with Germany but still well below the US and on average still below the international median. If the PMPRB is to remain true to its original mandate, it must modernize its regulatory framework and adopt a more consumer-centric approach to how it carries out its regulatory and reporting functions.

Detailed information on Canadian drug prices relative to drug prices in the comparator countries for 2014 can be found in the PMPRB Annual Report 2014, Key Pharmaceutical Trends: Drug Sales are on the Rise.

Program 1.2: Pharmaceutical Trends Program

Description

The PMPRB reports annually to Parliament through the Minister of Health on its price review activities, the prices of patented medicines and price trends for all drugs, and R&D expenditures as reported by pharmaceutical patentees. In supporting this requirement, the pharmaceutical trends program provides complete and accurate information on trends in manufacturers' prices of patented medicines sold in Canada and on patentees' research-and-development expenditures to interested stakeholders including: industry (i.e., brand-name, biotech, generic); federal, provincial and territorial (F/P/T) governments; consumer and patient advocacy groups; third party payers; and others. This information also provides assurance to Canadians that the prices of patented medicines are not excessive. In addition, as a result of the establishment of the National Prescription Drug Utilization Information System (NPDUIS) by F/P/T ministers of health the Federal Minister of Health requested that the PMPRB conduct analysis of price, utilization and cost trends for patented and non-patented prescription drugs so that Canada's health system has more comprehensive, accurate information on how all prescription drugs are being used and on the sources of cost increases. This function is aimed at providing F/P/T governments and other interested stakeholders with a centralized credible source of information on all prescription drug prices.

Budgetary Financial Resources (dollars)

| 2014–15 Main Estimates |

2014–15 Planned Spending |

2014–15 Total Authorities Available for Use |

2014–15 Actual Spending (authorities used) |

2014–15 Difference (actual minus planned) |

| 1,267,557 |

1,267,557 |

1,292,325 |

1,301,871 |

34,314 |

Human Resources (Full-Time Equivalents [FTEs])

| 2014–15 Planned |

2014–15 Actual |

2014–15 Difference (actual minus planned) |

| 11.0 |

9.2 |

(0.8) |

Performance Results

| Expected Results |

Performance Indicators |

Targets |

Actual Results |

| Information on pharmaceutical trends and cost drivers is available to stakeholders |

Number of new reports/studies posted on the PMPRB website |

12 reports/studies |

15 reports/studies |

| Number of presentations made by the PMPRB to an external audience |

10 information sessions |

25 information sessions |

Performance Analysis and Lessons Learned

In 2014-15, in addition to its Annual Report, the PMPRB published the following reports/studies:

Foreign Price Verification Methodology

Decision-tree for Determining Foreign Price Sources

NPDUIS Compass Rx 1st Edition, March 2015

Analysis Brief: NPDUIS CompassRx, 1st Edition, March 2015

New Drug Pipeline Monitor, 6th Edition, December 2014

Generic Drugs in Canada, 2013, December 2014

Utilization of Prescription Opioids in Canada's Public Drug Plans, 2006/07 to 2012/13, April 2014

Posters, 2015 Centre for Health Services and Policy Research (CHSPR) Health Policy Conference, March 2015

Generic Drugs in Canada, 2013

Cost Drivers of Private Drug Plans in Canada, 2012/13

Cost Drivers of Public Drug Plans in Canada, 2012/13

The Use of Gabapentin in Public Drug Plans

Monitoring New Drugs in Canada: A Multifaceted Approach

Generic Drugs in Canadian Private Plans, 2005–2013

Posters, 2014 Canadian Association for Health Services and Policy Research (CAHSPR) Conference, May 2014

Private Drug Plans in Canada

New Drug Pipeline Monitor

The PMPRB has played a long-standing role supporting efforts under the Value Price Initiative (now, pan-Canadian Pharmaceutical Alliance (pCPA)) to achieve significant reductions on generic drug prices. For several years this consisted mainly of providing comparative data on generic drug prices in Canada relative to international prices. More recently, however, the PMPRB has been fielding an increasing number of requests from lead provinces in pCPA negotiations for international pricing information on patented brand drugs. Alberta’s recent adoption of the PMPRB’s CPI methodology as a way of regulating price increases for both patented and non-patented drugs in that province speaks to the closeness of this federal-provincial partnership. Similar potential opportunities exist in the private market, as there is no independent government body that studies and reports on reimbursement and purchasing issues that are unique to private insurers and out-of-pocket payers.

