Annual Report 2007

Table Of Contents

- Mission and Values

- Letter to The Minister of Health

- Highlights 2007

- Chairperson’s Message

- About The Patented Medicine Prices Review Board: Mandate and Jurisdiction

- Governance

- Regulating Prices of Patented Medicines

- Compliance and Excessive Price Guidelines

- Voluntary Compliance Undertakings

- Hearings

- Reporting Information on Key Pharmaceutical Trends

- Trends in Sales of Patented Drugs

- Price Trends

- Comparison of Canadian Prices to Foreign Prices

- Utilization of Patented Drugs

- Manufacturing Trends in Canada

- Canadian Sales in The Global Context

- Analysis of Research and Development Expenditure

- National Prescription Drug Utilization Information System

- Monitoring and Reporting of Non-Patented Prescription Drug Prices

- Amendments to the Patented Medicines Regulations

- Review of the Board’s Excessive Price Gidelines

- Communications

- Glossary

- Acronyms

- Annex 1 - Criteria for Commencing an Investigation

- Annex 2 - Patented Drug Products Introduced in 2007

- Annex 3 - Research & Development

Mission and Values

The mission of the Patented Medicine Prices Review Board (PMPRB) is to protect consumer interests and contribute to Canadian health care by ensuring that prices of patented medicines are not excessive and by analyzing and reporting to Canadians on price trends of all medicines and on research and development conducted by patentees. The PMPRB achieves this by:

- promoting voluntary compliance with the Guidelines established by the Board;

- reviewing prices;

- taking remedial action when necessary;

- consulting with interested parties on Guidelines and other matters of policy; and

- fostering awareness of the Board´s mandate, activities and achievements through communication, dissemination of information and public education.

In fulfilling the mission we are committed to innovative leadership based on the following values:

- effectiveness and efficiency;

- fairness;

- integrity;

- mutual respect;

- transparency;

- supportive and challenging work environment.

The Patented Medicine Prices Review Board

Standard Life Centre

Box L40

333 Laurier Avenue West

Suite 1400

Ottawa, Ontario K1P 1C1

Telephone: (613) 952-7360

Facsimile: (613) 952-7626

TTY: (613) 957-4373

E-mail: pmprb@pmprb-cepmb.gc.ca

Web site: http://www.pmprb-cepmb.gc.ca

All PMPRB publications are available in both official languages, on line or by calling our toll-free number: 1 877 861-2350

Catalogue number: H78-2007; ISBN: 978-0-662-05582-2

PDF: Catalogue number: H78-2007E-PDF; ISBN: 978-0-662-48239-0

Letter to The Minister of Health

Highlights 2007

REGULATORY MANDATE

The PMPRB´s regulatory activities continued to increase in 2007.

Compliance

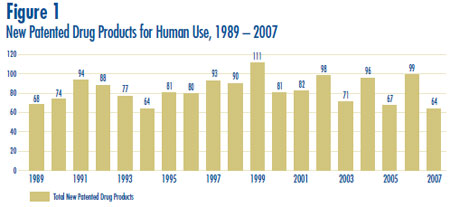

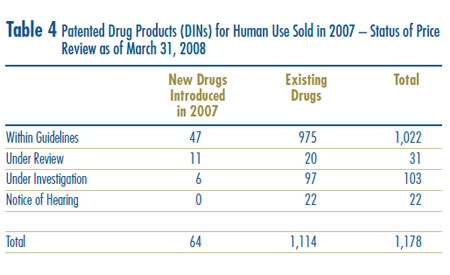

- Sixty four new patented drug products for human use were reported to the PMPRB in 2007 of which 20 medicines, representing 34 drug products, were new active substances. As of March 31, 2008, 53 new patented drug products had been reviewed. Of those, 47 were considered to be within the Guidelines, while 6 are subject to ongoing investigations.

- A total of 1,178 patented drug products for human use were under the PMPRB´s jurisdiction in 2007.

Enforcement

- The Board approved nine Voluntary Compliance Undertakings, including one in May 2008.

- The Board completed a total of six hearings, issued two Notices of Hearing in 2007 and one at the beginning of 2008. Currently, there are seven ongoing proceedings, including the Nicoderm matter, initiated in 1999.

REPORTING MANDATE

In addition to in-depth analysis of the key pharmaceutical indices, the PMPRB has published two reports under the Non-Patented Prescription Drug Prices initiative.

Sales Trends

- Sales of patented drugs in Canada increased by 3.0% to $12.3 billion in 2007. By comparison, annual growth in sales of patented drugs stood at 27.0% in 1999 and remained in double digits until 2003.

- The share of total sales accounted for by patented drugs declined from 68.1% in 2006 to 66.0% in 2007. This implies that sales of generic and non-patented branded drug products grew at a considerably faster rate than sales of patented drugs.

- Drugs treating the respiratory system and antineoplastics and immunomodulating agents (such as drugs used in chemotherapy) are the leading contributing drug classes to sales growth, the latter for a third consecutive year.

Price Trends

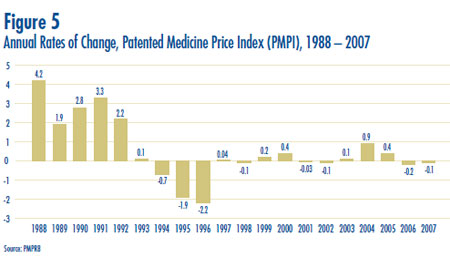

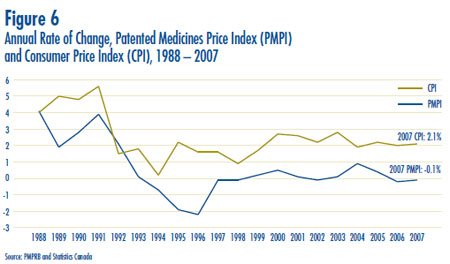

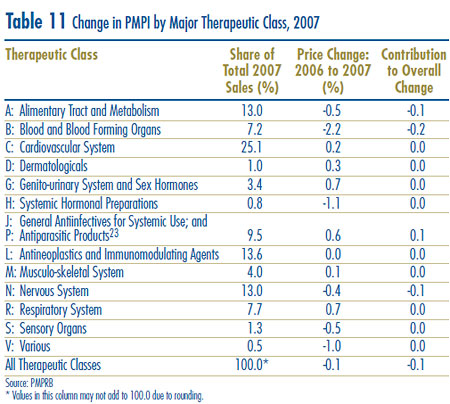

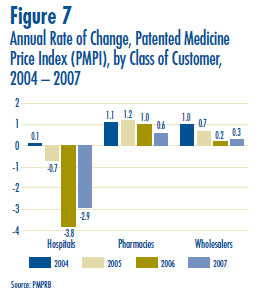

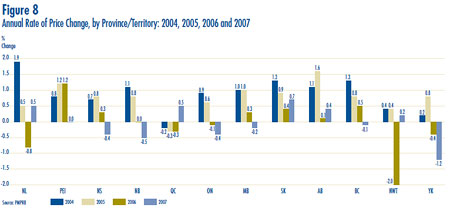

- Prices in Canada – the manufacturers´ prices of patented drugs, as measured by the Patented Medicine Price Index (PMPI), decreased on average by 0.1% in 2007. Again this year, the slight decline in the PMPI is attributable to falling prices paid by hospitals. The PMPI continues to vary by class of customer (hospitals, pharmacies, wholesalers)and across the provinces and territories.

- The Consumer Price Index (CPI) was at 2.1% over the same period. Inflation has exceeded the average increase in patented drug prices almost every year since 1988. This pattern continued in 2007

- Foreign-to-Canadian prices – Canadian prices were the second highest of the seven comparator countries. This ranking is attributable, in part, to currency conversion at market exchange rates. However, U.S. prices remain substantially higher than prices in Canada or any other comparator country.

Resaerch and Development

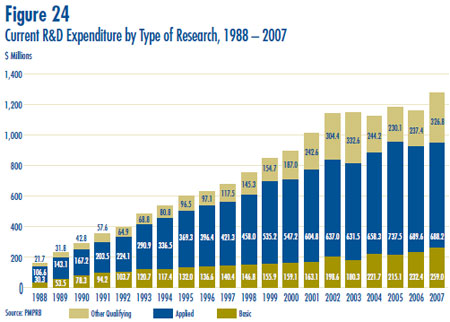

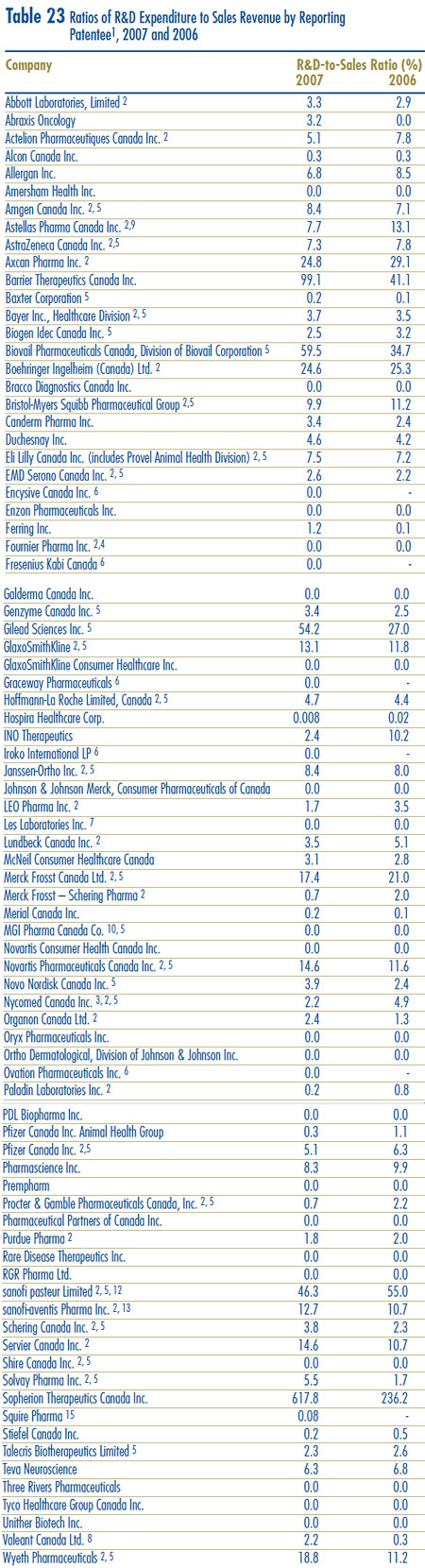

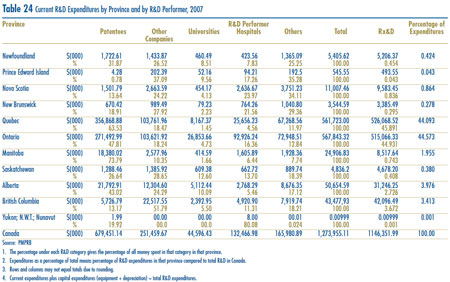

- Patentees reported total R&D expenditures of $1,325 million in 2007, an increase of 9.5% over the previous year. Rx&D members reported R&D expenditures of $1,184 million in 2007, an increase of 24.4% over 2006.

- Rx&D members accounted for 89.4% of all reported R&D expenditure, while non members reported expenditure of $141 million, a decrease of 45.9% over 2006.

- The R&D-to-sales ratio increased slightly, with 8.3% from 8.1% in 2006, as did the R&D-tosales ratio for members of Rx&D with 8.9% compared to 8.5% in the previous year. The ratios have been below 10% since 2001 and 2003 respectively.

- Patentees reported spending $259.0 million on basic research, representing 20.3% of current R&D expenditures. Basic research increased by 11.4% in 2007 relative to 2006.

Chairperson’s Message

The year 2007 has been active and challenging for both the Patented Medicine Prices Review Board, and our key stakeholders.

The year 2007 has been active and challenging for both the Patented Medicine Prices Review Board, and our key stakeholders.

Two key areas of activity drew significant attention during the past year. As part of the Board´s regulatory mandate, there was activity within nine ongoing or newly initiated hearings during 2007, the highest level in the Board´s 20 year history. The review of our Excessive Price Guidelines, an important project initiated in 2006, involved a cooperative effort between the Board, our Staff, and numerous stakeholders.

Since the inception of the PMPRB in 1987, the number of hearings had been maintained at a minimum. This was due in great measure to the effectiveness of the Board´s Excessive Price Guidelines, and our Voluntary Compliance Policy, rather than due to a lack of enforcement.

The Guidelines, first developed in 1989 and revised in 1994, have been, and continue to be, the subject of ongoing discussions. Following concerns expressed relative to the high introductory prices of patented medicines, the Board initiated a series of consultations with its stakeholders in May 2006, with the objective of determining whether, or not, revisions to the Excessive Price Guidelines were required. The process continues in a fair and transparent manner.

In 2007, the process included numerous face-to-face bilateral meetings with our stakeholders which built upon multilateral forums held in 2006. We heard the opinions from representatives of all three sectors of the pharmaceutical industry, i.e., brand name, biotech and generic, relating to the challenges they face within the current environment, including the impact of globalization on their research and marketing activities, and the influence of various regulatory regimes. Consumer and patient advocacy groups expressed their concern regarding access to necessary medicines, at affordable prices. Public and private drug plans have also participated in our consultations, and have provided their views regarding affordable and sustainable access to pharmaceuticals in Canada. In January of 2008, we released a paper requesting feedback on the proposed changes to the Guidelines that derived from the consultations, as well as on a range of options to address the issues that arose from the decision of the Federal Court of Canada in the LEO Pharma matter.

The March 2007 Federal Court decision raised a controversy. It was interpreted by some as creating disincentives for patentees in offering various benefits to patients. The Board has worked diligently in trying to address this issue in its revised Guidelines, and possibly, in amendments that were suggested to the Patented Medicines Regulations. The Board is committed to its primary role of protecting consumers´ interests by ensuring that prices of patented medicines in Canada are not excessive.

During 2007, our reporting mandate also provided several challenges. We introduced the New Drug Pipeline Monitor, which provides drug plan managers and others with information relating to newly developed drug products. Two studies were also published relating to non-patented prescription drug prices, and we initiated a series of new projects under the National Prescription Drug Utilization Information System (NPDUIS) which include research examining the potential impact of long-term demographic change on public drug plans, recent trends in dispensing fees reimbursed by drug plans, and methodological alternatives for measuring volumes of treatment in utilization analysis. Also, we are proceeding with the upcoming publication of the new edition of the Pharmaceutical Trends Overview Report, the second installment of our New Drug Pipeline Monitor report, and the publication of a methodology and management tool for forecasting Drug Plan Expenditures.

We will continue to provide our stakeholders with the opportunity to participate in the ongoing consultation activities, which is a critically important part of the Board´s efforts to reach decisions that are balanced and fair, and which will serve all Canadians effectively.

I wish to take this opportunity to thank the Board Members for their tireless efforts during this period of high activity, as well as the Staff who have taken on the new consultation initiatives with enthusiasm, while continuing with their regular activities, and all of the stakeholders, who continue to help with the development of new guidelines and policies.

Brien G. Benoit, MD

Chairperson

About The Patented Medicine Prices Review Board: Mandate and Jurisdiction

The Patented Medicine Prices Review Board is an independent quasi-judicial body established by Parliament in 1987 under the Patent Act (Act). The Minister of Health is responsible for the pharmaceutical provisions of the Act as set out in sections 79 to 103.

Although part of the Health Portfolio, the PMPRB carries out its mandate at arm´s length from the Minister of Health.1 It also operates independently of other bodies such as Health Canada, which approves drugs for safety and efficacy, and public drug plans, which have responsibility for approving the listing of drugs on their respective formularies for reimbursement purposes.

MANDATE

The PMPRB has a dual role:

Regulatory

To ensure that prices charged by patentees for patented medicines sold in Canada are not excessive, thereby protecting consumers and contributing to Canadian health care.

Reporting

To report on pharmaceutical trends of all medicines, and on R&D spending by pharmaceutical patentees, thereby contributing to informed decisions and policy making.

JURISDICTION

Regulatory

The PMPRB is responsible for regulating the prices that patentees charge – the factory-gate price – for prescription and non-prescription patented drugs sold in Canada to wholesalers, hospitals, pharmacies or others, for human and veterinary use, to ensure that they are not excessive. The PMPRB regulates the price of each patented drug product, including each strength of each dosage form of each patented medicine sold in Canada. This is normally the level at which Health Canada assigns a Drug Identification Number (DIN).

Health Canada assesses new medicines to ensure that they conform to the Food and Drugs Act and the Food and Drug Regulations. Formal authorization to market or distribute a medicine is granted through a Notice of Compliance (NOC). A medicine may be temporarily distributed with specified restrictions before receiving an NOC, as an Investigational New Drug or under Health Canada´s Special Access Programme (SAP).

The PMPRB has no authority to regulate the prices of non-patented drugs, and does not have jurisdiction over prices charged by wholesalers or retailers, or over pharmacists´ professional fees. Also, matters such as whether medicines are reimbursed by public drug plans, distribution and prescribing are outside the purview of the PMPRB.

Under the Patented Medicines Regulations, patentees are required to file price and sales information twice a year for each strength of each dosage form of each patented medicine sold in Canada for price regulation purposes. Patentees are also required to file R&D expenditures once a year for reporting purposes.

Patentees are also required to inform the PMPRB of their intention to sell a new patented medicine. They are not required to obtain approval of the price of a patented medicine before it is sold, but they are required to comply with the Act to ensure that prices of patented medicines sold in Canada are not excessive. In the event that the Board finds, after a public hearing, that a price is or was excessive in any market, it may order the patentee to reduce the price and take measures to offset any excess revenues it may have received.

Reporting

The PMPRB reports annually to Parliament, through the Minister of Health, on its activities, on pharmaceutical trends relating to all medicines, and on the R&D spending by pharmaceutical patentees. In addition to these reporting responsibilities, under section 90 of the Act, the Minister of Health has the authority to direct the PMPRB to inquire into any other matter. Under this provision, the Minister has directed the Board to undertake two initiatives: the National Prescription Drug Utilization Information System (NPDUIS), and monitoring and reporting on Non-Patented Prescription Drug Prices (NPPDP).

National Prescription Drug Utilization Information System

Since 2001, pursuant to an agreement by the Federal/Provincial/Territorial Ministers of Health, the PMPRB has been conducting research under the NPDUIS. The purpose of the NPDUIS is to provide critical analyses of price, utilization and cost trends so that Canada´s health system has more comprehensive and accurate information on how prescription drugs are being used and on sources of cost increases.