The PMPRB must enhance awareness of its consumer protection mandate and build on its honest broker reputation with stakeholders and the public at large by: intensifying its partnership with public payers to provide even more timely and relevant market intelligence; expanding the scope of pharmaceutical topics it reports on to provide private payers and consumers with information to help them make better, more cost effective choices; working closely with international counterparts in sharing knowledge and best practices; and adopting a more proactive approach to communicating its regulatory and reporting achievements to stakeholders and the public.

Internal Services

Description

Internal Services are groups of related activities and resources that are administered to support the needs of programs and other corporate obligations of an organization. These groups are Management and Oversight Services, Communications Services, Legal Services, Human Resources Management Services, Financial Management Services, Information Management Services, Information Technology Services, Real Property Services, Materiel Services, Acquisition Services, and Travel and Other Administrative Services. Internal Services include only those activities and resources that apply across an organization and not those provided to a specific program.

Budgetary Financial Resources (dollars)

| 2014–15 Main Estimates |

2014–15 Planned Spending |

2014–15 Total Authorities Available for Use |

2014–15 Actual Spending (authorities used) |

2014–15 Difference (actual minus planned) |

| 2,832,463 |

2,832,463 |

2,900,196 |

3,084,518 |

252,055 |

Human Resources (FTEs)

| 2014–15 Planned |

2014–15 Actual |

2014–15 Difference (actual minus planned) |

| 19.0 |

22.3 |

3.3 |

Performance Analysis and Lessons Learned

In 2014-15, the PMPRB established an integrated process for establishing current and future staffing and budget needs/strategies. The Management Committee in collaboration with the Chief, Finance Services and the Chief, HR Services review the budget and staffing requirements of the entire organization regularly and each director must risk manage his or her branch A-base budget allocation.

The development and implementation of the electronic document management system, RIMS was completed. All branches are now trained and RIMS is being used by all employees.

Over the past year, the PMPRB now has in place an approved Departmental Security Plan and an action plan for its implementation. In addition, the PMPRB undertook a Security Information Bulletin campaign and established a Departmental Security Committee which meets regularly to discuss security issues.

Section III: Supplementary Information

Financial Statements Highlights

Condensed Statement of Operations (unaudited)

For the Year Ended March 31, 2015

(dollars)

| Financial Information |

2014–15 Planned Results* |

2014–15 Actual |

2013–14 Actual |

Difference

(2014–15 actual minus

2014–15 planned) |

Difference

(2014–15 actual minus

2013–14 actual) |

| Total expenses |

12,515,942 |

8,806,161 |

8,749,006 |

(3,709,781) |

57,155 |

| Total revenues |

- |

114 |

213 |

114 |

(99) |

| Net cost of operations before government funding and transfers |

12,515,942 |

8,806,047 |

8,748,793 |

(3,709,895) |

57,254 |

*Planned spending in 2014-15 is based on the assumption that the PMPRB will spend the full $2,470,000 held in the SPA reserved for conducting public hearings. This is done because these expenditures are dependent on the number of hearings, and the length and complexity of the hearings held, which are difficult to predict.

** Revenues that are non-respendable are not available to discharge the Board's liabilities. Non-respendable revenues are earned on behalf of the Government of Canada. The PMPRB collects non-respendable revenues as a result of payments made by patentees to the Government of Canada through Voluntary Compliance Undertakings (VCUs) or Board Orders to offset excess revenues. In 2014-15, the PMPRB collected non-respendable revenues in the amount of $2,731,123. In 2013-14, the non-respendable revenues were $10,605,109.

|

Condensed Statement of Financial Position (unaudited)