Non-Patented Prescription Drug Prices

In 2005, the Minister of Health, on behalf of himself and his provincial and territorial colleagues, directed the PMPRB to monitor and report on non-patented prescription drug prices. This function is aimed at providing a centralized credible source of information on non-patented prescription drug prices.

As of April 2008, NPPDP studies are conducted under the umbrella of the NPDUIS.

1 The Health Portfolio contributes to specific dimensions of improving the health of Canadians. It comprises Health Canada, the Public Health Agency of Canada, the Canadian Institutes of Health Research, the Hazardous Materials Information Review Commission, the Assisted Human Reproduction Agency of Canada and the Patented Medicine Prices Review Board.

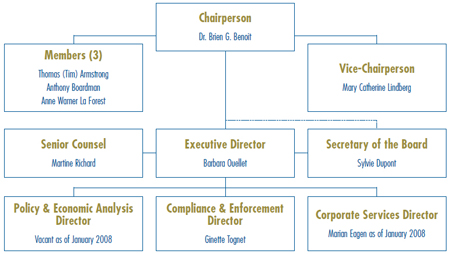

Governance

The Board consists of not more than five members who serve on a part-time basis. Board Members, including a Chairperson and a Vice-Chairperson, are appointed by the Governor-in-Council. The Chairperson is designated under the Patent Act as the Chief Executive Officer of the PMPRB with the authority and responsibility to supervise and direct its work.

MEMBERS OF THE BOARD

Chairperson

Brien G. Benoit, BA, MD, MSc, FRCSC, FACS

Brien G. Benoit was first appointed as a Member of the PMPRB in May of 2005, and in October of the same year, he became Vice-Chairperson assuming the responsibilities of Chairperson until his permanent appointment in June 2006.

A neurosurgeon, Dr. Benoit is on the Active Attending Staff of The Ottawa Hospital, and is a Professor of Neurosurgery at the University of Ottawa, regularly involved in the training of neurosurgical residents. Throughout his career, he has held several administrative positions including Chief of Neurosurgery of the Ottawa Civic/The Ottawa Hospital (1980-2003), Chief of Surgery of the Ottawa Civic Hospital (2002-2003), Program Director for Neurosurgery at the University of Ottawa (1995-2003), Chair of Neurosurgery at the University of Ottawa (1997-2003) and Deputy Surgeon-in-Chief of The Ottawa Hospital – Civic Campus (2002-2004).

Dr. Benoit has published extensively in leading academic journals, and has participated in several multi-centre clinical trials. He was awarded Best Surgical Teacher from the Department of Surgery at the University of Ottawa in 1991 and 2000.

In addition to being a Fellow of the Royal College of Physicians and Surgeons of Canada, Dr. Benoit is a member of several professional associations including the Canadian Medical Association, the Ontario Medical Association, The American College of Surgeons, The Canadian Neurosurgical Society and the Congress of Neurological Surgeons.

VICE-CHAIRPERSON

Mary Catherine Lindberg, BSP

Mary Catherine Lindberg was appointed Member and Vice-Chairperson of the Board in June 2006.

Ms. Lindberg is currently the Executive Director of the Council of Academic Hospitals of Ontario (CAHO), an organization of 25 Academic Hospitals that are fully affiliated with a University and its Faculty of Medicine. Prior to retiring from the Ministry of Health and Long Term Care, she was an Assistant Deputy Minister with responsibilities for registration and eligibility for the Ontario Health Insurance Plan (OHIP), payment to physicians, the Ontario Drug Program and the Laboratories.

Some of her major activities were the development and introduction of the Trillium Drug Program, leading negotiations for the government with physicians, pharmacists, chiropractors, physiotherapists, optometrists and private laboratory owners. Ms. Lindberg has a degree in pharmacy from the University of Saskatchewan and has her pharmacist´s license in the provinces of both Saskatchewan and Ontario.

MEMBERS

Thomas (Tim) Armstrong, BA, LLB, QC, O. Ont.

Tim Armstrong was first appointed Member of the Board in October 2002. He was re-appointed for a second term in 2007.

Mr. Armstrong practiced law from 1958 to 1974, first in the Civil Litigation Division of the federal Department of Justice, subsequently in private practice in Toronto with Jolliffe, Lewis & Osler and later as senior partner of Armstrong & MacLean, specializing in administrative law litigation, presenting cases to administrative tribunals, the Ontario courts, the Federal Court, and the Supreme Court of Canada.

In 1974, he began his career as a senior Ontario public servant as Chair of the Ontario Labour Relations Board (1974-1976), Deputy Minister of Labour (1976-1986), Agent General for Ontario in Tokyo (1986-1990), and Deputy Minister of Industry, Trade and Technology (1991-1992). He was advisor to the Premier of Ontario on Economic Development from 1992 to 1995. Mr. Armstrong was counsel to the law firm McCarthy Tétrault from 1995 to 2002. In the 1990´s, he served as a member on the boards of directors of Algoma Steel, deHavilland Aircraft and Interlink Freight.

He has been Chief Representative for Canada for the Japan Bank for International Cooperation since 1996 and also serves as arbitrator and mediator by consensual, provincial and federal government appointment in the field of labour relations. In his dispute resolution work, he was appointed facilitator/mediator by the Ontario Health Services Restructuring Commission from 1998-1999. Subsequently, in 2002-2003, he was designated by the Ontario government as mediator/arbitrator under the City of Toronto Labour Disputes Resolution Act, 2002.

He is currently the Chair of the Radiation Safety Institute of Canada and Vice-Chair of the Ontario Press Council.

Mr. Armstrong was awarded the Order of Ontario in 1995 in recognition of his contribution to public service in Ontario.

Anthony Boardman, BA, PhD

Anthony Boardman was appointed Member of the Board in January 1999 and was re-appointed in March 2005.

Dr. Boardman is the Van Dusen Professor of Business Administration in the Strategy and Business Economics Division of the Sauder School of Business at the University of British Columbia (UBC). He graduated from the University of Kent at Canterbury (BA, 1970), and Carnegie-Mellon University (PhD, 1975). Prior to taking up his position at UBC he was a professor at the Wharton School, University of Pennsylvania.

His current research interests include public-private partnerships, cost-benefit analysis and strategic management. Dr. Boardman has been a consultant to many private and public organizations including Vodafone, Stora Enzo, PricewaterhouseCoopers, the Treasury of New Zealand and all levels of government in Canada. He has taught executive programs in Finland, China, Australia and elsewhere, and has won a number of teaching awards. As a member of the MBA Core Team at UBC, he won the Alan Blizzard award. Between 1995 and 2001, Dr. Boardman was a member of the Pharmacoeconomic Initiative Scientific Committee in BC. Currently, he is a member of the National Academies Committee on Medical Isotope Production Without Highly Enriched Uranium.

During his career, Dr. Boardman has published many articles in leading academic journals. Currently, he is working on the fourth edition of Cost-Benefit Analysis: Concepts and Practice.

Anne Warner La Forest, LLB (UNB), LLM (Cantab)

Anne Warner La Forest was appointed Member of the Board in March 2007.

Ms. La Forest is currently a law professor at the University of New Brunswick. Member of the New Brunswick Securities Commission since 2004, she is also the Chair of the Commission´s Human Resources Committee.

After working in private practice with the firm of Fraser & Beatty in Toronto for several years, Ms. La Forest joined the Faculty of Law at Dalhousie University in 1991. In 1996, she was appointed Dean of the New Brunswick University Faculty of Law, a position she held until 2004.

A member of the bars of New Brunswick, Nova Scotia and Ontario, Ms. La Forest has extensive experience as an arbitrator and has acted as a consultant on matters relating to human rights, employment, property and extradition law. She has been a member of the Nova Scotia Human Rights Tribunal, a member of the Social Sciences and Humanities Research Council and Chair of the Fellowships Committee. She has also served as Arbitrator in the province of Nova Scotia as well as Commissioner of the province´s Human Rights Commission. She is a Fellow of the Cambridge Commonwealth Society and is currently a member of the Board of Governors of the National Judicial Institute.

She holds an LL.M. degree in International Law from Cambridge University in the United Kingdom.

Ms. La Forest has published many articles, books and case comments during her career and has been the chair or has served as a panelist at many national and international law conferences.

PMPRB Senior Staff

The Executive Director manages the work of the Staff. In addition to the Executive Director, Senior Staff consists of the Director of Compliance and Enforcement, the Director of Policy and Economic Analysis, the Director of Corporate Services, the Secretary of the Board, and Senior Counsel.

Executive Director

Is responsible for overall leadership of the operations of the PMPRB and of Staff.

Compliance and Enforcement

Reviews the prices of patented medicines sold in Canada to ensure that they are not excessive; encourages patentees to comply voluntarily with the Board´s Excessive Price Guidelines; implements related compliance and enforcement policies; and investigates complaints into the prices of patented medicines.

Policy and Economic Analysis

Develops policy advice on possible changes to the Board´s Excessive Price Guidelines and on other issues, as needed; analyzes pharmaceutical trends and prepares reports; and conducts studies both in support of Compliance and Enforcement and as directed by the Minister of Health.

Corporate Services

Administers the Board´s internal policies: Human Resources, Financial Management, and Information Technology.

Secretary of the Board

Develops and manages the PMPRB´s communications, media relations and public enquiries; manages the Board´s hearing process, including the official record of proceedings; and coordinates activities pursuant to the Access to Information Act and the Privacy Act ; and

Senior Counsel

Advises the PMPRB on legal matters and leads the prosecution team in proceedings before the Board.

Budget

The PMPRB operated with a budget of $11,525,000 in 2007-2008 and an approved staff level of 62 full-time equivalent employees. In addition to a budget for carrying out its mandate, the PMPRB budget included resources for the National Prescription Drug Utilization Information System (NPDUIS) and for the monitoring and reporting on Non-Patented Prescription Drug Prices (NPPDP), as mandated by the Minister of Health.

Regulating Prices of Patented Medicines

- Compliance and Excessive Price Guidelines

- Voluntary Compliance Undertakings

- Hearings

Compliance and Excessive Price Guidelines

Under section 82 of the Patent Act (Act), pharmaceutical patentees are required to notify the PMPRB of their intention to offer a patented drug product for sale and the date on which they expect to begin selling it.

Under the Patented Medicines Regulations (Regulations), patentees are subsequently required to:

- file a Medicine Identification Sheet (Form 1) within 7 days after either the issuance of a Notice of Compliance or the date on which the patented drug product was first sold in Canada, whichever comes first. A copy of the product monograph, or information similar to that contained in a product monograph when an Notice of Compliance has not been issued, must also be filed at the same time as Form 1;

- report information on the introductory prices and sales covering the first day of sale in Canada of new patented drug products (Form 2), within 30 days of the date of first sale; and

- continue to file detailed information on prices and sales of each patented drug product for the first and last six-month periods of each year (Form 2), 30 days after the end of each period, i.e., on July 30 and January 30 respectively, for as long as the drug product remains under the Board´s jurisdiction.

The PMPRB reviews the pricing information for all patented medicines sold in Canada on an ongoing basis to ensure that the prices charged by patentees comply with the Excessive Price Guidelines (Guidelines) established by the Board. The Guidelines are published in the PMPRB´s Compendium of Guidelines, Policies and Procedures.2

Excessive Price Guidelines

- The Guidelines are based on the price determination factors in section 85 of the Act and have been developed by the Board in consultation with stakeholders, including the provincial and territorial Ministers of Health, consumer groups and the pharmaceutical industry. In summary, the Guidelines provide that:

- prices for most new patented drug products are limited such that the cost of therapy for the new drug product does not exceed the highest cost of therapy for existing drug products used to treat the same disease in Canada;

- prices of new breakthrough patented drug products and those that bring a substantial improvement are generally limited to the median of the prices charged for the same patented drug product in other industrialized countries listed in the Regulations (France, Germany, Italy, Sweden, Switzerland, the United Kingdom and the United States);

- price increases for existing patented drug products are limited to changes determined by the Board´s Consumer Price Index (CPI) methodology; and

- prices of patented drug products in Canada may at no time exceed the highest price for the same patented drug product in the foreign countries listed in the Regulations.

When Board Staff finds that the price of a patented drug product appears to exceed the Guidelines, and the circumstances meet the criteria for commencing an investigation, Board Staff will conduct an investigation to determine if the price of the patented drug product in fact exceeds the Guidelines. Additional information on the criteria for commencing an investigation is available in Annex 1, on page 55. An investigation could result in:

- its closure where it is concluded that the price was within the Guidelines;

- a Voluntary Compliance Undertaking (VCU) by the patentee to reduce the price and take other measures to comply with the Guidelines, including the repayment of excess revenues obtained as a result of excessive prices; or

- a public hearing to determine if the price is excessive and to make any remedial Order determined by the Board.

The list of New Patented Medicines Reported to the PMPRB is posted on its Web site every month. This list includes information on the status of the review of new patented medicines, i.e., under review, within Guidelines, under investigation, VCU, or Notice of Hearing.

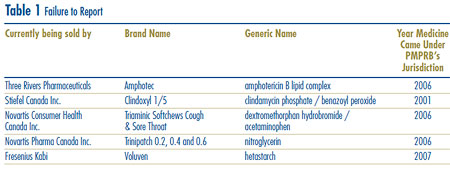

Failure to Report

In order to fulfill its regulatory mandate, as described on page 2, the PMPRB relies upon the patentees´ full and timely disclosure of any and all medicines being sold in Canada to which a patent pertains. Late filing by patentees is an important issue because it may delay the price review. Although, in most cases, patentees ultimately comply with the filing requirements, an issue exists regarding a number of patentees´ failure to report complete information within the time frames specified in the Regulations. Five new drug products (8 DINs) were first reported to the PMPRB in 2007 although they had been patented and sold previously. See Table 1. Amphotec (two DINs), Clindoxyl 1/5, Triaminic Softchews Cough & Sore Throat, Trinipatch (three DINs) and Voluven were patented and sold in Canada prior to being reported as being under the PMPRB´s jurisdiction. They are currently being sold by Three Rivers Pharmaceuticals, Stiefel Canada Inc., Novartis Consumer Health Canada Inc., Novartis Pharma Canada Inc., and Fresenius Kabi, respectively.

Failure to File (FTF)

The Board is pleased to report that there were no Board Orders issued for the January to June and July to December 2007 filing periods. It is a patentee´s statutory responsibility to ensure complete information is filed within the statutory time frame. Information on the statutory reporting requirements is available in the Act, the Regulations, the Guidelines, and the Patentee´s Guide to Reporting, all of which can be found on the PMPRB Web site under Legislation, Regulations and Guidelines.

Human Drug Advisory Panel

The Board established the Human Drug Advisory Panel (HDAP) to provide recommendations for the categorization of new drug products and the selection of comparable drug products. The mandate of the HDAP is to provide credible, independent and expert scientific advice to the PMPRB respecting the development and application of the Guidelines related to the scientific evaluation of patented medicines. The approach is evidence-based and the recommendations reflect medical and scientific knowledge and current clinical practice.

The HDAP is comprised of three members:

- Dr. Jean Gray MD, FRCPC, Professor Emeritus of medical education, medicine and pharmacology at Dalhousie University;

- Dr. Mitchell Levine MD, MSc, FRCPC, FISPE, Professor, Department of Clinical Epidemiology and Biostatistics, St. Joseph´s Healthcare Hamilton Centre for Evaluation of Medicines; and

- Dr. Adil Virani, Director of Pharmacy Services at the Fraser Health Authority and Assistant Professor in the Faculty of Pharmaceutical Sciences at the University of British Columbia (appointed on April 1, 2008). The PMPRB recently bid farewell to Dr. James McCormack as he completed his mandate as a member of the HDAP. His expert advice and invaluable contribution to the scientific review of new patented medicines since 2002 will be long remembered.

During 2007 the HDAP reviewed a total of 50 drug products.

New Patented Drug Products in 2007

There were 64 new patented drug products3 for human use introduced in 2007. Some are one or more strengths of a new active substance (NAS) and others are new presentations of existing medicines.

For purposes of the price review, a new patented drug product in 2007 is defined as any patented drug product first sold in Canada, or previously sold but first patented between December 1, 2006 and November 30, 2007.4

Figure 1 below provides information on new patented drug products for human use from 1989 to 2007.

Eleven (17%) of the 64 new patented drug products were being sold in Canada prior to the issuance of a Canadian patent which brought them under the PMPRB´s jurisdiction. These are denoted by a “FPG” (first patent granted) in Annex 2 on page 56. Table 2 identifies the number of patented drug products by the year in which they were first sold. The time delay between date of first sale and date of patent grant for these products ranged from several months to five years.

New Active Substances in 2007

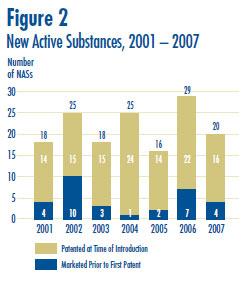

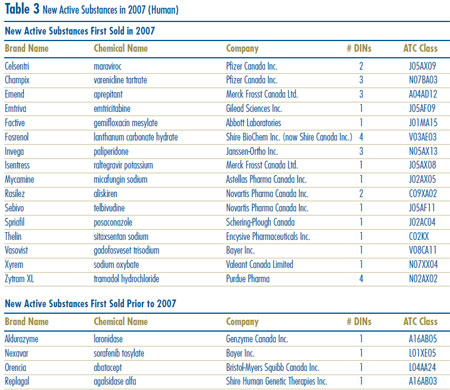

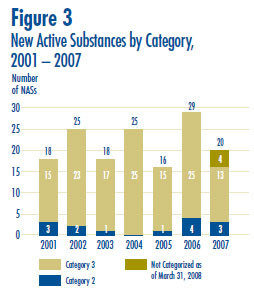

A new active substance (NAS) may include more than one drug product if it is sold in more than one strength or dosage form. In 2007, there were 20 NASs marketed as 34 drug products. As shown in Figure 2 and Table 3, four of the 20 patented NASs that came under the PMPRB´s jurisdiction were sold prior to 2007.

The PMPRB´s list of patented NASs in any year may differ from the list of NASs approved by Health Canada´s Therapeutic Products Directorate (TPD) for the following reasons:

- the NAS is not patented and therefore not subject to the PMPRB´s jurisdiction;

- the NAS may not be on the TPD list because it is being sold under the Special Access Programme (SAP) before it receives a Notice of Compliance (NOC); or

- the NAS may have been approved, but is not being sold. Health Canada reported 20 NASs in 2007 but not all were introduced to the market in that year.5

Figure 3 provides a breakdown of the patented NASs for human use, by category assigned for price review purposes, over the seven-year period 2001 through 2007 inclusive.6 Summary Reports of the price reviews of NASs are posted on the PMPRB Web site when the price review is completed and the price is within the Guidelines.7

Price Review of New Patented Drugs for Human Use

A list of the 64 new patented drug products and their price review status appears in Annex 2, on page 56. Of the 64 new patented drug products:

- the prices of 53 had been reviewed as of March 31, 2008;

- 47 were found to be within the Guidelines;

- 6 were priced at levels which appeared to exceed the Guidelines based on the introductory price tests and investigations were commenced.8 For a more detailed explanation of the criteria for commencing an investigation, please refer to Annex 1, on page 55; and

- the prices of 11 new patented drug products are still under review.