As at March 31, 2015

(dollars)

| Financial Information |

2014–15 |

2013–14 |

Difference (2014–15 minus 2013–14) |

| Total net liabilities |

1,510,991 |

1,112,115 |

398,876 |

| Total net financial assets |

851,654 |

571,604 |

280,050 |

| Departmental net debt |

659,337 |

540,511 |

118,826 |

| Total non-financial assets |

165,738 |

73,343 |

92,395 |

| Departmental net financial position |

(493,599) |

(467,168) |

(26,431) |

Total Liabilities

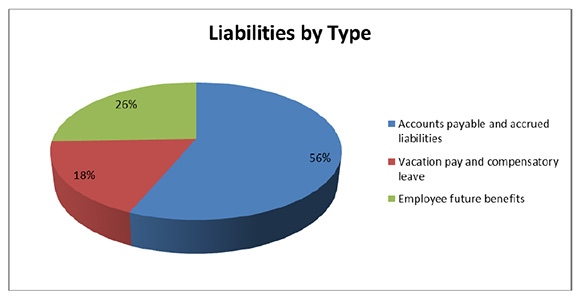

Figure description

Total liabilities were $1,510,991 as at the end of 2014-15, an increase of $398,876 from the previous year. The increase in liabilities was as follows:

- Accounts payable and accrued liabilities increased by $280,467.

- Vacation pay and compensatory leave increased by $20,634.

- Employee future benefits increased by $97,775.

Total Liabilities

Total liabilities were $1,510,991 as at the end of 2014-15, an increase of $398,876 from the previous year. The increase in liabilities was as follows:

- Accounts payable and accrued liabilities increased by $280,467.

- Vacation pay and compensatory leave increased by $20,634.

- Employee future benefits increased by $97,775.

Total Assets

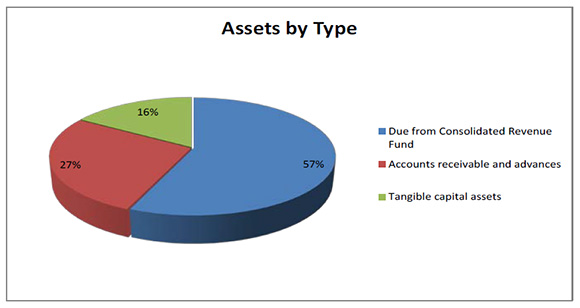

Figure description

Total assets were $1,017,392 as at the end of 2014-15, an increase of $372,445 from the previous year. The variances in assets were as follows:

- Increase in Due from the Consolidated Revenue Fund of $191,691.

- Increase in Accounts receivable and advances of $88,359

- Increase in Tangible capital assets of $92,395.

Total Assets

Total assets were $1,017,392 as at the end of 2014-15, an increase of $372,445 from the previous year. The variances in assets were as follows:

- Increase in Due from the Consolidated Revenue Fund of $191,691.

- Increase in Accounts receivable and advances of $88,359

- Increase in Tangible capital assets of $92,395.

Financial Statements

The financial highlights presented within this Departmental Performance Report are intended to serve as a general overview of the PMPRB’s financial position and operations. The PMPRB’s Financial Statementsxxiv can be found on its website.

Supplementary Information Tables

The supplementary information tables listed in the 2014–15 Departmental Performance Report are available on the PMPRB’s website.

Tax Expenditures and Evaluations

The tax system can be used to achieve public policy objectives through the application of special measures such as low tax rates, exemptions, deductions, deferrals and credits. The Department of Finance Canada publishes cost estimates and projections for these measures annually in the Tax Expenditures and Evaluations xxvii publication. The tax measures presented in the Tax Expenditures and Evaluations publication are the responsibility of the Minister of Finance.

Section IV: Organizational Contact Information

The Patented Medicine Prices Review Board

Box L40

Standard Life Centre

333 Laurier Avenue West

Suite 1400

Ottawa, Ontario K1P 1C1

Telephone: (613) 952-7360

Toll-free no.: 1-877-861-2350

Facsimile: (613) 952-7626

TTY: (613) 957-4373

Email: pmprb@pmprb-cepmb.gc.ca

Website: www.pmprb-cepmb.gc.ca

Appendix: Definitions

appropriation (crédit): Any authority of Parliament to pay money out of the Consolidated Revenue Fund.

budgetary expenditures (dépenses budgétaires): Includes operating and capital expenditures; transfer payments to other levels of government, organizations or individuals; and payments to Crown corporations.

Departmental Performance Report (rapport ministériel sur le rendement): Reports on an appropriated organization’s actual accomplishments against the plans, priorities and expected results set out in the corresponding Report on Plans and Priorities. These reports are tabled in Parliament in the fall.

full-time equivalent (équivalent temps plein): Is a measure of the extent to which an employee represents a full person-year charge against a departmental budget. Full-time equivalents are calculated as a ratio of assigned hours of work to scheduled hours of work. Scheduled hours of work are set out in collective agreements.