Patented Over-the-Counter Drug Products

Amendments to the Patented Medicines Regulations were registered on March 6, 2008 and published in the Canada Gazette, Part II, on March 19, 2008. Changes have been made to the approach for regulating the prices of patented over-the-counter (OTC) drug products. Board Staff will only review the price of a patented OTC drug product when a complaint has been received. Refer to the Compendium of Guidelines, Policies and Procedures for further information.

Price Review of Existing Patented Drugs for Human Use

For the purpose of this report, existing drug products include all patented drug products that were first sold and reported to the PMPRB prior to December 1, 2007. The Guidelines limit the price changes for existing patented drugs to changes in the Consumer Price Index (CPI) based on the methodology developed by the Board. In addition, the price of a patented drug product cannot exceed the highest price of the same patented drug product in the countries listed in the Regulations (France, Germany, Italy, Sweden, Switzerland, the United Kingdom, and the United States).

At the time of this report, there were 1,114 existing drug products:

- the prices of 975 existing drug products (87.5%) were within the Guidelines;

- 20 existing drug products were still under review.

- 97 existing drug products were the subject of investigations (see previous paragraph for price tests applied to existing drug products);

- 37 were opened in 2007

- 31 were opened in 2006

- 14 were opened in 2005

- 1 was opened in 2003

- 1 was opened in 2004 as a result of introductory pricing

- 1 was opened in 2005 as a result of introductory pricing

- 12 were opened in 2006 as a result of introductory pricing

- 22 existing drug products – Nicoderm (three DINs), Adderall XR (six DINs), Copaxone, Concerta (four DINs), Strattera (five DINs), Penlac, Quadracel, Pentacel – were, or are currently, the subject of a hearing under section 83 (see Hearings, on page 18).

A summary of the status of the price review of the new and existing patented drug products for human use in 2007 is provided in Table 4.

CDR / PMPRB

The Common Drug Review (CDR) is a single process for reviewing new drugs and providing formulary listing recommendations to participating publicly-funded federal, provincial and territorial drug benefit plans in Canada. All jurisdictions are participating in the CDR except Québec. The CDR reviews new drugs and provides an evidence-based formulary listing recommendation made by the Canadian Expert Drug Advisory Committee (CEDAC). The drug plans consider the CEDAC recommendation and also their individual plan mandates, priorities and resources when making formulary listing and coverage decisions. More information on CDR and CEDAC is available from the Canadian Agency for Drugs and Technologies in Health (CADTH) Web site (http://www.cadth.ca).

Table 5 provides information on CDR reviews and on the PMPRB price reviews. The CDR reviews drug products following the issuance of an NOC. The PMPRB reviews all patented medicines sold in Canada. A medicine may be sold prior to the issuance of a patent. As such, it would not be under the PMPRB´s jurisdiction.

Table 5 Review Status

| Brand Name |

Company |

CEDAC RECOMMENDATION in 2007 Generic Name |

PMPRB STATUS |

| AltaceHCT |

Sanofi-Aventis Canada Inc. |

ramipril/hydrochlorothiazide |

To List |

Within Guidelines |

| Azilect |

Teva Neurosciences |

rasagiline mesylate |

Do not list |

Under Investigation |

| Baraclude |

Bristol-Myers Squibb Canada |

entecavir |

To List* |

Within Guidelines; |

| Champix |

Pfizer Canada Inc. |

varenicline tartrate |

To List* |

Within Guidelines |

| Cipralex |

Lundbeck Canada Inc. |

escitalopram oxalate |

Do not list |

Within Guidelines |

| Ciprodex |

Alcon Canada Inc. |

ciprofloxacin hydrochloride & dexamethasone otic suspension |

To List* |

Under Investigation |

| Denavir |

Novartis Consumer Health Care Inc. |

penciclovir |

Do not list |

Under Investigation |

| Elaprase |

Shire Human Genetic Therapies, Inc. |

idursulfase |

Do not list |

Not Under PMPRB Jurisdiction |

| Exjade |

Novartis Pharmaceuticals Canada Inc. |

deferasirox |

To List* |

Within Guidelines |

| Hepsera |

Gilead Sciences Canada Inc. |

adefovir dipivoxil |

To List* |

Within Guidelines |

| Humira |

Abbott Laboratories, Limited |

adalimumab |

To List* |

Within Guidelines |

| Myozyme |

Genzyme Canada Inc. |

alglucosidase alfa |

To List* |

Not Under PMPRB Jurisdiction |

| Nexavar |

Bayer Inc. |

sorafenib tosylate |

Do not list |

Within Guidelines |

| Orencia |

Bristol-Myers Squibb Canada |

abatacept |

To List* |

Within Guidelines |

| Prexige |

Novartis Pharmaceuticals Canada Inc. |

lumiracoxib |

Do not list |

Not Under PMPRB Jurisdiction |

| Prezista |

Janssen-Ortho Inc. |

darunavir |

To List* |

Within Guidelines |

| Raptiva |

Serono Canada Inc. |

efalizumab |

|

Not Under PMPRB Jurisdiction |

| Revatio |

Pfizer Canada Inc. |

sildenafil citrate |

To List** |

Within Guidelines |

| Rituxan |

Hoffmann-La Roche Limited |

rituximab |

To List* |

Within Guidelines |

| Sativex |

GW Pharma Ltd. |

delta-9-tetrahydrocannabinol /cannabidiol |

Do not list |

Within Guidelines |

| Sebivo |

Novartis Pharmaceuticals Canada Inc. |

telbivudine |

Do not list |

Within Guidelines |

| Somatuline Autogel |

Ipsen Limited |

lanreotide acetate |

To List** |

Not Under PMPRB Jurisdiction |

| Sutent |

Pfizer Canada Inc. |

sunitinib malate |

Do not list |

Within Guidelines |

| Tramacet |

Janssen-Ortho Inc. |

tramadol hydrochloride /acetaminophen |

Do not list |

Within Guidelines |

| Tysabri |

Biogen Idec Canada Inc. |

natalizumab |

Do not list |

Under Investigation |

| Vantas |

Paladin Labs Inc. |

histrelin acetate |

Do not list |

Patented - No sales reported |

| Vesicare |

Astellas Pharma Canada Inc. |

solifenacin succinate |

Do not list |

Within Guidelines |

| Zytram XL |

Purdue Pharma |

tramadol hydrochloride |

Do not list |

Under Review |

Sources: PMPRB and CADTH

* List with criteria/condition

** List in a manner similar to other drugs in class

Update of New Patented Drug Products reported in previous Annual Reports

Table 6 provides an update of the review status of new patented drug products reported in previous years´ Annual Reports.

Table 6 Summary of Review Status of New Patented Drug Products Reported to the PMPRB in 2002, 2003, 2004, 2005, 2006 and 2007

|

2002 |

2003 |

2004 |

2005 |

2006 |

2007 |

| New Patented Drug Products reported in Annual Report |

94 |

70 |

94 |

66 |

99 |

64 |

| Failure to file reported after publication of Annual Report |

4 |

1 |

2 |

1 |

6 |

n/a |

| Total for year |

98 |

71 |

96 |

67 |

105 |

64 |

| Under Review |

0 |

0 |

0 |

0 |

12 |

11 |

| Within Guidelines |

91 |

66 |

78 |

58 |

80 |

47 |

| Investigation |

0 |

0 |

1 |

1 |

12 |

6 |

| Voluntary Compliance Undertaking (VCU) |

3 (Starlix) 1 (Busulfex) 1 (Tamiflu) |

1 (Dukoral) |

2 (Paxil CR) 1 (Hextend) 2 (Eloxatin) 1 (Forteo) |

1 (Nuvaring) 1 (Vaniqa) |

1 (Lantus) |

|

| Notice of Hearing (NOH) |

|

3 (Concerta) |

6 (Adderall XR) 1 (Penlac) |

5 (Strattera) 1 (Concerta) |

|

|

| NOH/VCU |

1 (Fasturec) |

1 (Evra) |

3 (Risperdal Consta) |

|

|

|

| NOH Complete |

1 (Dovobet) |

|

1 (Copaxone) |

|

|

|

Update of Existing Medicines from the 2006 Annual Report

In the 2006 Annual Report, it was reported that, of the 1,082 existing patented drug products for human use sold in 2006, the prices of 17 were still under review. The results of those reviews concluded that: 6 drug products were within the Guidelines; 4 drug products were priced at levels that appeared to exceed the Guidelines and therefore investigations were initiated; and 8 are still under review, one of which was added due to failure to report.

In last year´s Report, the PMPRB had also reported that 65 patented drug products were under investigation. Of those, 17 investigations have been concluded: in 13 cases the prices were ultimately found to be within the Guidelines; and for 4 cases, VCUs were approved – Forteo, Octreoscan, Vaniqa, and Zemplar. (See Voluntary Compliance Undertakings.) Forty-eight are still under investigation. Also in last year´s Annual Report, it was reported that 27 drug products were the subject of a Notice of Hearing. At the time of this report, four hearings have been concluded; Airomir, Copaxone, Dovobet and Risperdal Consta (3 DINs). The hearings involving the remaining 22 drug products are ongoing.

Patented Drug Products for Veterinary Use

The complaints-driven approach for regulating the prices of patented veterinary drug products remained in place for 2007. Board Staff only reviews the introductory prices of new patented veterinary drug products. Existing drug products are subject to review only when a complaint with significant evidence has been received. No complaints were received in 2007.

In last year´s Annual Report, it was reported that one patented drug product for veterinary use was under review and it remains under review at the time of this report. In 2007, seven new patented drug products were reported to the PMPRB. These are under review. Summary reports of the price reviews of patented drug products for veterinary use are made available on the PMPRB Web site under Regulatory; Patented Medicines; Reports on New Patented Drugs for Veterinary Use.

Amendments to the Patented Medicines Regulations were registered on March 6, 2008 and published in the Canada Gazette, Part II, on March 19, 2008. Changes have been made to the complaints-driven approach for regulating the prices of patented veterinary drug products. Board Staff will only review the price of a patented drug product for veterinary use when a complaint has been received. Refer to the PMPRB Web site for further information.

2 The Compendium of Guidelines, Policies and Procedures (Compendium) is available on the PMPRB Web site under Legislation, Regulations and Guidelines, or by calling the toll-free number: 1 877 861-2350.

3 The PMRPB reviews the prices of each unique strength and dosage form of a medicine. This is the level at which Health Canada issues a DIN when a drug product receives approval to sell in Canada (i.e., the Notice of Compliance - NOC). Not all new patented drug products have a DIN – for example, when a drug product is available to patients under Health Canada´s Special Access Programme.

4 Because of timing of the filing requirements under the Patented Medicines Regulations, and the manner of calculating benchmark prices, drug products introduced or patented in December are considered to be new patented products in the following year.

5 Annual Drug Submission Performance Report, Section 4, January-December 2007, Therapeutic Products Directorate, Health Canada.

6 For purposes of conducting price reviews for new drug products, the PMPRB categorizes new drug products as follows:

- Category 1 – a new DIN of an existing dosage form of an existing medicine, or a new DIN of another dosage form of the medicine that is comparable to the existing dosage form.

- Category 2 – is one that provides a breakthrough or substantial improvement. It is a new DIN of a non-comparable dosage form of an existing medicine or the first DIN of a new chemical entity.

- Category 3 – a new DIN of a non-comparable dosage form of an existing medicine or the first DIN of a new chemical identity. These DINs provide moderate, little or no therapeutic advantage over comparable medicines. This group includes those new drug products that are not included in Category 2.

For complete definitions of the categories, refer to the Compendium of Guidelines, Policies and Procedures, Chapter 3, section 3, page 21.

7 Summary Reports for new patented drugs for human use are available under Regulatory; Patented Medicines; Reports on New Patented Drugs for Human Use.

8 The Guidelines provide that the following price tests will be used to determine whether an introductory price is excessive: the Reasonable Relationship test; the Therapeutic Class Comparison test; the Median of International Price Comparison test; and the Highest International Price Comparison test. For more information on their application, please consult the Compendium of Guidelines, Policies and Procedures (Compendium) available on the PMPRB Web site under Legislation, Regulations and Guidelines, or by calling the toll-free number: 1 877 861-2350.

Voluntary Compliance Undertakings

A Voluntary Compliance Undertaking (VCU) is a written undertaking by a patentee to adjust the price of a patented drug product to conform to the Excessive Price Guidelines (Guidelines).

Under the Compliance and Enforcement Policy, patentees are given an opportunity to submit a VCU when Board Staff concludes, following an investigation, that the price at which a patentee is selling or has sold a patented medicine in Canada appears to have exceeded the Guidelines.

Publication of VCU

VCUs are published upon their approval by the Chairperson. Once a patentee has been informed that the terms of a VCU have been approved, the document becomes public. In the context of the PMPRB´s policy on compliance and enforcement, VCUs are posted on our Web site, reported in our NEWSletter, and included in the Annual Report.

Approval of a VCU by the Chairperson is an alternative compliance mechanism to the commencement of formal proceedings through the issuance of a Notice of Hearing.

Under the PMPRB´s Compliance and Enforcement Policy, a VCU can also be submitted following the issuance of a Notice of Hearing. A VCU submitted at this point must be approved by the Hearing Panel.

Since January 2007, nine VCUs were approved, three following the issuance of a Notice of Hearing and one as a result of a Board Order.

- Airomir, 3M Canada Company

- Denavir, Barrier Therapeutics, Canada Inc. – May 2008

- Dovobet, LEO Pharma Inc.

- Forteo, Eli Lilly Canada Inc.

- Lantus, sanofi-aventis Canada Inc. – March 2008

- OctreoScan, Bristol-Myers Squibb Canada Co.

- Risperdal Consta, Janssen-Ortho Inc.

- Vaniqa, Barrier Therapeutics Canada Inc. – February 2008

- Zemplar, Abbott Laboratories Limited

Airomir is used for the treatment of asthma, chronic bronchitis, and other breathing disorders.

On May 14, 2007, the Hearing Panel approved a VCU agreed to by 3M Canada Company (3M Canada) and Board Staff, for the payment in full of revenues alleged by Board Staff to have been excessive, totaling $485,498.58, derived from January 1, 2004 to December 29, 2006. The proceeding into the price of Airomir, commenced by the issuance of a Notice of Hearing on February 20, 2006, was concluded with the approval of the VCU. 3M Canada met the terms of the VCU.

For purposes of the application of the Board´s Excessive Price Guidelines, Graceway Pharmaceuticals (Graceway) is the Canadian patentee of Airomir as of December 29, 2006. Under the Patented Medicines Regulations, Graceway is required to file pricing and sales information with the PMPRB twice a year, at regular intervals, as well as file its R&D expenditures annually.

Denavir is indicated for the treatment of recurrent herpes labialis (cold sores) in adults.

On May 20, 2008, the Chairperson of the Board approved a VCU submitted by Barrier Therapeutics Canada Inc. (Barrier) for the medicine Denavir.

Barrier undertook to reimburse the excess revenues accrued over the period of August 2006 to December 2007 in the amount of $61,021.80 by making a payment to the Government of Canada.

Dovobet is a dermatological drug required for bringing psoriasis under control.

On January 19, 2008, the Chairperson of the Board approved a VCU submitted by LEO Pharma Inc., for the medicine Dovobet. A Board Order issued on September 17, 2007, following a hearing, required LEO Pharma to price Dovobet at a non-excessive level, and to offset the excess revenues derived from the sale of Dovobet in Canada from 2002 through to December 2005. (For more information on the hearing in this matter, see the Hearings section of this report on page 18.)

For the period January 1, 2006 through December 31, 2006, Board Staff calculated the maximum non-excessive (MNE) price in accordance with the Board Order. In 2006, the average transaction price (ATP) of Dovobet exceeded the 2006 maximum non-excessive (MNE) price, resulting in excess revenues of $870,425.68. To offset these excess revenues, LEO Pharma submitted a VCU and made a payment in full to the Government of Canada.

Forteo is indicated for the treatment of postmenopausal women with severe osteoporosis who are at high risk of fracture or who have failed or are intolerant to previous osteoporosis therapy; and to increase bone mass in men with primary or hypogonadal severe osteoporosis who have failed or are intolerant to previous osteoporosis therapy.

On June 28, 2007, the Chairperson accepted a VCU for Forteo submitted by Eli Lilly Canada Inc. (Lilly).

The VCU included a reduction of the price of Forteo below the MNE price for 2007 in order to offset excess revenues. In the event that all excess revenues had not been offset by December 31, 2007, Lilly had undertaken to make a payment to the federal government in the amount of the remainder of the excess revenues that had not been offset. Excess revenues were offset by December 31, 2007.

Lantus (insulin glargine) is indicated for once-daily subcutaneous administration in the treatment of adult patients with Type 1 or Type 2 diabetes mellitus and pediatric patients (age 6-17 years) with Type 1 diabetes mellitus who require basal (long-acting) insulin for the control of hyperglycemia.

On March 14, 2008, the Chairperson of the Board approved a VCU submitted by sanofi-aventis Canada Inc. (sanofi-aventis) for the medicine Lantus.

In addition to reducing the price of Lantus to a non-excessive level, sanofi-aventis offset the cumulative excess revenues it received from sales of Lantus as of September 18, 2006 by making a payment to the Government of Canada in the amount of $694,239.50 and reducing the price of another medicine, ALTACE HCT. In the event that the full amount of excess revenues, totaling $3,969,554.83, has not been completely offset by December 31, 2008, sanofi-aventis has undertaken to make a further payment to the Government of Canada.

OctreoScan is a radiopharmaceutical agent used for the diagnosis of brain diseases and tumors.

On September 19, 2007, the Chairperson of the Board accepted a VCU for OctreoScan submitted by Bristol-Myers Squibb Medical Imaging, a Division of Bristol-Myers Squibb Canada Co. (Bristol-Myers Squibb).

In addition to reducing the price of OctreoScan to a non-excessive level, Bristol-Myers Squibb offset the excessive revenues accrued, in the amount of $387,181.87, by making payments to the hospitals that purchased OctreoScan and by making a payment to the Government of Canada for the remaining excess revenues in the amount of $7,439.82.

Risperdal Consta is a new formulation of an existing compound (risperidone) indicated for the management of the manifestations of schizophrenia and related psychotic disorders.