Government of Canada outcomes (résultats du gouvernement du Canada): A set of 16 high-level objectives defined for the government as a whole, grouped in four spending areas: economic affairs, social affairs, international affairs and government affairs.

Management, Resources and Results Structure (Structure de la gestion, des ressources et des résultats): A comprehensive framework that consists of an organization’s inventory of programs, resources, results, performance indicators and governance information. Programs and results are depicted in their hierarchical relationship to each other and to the Strategic Outcome(s) to which they contribute. The Management, Resources and Results Structure is developed from the Program Alignment Architecture.

non-budgetary expenditures (dépenses non budgétaires): Includes net outlays and receipts related to loans, investments and advances, which change the composition of the financial assets of the Government of Canada.

performance (rendement): What an organization did with its resources to achieve its results, how well those results compare to what the organization intended to achieve and how well lessons learned have been identified.

performance indicator (indicateur de rendement): A qualitative or quantitative means of measuring an output or outcome, with the intention of gauging the performance of an organization, program, policy or initiative respecting expected results.

performance reporting (production de rapports sur le rendement): The process of communicating evidence-based performance information. Performance reporting supports decision making, accountability and transparency.

planned spending (dépenses prévues): For Reports on Plans and Priorities (RPPs) and Departmental Performance Reports (DPRs), planned spending refers to those amounts that receive Treasury Board approval by February 1. Therefore, planned spending may include amounts incremental to planned expenditures presented in the Main Estimates.

A department is expected to be aware of the authorities that it has sought and received. The determination of planned spending is a departmental responsibility, and departments must be able to defend the expenditure and accrual numbers presented in their RPPs and DPRs.

plan (plan): The articulation of strategic choices, which provides information on how an organization intends to achieve its priorities and associated results. Generally a plan will explain the logic behind the strategies chosen and tend to focus on actions that lead up to the expected result.

priorities (priorité): Plans or projects that an organization has chosen to focus and report on during the planning period. Priorities represent the things that are most important or what must be done first to support the achievement of the desired Strategic Outcome(s).

program (programme): A group of related resource inputs and activities that are managed to meet specific needs and to achieve intended results and that are treated as a budgetary unit.

Program Alignment Architecture (architecture d’alignement des programmes): A structured inventory of an organization’s programs depicting the hierarchical relationship between programs and the Strategic Outcome(s) to which they contribute.

Report on Plans and Priorities (rapport sur les plans et les priorités): Provides information on the plans and expected performance of appropriated organizations over a three-year period. These reports are tabled in Parliament each spring.

result (résultat): An external consequence attributed, in part, to an organization, policy, program or initiative. Results are not within the control of a single organization, policy, program or initiative; instead they are within the area of the organization’s influence.

statutory expenditures (dépenses législatives): Expenditures that Parliament has approved through legislation other than appropriation acts. The legislation sets out the purpose of the expenditures and the terms and conditions under which they may be made.

Strategic Outcome (résultat stratégique): A long-term and enduring benefit to Canadians that is linked to the organization’s mandate, vision and core functions.

sunset program (programme temporisé): A time-limited program that does not have an ongoing funding and policy authority. When the program is set to expire, a decision must be made whether to continue the program. In the case of a renewal, the decision specifies the scope, funding level and duration.

target (cible): A measurable performance or success level that an organization, program or initiative plans to achieve within a specified time period. Targets can be either quantitative or qualitative.

voted expenditures (dépenses votées): Expenditures that Parliament approves annually through an Appropriation Act. The Vote wording becomes the governing conditions under which these expenditures may be made.

whole-of-government framework (cadre pangouvernemental): Maps the financial contributions of federal organizations receiving appropriations by aligning their Programs to a set of 16 government-wide, high-level outcome areas, grouped under four spending areas.