On June 7, 2007, the Hearing Panel approved a VCU agreed to by Janssen-Ortho Inc. and Board Staff to, among others, reduce the price of Risperdal Consta to a non-excessive level and to offset excess revenues in the amount of $4,386,172.99. By Order of the Board, the proceeding that was commenced with the issuance of a Notice of Hearing on January 30, 2006, was thereby concluded.

Janssen-Ortho Inc. met the terms of the VCU.

Vaniqa (eflornithine hydrochloride) is indicated for slowing of the growth of unwanted facial hair in women. It is recommended as an adjunct to any hair removal technique.

On February 28, 2008, the Chairperson of the Board approved a VCU submitted by Barrier Therapeutics Canada Inc., for the medicine Vaniqa.

Barrier reimbursed the excess revenues accrued over the period of November 2005 to December 2007, by making a payment to the Government of Canada, in the amount of $70,860.59.

Vaniqa is no longer sold in Canada.

Zemplar is indicated for the prevention and treatment of secondary hyperparathyroidism associated with chronic renal failure.

On September 26, 2007, the Hearing Panel approved a VCU agreed to by Abbott Laboratories Limited (Abbott) and Board Staff to ensure that, among others, the price of Zemplar IV is not excessive and to offset alleged excess revenues in the amount of $58,741.67.

The Chairperson had issued a Notice of Hearing on July 24, 2007, pertaining to the allegations of Board Staff that Zemplar IV had been, and was being, sold by Abbott at prices exceeding those indicated by the Board´s Excessive Price Guidelines. On September 17, 2007, the Hearing Panel received the above-mentioned VCU which proposed to resolve all issues raised by the Notice of Hearing.

By Order of the Board, the proceeding was thereby concluded. Abbott met the terms of the VCU.

The prices of these patented medicines are to remain within the Board´s Guidelines in all future periods in which they remain under its jurisdiction.

Hearings

The PMPRB´s regulatory mandate is to ensure that patentees´ prices of patented medicines are not excessive, thereby protecting consumer interests and contributing to Canadian health care.

In the event that the price of a patented medicine appears to be excessive, the Board can hold a public hearing and, if it finds that the price is excessive, it may issue an Order to reduce the price and to offset revenues received as a result of excessive prices. The Board´s decisions are subject to judicial review in the Federal Court of Canada (FC).

On January 1, 2007, there were eight ongoing hearings. The Board subsequently issued four Notices of Hearing into the matters of the medicines Zemplar, Penlac, and Quadracel-Pentacel, and into the matter of Apotex. It also initiated proceedings into the matter of Celgene Corporation and the medicine Thalomid with respect to its jurisdiction over the price of the medicine.

Of these 13 hearings, three were resolved by way of VCUs: Airomir, Riserpdal Consta and Zemplar. More details on these VCUs are available in the VCU section of this report. Board Orders, concluding the proceedings, were issued in the Dovobet and Copaxone matters. The Thalomid matter was also concluded when the Hearing Panel ruled that it has jurisdiction over the price of the medicine. At the time of publication of this Annual Report, seven matters remain before the Board.

Table 7 provides a summary of all matters before the Board in 2007 up to the publication of this report.

Table 7. Status of the Board´s Proceedings in 2007-2008

| In the matter of |

Indication |

Status |

|

Adderall XR

Shire Canada Inc.

(Formerly Shire BioChem Inc.)

|

Indicated for the treatment of Attention Deficit Hyperactivity Shire Canada Inc. Disorder(ADHD). |

The Board issued a Notice of Hearing in this matter on January 18, 2006. The Hearing Panel issued its decision on the merits on April 10, 2008. The Board is expected to issue an Order, concluding these proceedings in the coming weeks.

On December 15, 2006, the Hearing Panel issued a decision dismissing Shire´s motion for an order that the Board amend its Notice of Hearing to limit its inquiry to the period following the date of issuance of Shire´s patent 2,348,090, namely, April 13, 2004. Shire filed an application for judicial review with the FC. The FC issued its decision on December 19, 2007, dismissing the matter. Shire has appealed the FC decision. The Federal Court of Appeal has not yet heard the parties (i.e., Shire, Janssen-Ortho (intervener), and the Attorney General of Canada) on the appeal. |

Airomir

3M Canada Company |

Used for the treatment of asthma, chronic bronchitis, and other breathing disorders. |

The proceeding into the matter of 3M Canada Company and the price of Airomir, commenced by the issuance of a Notice of Hearing on February 20, 2006, was concluded with the approval of a VCU on May 14, 2007. For more information on this matter, see Voluntary Compliance Undertakings, on page 17. |

Apotex Inc.

(initiated in 2008) |

|

The Board issued a Notice of Hearing in the matter of Apotex Inc. on March 3, 2008, requiring information concerning its status as a patentee and the filing of all statutory information required of a patentee pursuant to the Patent Act and the Patented Medicines Regulations, 1994. The Hearing Panel is scheduled to hear this matter on October 6, 2008. |

Concerta

Janssen-Ortho Inc. |

Indicated for the treatment of Attention Deficit Hyperactivity Disorder (ADHD). |

The Board issued a Notice of Hearing in this matter on July 24, 2006. The Board´s decision in this matter is pending.

It is important to note that Janssen-Ortho was granted the status of intervener in the judicial review application launched by Shire with regard to the Board´s December 15, 2006 decision (Shire and the issue of pre-patent, as described under Adderall XR above). Janssen-Ortho has also appealed the December 19, 2007 FC decision dismissing the case.

|

Copaxone

Teva Neuroscience G.P.-S.E.N.C. |

Indicated for use in ambulatory patients with Relapsing-Remitting Multiple Sclerosis to reduce the frequency of relapses. |

The Board issued a Notice of Hearing into the matter of Copaxone on May 8, 2006. After hearing the parties, the Hearing Panel issued its decision and reasons in this matter on February 25, 2008, including instructions that the parties file a proposed Board Order. The Panel received

separate submissions on a proposed Board Order and issued its Order on May 12, 2008, and, having found that Copaxone had been sold at an excessive price, required Teva to reimburse $2,417,223.29 in excess revenues.

Teva Neuroscience has filed a Notice of Application with the FC seeking judicial review. A hearing date has not yet been scheduled. |

Dovobet

LEO Pharma Inc. |

A dermatological drug administered for bringing psoriasis under control. |

The Board issued a Notice of Hearing in the matter of LEO Pharma Inc. and the medicine Dovobet on November 29, 2004. This matter was concluded with the issuance of a Board Order on September 17, 2008, requiring LEO Pharma to price Dovobet at a non-excessive level, and to offset the excess revenues derived from the sale of Dovobet in Canada from 2002 through to December 2005. |

Nicoderm

Hoechst Marion Roussel Canada |

Indicated for smoking cessation |

The Board issued a Notice of Hearing in this matter in April 1999. Following proceedings before the FC, the matter was returned before the Board. The Hearing Panel will hear the parties on the resolution of this matter on July 3, 2008. |

Penlac

sanofi-aventis Canada Inc. |

Indicated as part of a comprehensive nail management program in immunocompetent patients with mild to moderate onychomycosis of fingernails and toenails without lunula involvement |

The Board issued a Notice of Hearing in this matter on March 26, 2007. Hearing sessions were initiated in June 2007. The Hearing Panel will complete the evidentiary portion of this hearing on July 14-15, 2008 and will hear final arguments on August 20. |

Quadracel and Pentacel

sanofi pasteur Limited |

Quadracel – indicated for the primary immunization of infants, at or above the age of 2 months, and as a booster in children up to their 7th birthday against diphtheria, tetanus, whooping cough (pertussis) and poliomyelitis.

Pentacel – indicated for the routine immunization of all children between 2 and 59 months of age against diphtheria, tetanus, whooping cough (pertussis), poliomyelitis and haemophilus influenzae type b disease. It is sold in Canada in the form of a reconstituted product for injection combining

one single dose vial of Act HIB (Lyophilized powder for injection) and one single (0.5 mL) dose ampoule of Quadracel (suspension for injection).

|

The Board issued a Notice of Hearing in this matter on March 27, 2007. Following the Hearing Panel´s decision of November 26, 2007 denying sanofi pasteur´s Motion that the Panel replace its counsel in this proceeding, sanofi pasteur filed a judicial review application with the FC. The application for judicial review was dismissed. The Panel will reconvene this hearing on June 13, 2008. |

Risperdal Consta

Janssen-Ortho Inc. |

A new formulation of an existing compound (risperidone) indicated for the management of the manifestations of schizophrenia and related psychotic disorders |

The Board issued a Notice of Hearing in the matter of Janssen-Ortho Inc. and the medicine Risperdal Consta on January 30, 2006. The matter was concluded on June 7, 2007, with the Hearing Panel´s approval of a VCU agreed to by Janssen-Ortho Inc. and Board Staff to, among others, reduce the price of Risperdal Consta to a non-excessive level and to offset excess revenues in the amount of $4,386,172.99. For more information on the VCU, see Voluntary Compliance Undertakings, on page 18. |

Strattera

Eli Lilly Canada Inc. |

Indicated for the treatment of Attention Deficit Hyperactivity Disorder (ADHD) in children 6 years of age and over, adolescents and adults. |

The Board issued a Notice of Hearing in this matter on December 15, 2006. Hearing dates have not yet been scheduled. |