Endnotes

i. Patent Act, http://www.laws-lois.justice.gc.ca/eng/acts/P-4/

ii. Patented Medicines Regulations, http://laws-lois.justice.gc.ca/eng/regulations/SOR-94-688/index.html

iii. Additional information on the National Prescription Drug Utilization Information System can be found on the PMPRB website, http://www.pmprb-cepmb.gc.ca/en/npduis/about-npduis&lang=en

iv. Generic Drugs in Canada, 2013, December 2014, can be found on the PMPRB website, http://www.pmprb-cepmb.gc.ca/view.asp?ccid=1122&lang=en

v. Pharmaceutical Pricing and Reimbursement Information (PPRI) is a networking and information-sharing initiative on burning issues of pharmaceutical policies from a public health perspective. It involves a network of around 70 institutions (mainly relevant authorities and third party payers) from all 28 European Union Member States plus more than ten further, mainly European, countries.

vi. The service standard for the scientific review of new patented drug products and the results for 2014 can be found on the PMPRB website, http://www.pmprb-cepmb.gc.ca/view.asp?ccid=499&lang=en

vii. The service standard for the price review of new patented drug products and the results for 2014 can be found on the PMPRB website, http://www.pmprb-cepmb.gc.ca/view.asp?ccid=500&lang=en

viii. The service standard for the price review of existing patented drug products and the results for 2014 can be found on the PMPRB website, http://www.pmprb-cepmb.gc.ca/view.asp?ccid=501&lang=en

ix. The Monitoring and Evaluation Plan for the Major Changes in the Guidelines (GMEP 2014), can be found on the PMPRB website, http://www.pmprb-cepmb.gc.ca/view.asp?ccid=1141&lang=en

x. The PMPRB Interpretation Policy can be found on the PMPRB website, http://www.pmprb-cepmb.gc.ca/view.asp?ccid=1128&lang=en

xi. In 2010, as a result of provinces and territories joint effort to explore bulk pricing and purchasing strategies, the Council of the Federation established the pan-Canadian Pharmaceutical Alliance (pCPA). The pCPA conducts joint provincial/territorial negotiations for brand and generic drugs to achieve greater value for publicly funded drug programs.

xii. The Consultation Policy can be found on the PMPRB website, http://www.pmprb-cepmb.gc.ca/view.asp?ccid=1028&lang+en

xiii. Information on Backing-Out Formulas for Foreign Price Verification can be found on the PMPRB website, http://www.pmprb-cepmb.gc.ca/view.asp?ccid=504&lang=en

xiv. France, United Kingdom, Sweden, Switzerland, Germany, United States, Italy

xv. The PMPRB recognized sources can be found on the PMPRB website, http://www.pmprb-cepmb.gc.ca/view.asp?ccid=502&lang=en

xvi. The decision tree can be found on the PMPRB website, http://www.pmprb-cepmb.gc.ca/view.asp?ccid=502&lang=en

xvii. PMPRB NEWSletter, January 2015 can be found on the PMPRB website, http://www.pmprb-cepmb.gc.ca/view.asp?ccid=1145&lang=en

xviii. Whole-of-government framework, http://www.tbs-sct.gc.ca/ppg-cpr/frame-cadre-eng.aspx

xix. Public Accounts of Canada 2015, http://www.tpsgc-pwgsc.gc.ca/recgen/cpc-pac/index-eng.html

xx. Public Works and Government Services Canada website, http://www.tpsgc-pwgsc.gc.ca/comm/index-eng.html

xxi. When consideration of the foregoing factors does not enable the Board to make a determination as to whether the medicine is or has been sold at an excessive price, it may also consider the cost of making and marketing the medicine and such other factors it believes are relevant in the circumstances.

xxii. This percentage, based on the number of price reviews completed at March 31, 2015, is calculated as follows: the sum of the number of price reviews found to be within the Guidelines, plus the number of price review which did not trigger an investigation, plus the number of Voluntary Compliance Undertakings; divided by the total number of patented drug products at March 31, 2015 minus the number of drug products still under review.

xxiii. Patented Medicine Prices Review Board, Bulletin, Issue No. 12, September 1993

xxiv. The Financial Statements can be found on the PMPRB’s website, http://www.pmprb-cepmb.gc.ca/view.asp?ccid=1223&lang=en

xxv. The Departmental Sustainable Development Strategy can be found on the PMPRB’s website, http://www.pmprb-cepmb.gc.ca/view.asp?ccid=1220&=en

xxvi. Information on Internal Audits and Evaluations can be found on the PMPRB website, http://www.pmprb-cepmb.gc.ca/view.asp?ccid=1222&lang=en

xxvii. Government of Canada Tax Expenditures, http://www.fin.gc.ca/purl/taxexp-eng.asp