Thalomid

Celgene Corporation |

Thalomid does not have a Notice of Compliance but patients in Canada have been purchasing Thalomid from Celgene since 1995 (through Health Canada´s Special Access Programme). Thalomid has been particularly successful in slowing the progress of multiple myeloma, a form of cancer. |

A Hearing Panel of the Board heard submissions from Celgene Corporation and Board Staff on the Board´s jurisdiction in the matter of the price of Thalomid as provided to Canadian patients under Health Canada´s Special Access Programme. In its decision of January 21, 2008, the Board ruled that it has jurisdiction over the price of Thalomid. Celgene Corporation filed a Notice of Application with the FC for a judicial review of the Panel´s decision. A hearing date has not yet been scheduled. |

Zemplar

Abbott Laboratories Limited |

Indicated for the prevention and treatment of secondary hyperparathyroidism associated with chronic renal failure. |

The Board issued a Notice of Hearing in this matter on July 24, 2007. The matter was concluded on September 26, 2007, with the approval of a VCU agreed to by Abbott Laboratories Limited and Board Staff to ensure that, among others, the price of Zemplar IV is not excessive and to offset alleged excess revenues in the amount of $58,741.67. For more information on the VCU, see Voluntary Compliance Undertakings, on page 18.

|

Reporting Information on Key Pharmaceutical Trends

- Trends in Sales of Patented Drugs

- Price Trends

- Comparison of Foreign Prices to Canadian Prices

- Utilization of Patented Drugs

- Manufacturing Trends in Canada

- Canadian Sales in The Global Context

- Analysis of Research and development Expenditure

Trends in Sales of Patented Drugs

Trends in Sales of Patented Drugs 9

Patentees are required, under the Patented Medicines Regulations (Regulations) to submit detailed information on their sales of patented drugs, including information on quantities sold and net revenues received for each product by class of customer in each province/territory. This information allows the PMPRB to analyze trends in sales, prices and utilization of patented drugs. Results of this analysis are presented in this section.10

Sales and Prices

Canadians spend much more today on drugs than they did a decade ago. However, it is important to understand that an increase in spending on drugs does not in itself imply rising drug prices. Previous Annual Reports have found little change in patented drug prices while sales growth was 10-20%. In these instances sales growth was driven by changes in the volume and composition of drug utilization.11 A variety of factors can produce such changes. These include:

- increases in total population;

- changes in the demographic composition of the population (e.g., shifts in the age-distribution toward older persons with more health problems);

- increased incidence of health problems requiring drug therapy;

- changes in the prescribing habits of physicians (e.g., shifts away from older, less expensive drugs to newer, more expensive medications);

- greater use of drug therapy instead of other forms of treatment; and,

- use of new drug products to treat conditions for which no effective treatment existed previously

Sales Trends

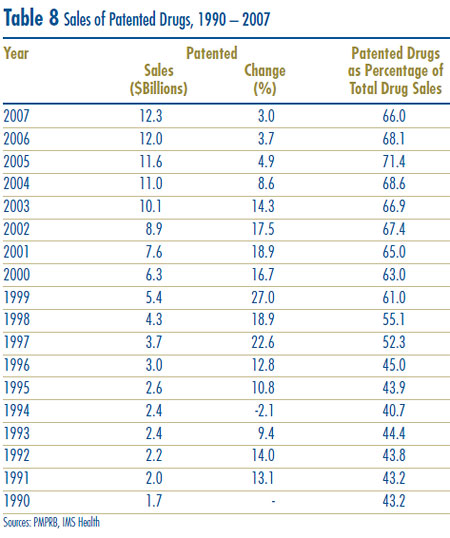

Table 8 reports patentees´ total sales of patented drugs in Canada for the years 1990 through 2007. Sales of patented drugs rose to $12.3 billion from $12.0 billion in 2006, an increase of 3.0%. By comparison, annual growth in sales of patented drugs stood at 27.0% in 1999 and remained in double-digits until 2003.

The fourth column of Table 8 gives sales of patented drugs as a share of overall drug sales. This share rose from approximately 43% in 1990 to 71.4% in 2005. It declined from 68.1% in 2006 to 66.0% in 2007, which implies that sales of generic and non-patented branded drug products grew at a considerably faster rate between these years than sales of patented drugs.12

Drivers of Expenditure Growth

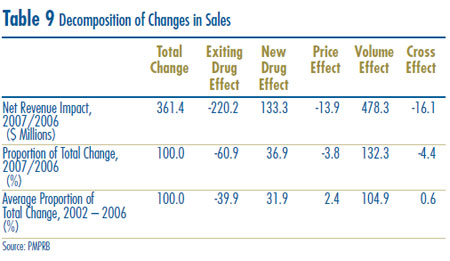

Table 9 decomposes the sales growth that occurred between 2006 and 2007 into distinct elements reflecting the impacts of:

- previously patented drugs that have gone off-patent or left the Canadian market (“Exiting Drug Effect”);

- patented drugs introduced to the Canadian market in 2007 (“New Drug Effect”);

- changes in prices among patented drugs that had Canadian sales in both 2006 and 2007 (“Price Effect”);

- differences in the quantities of such drugs sold in the two years (“Volume Effect”); and

- interactions of price and quantity changes (“Cross Effect”).

The first row of Table 9 gives these impacts as dollar amounts. The second row expresses the impacts as proportions of the change in sales between 2006 and 2007. For the sake of comparison, the third row provides year-over-year proportionate impacts averaged over the period 2002 through 2006.13

The results in this table show that the increase in sales that occurred between 2006 and 2007 was mostly the result of underlying increases in the quantities of patented drugs sold. The resulting volume effect was large enough to more than compensate for a relatively large (negative) exiting drug effect. The contribution of the new drugs in augmenting sales was less than a third that of the volume effect.14 Finally, the overall impact of price changes on sales was negative, but very small in magnitude.

Results obtained for 2007 are typical. The averaged proportionate impacts for 2002 – 2006 imply that year-over-year sales growth has been driven mostly by rising utilization. In comparison, the impact of price changes has been negligible.

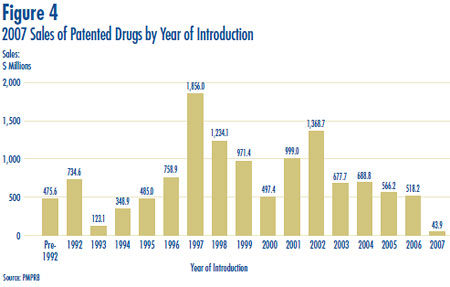

The pronounced decline in sales growth of the last few years is a striking development. Last year´s Annual Report argued that throughout the 1990´s sales growth was largely driven by a succession of new “blockbuster” products that ultimately achieved very high sales volumes, and that since the beginning of the current decade the pharmaceutical industry had not introduced new high-volume products in sufficient numbers to sustain the double-digit sales growth seen in the 1990´s. As a result, 2006 sales of patented drugs were still dominated by products introduced between 1995 and 1999.

These patterns appear once again in 2007 sales. Figure 4 breaks down patentees´ 2007 sales by the year in which products were first sold in Canada. The results in Figure 4 clearly demonstrate that sales of patented drugs are still dominated by products introduced in the second half of the 1990´s: in 2007 products introduced before 2000 accounted for sales of $7.0 billion, compared to $5.4 billion for products introduced in 2000 or later. Patented drugs introduced to Canada in 1997 still account for by far the largest component of 2007 sales.

Table 9 Decomposition of Changes in Sales

figure 4

Sales by Therapeutic Class

The PMPRB normally classifies drugs according to the World Health Organization´s (WHO) Anatomical Therapeutic Chemical (ATC) system when it conducts analyses at the level of therapeutic class. This is a hierarchical system that classifies drugs according to their principal therapeutic use and chemical composition. At its most aggregate level, Level 1, the ATC system classifies drugs according to the aspect of human anatomy with which they are primarily associated.

Table 10 breaks out sales of patented drugs in Canada in 2007 by major therapeutic class, defined by ATC Level 1. The table gives the 2007 sales for each class, the share of the total sales this represents and the rate at which sales grew relative to 2006. Values in the last column represent the component of overall sales growth attributable to drugs in the corresponding therapeutic class.15 By this measure, the primary drivers of sales growth between 2006 and 2007 were:

- drugs treating the respiratory system and

- antineoplastics and immunomodulating agents.

These two classes jointly accounted for more that 80% of sales growth. This is the third consecutive year antineoplastics and immunomodulating agents have emerged as a leading contributor to sales growth.

Table 10 Patentees´ Sales of Patented Drugs by Therapeutic Class

| Therapeutic Class |

Sales 2007 ($M) |

Share of Total 2007 Sales (%) |

Growth: 2007/2006 ($M) (%) |

Share of Sales Growth (%) |

| A: Alimentary Tract and Metabolism |

1,602.1 |

13.0 |

39.3 |

2.5 |

10.9 |

| B: Blood and Blood Forming Organs |

883.7 |

7.2 |

86.0 |

10.8 |

23.8 |

| C: Cardiovascular System |

3,105.3 |

25.1 |

41.7 |

1.4 |

11.5 |

| D: Dermatologicals |

126.8 |

1.0 |

27.2 |

27.3 |

7.5 |

| G: Genito-urinary System and Sex Hormones |

417.1 |

3.4 |

36.6 |

9.6 |

10.1 |

| H: Systemic Hormonal Preparations |

95.4 |

0.8 |

-7.4 |

-7.2 |

-2.0 |

| J: General Antiinfectives for Systemic Use; and P: Antiparasitic Products16 |

1,175.7 |

9.5 |

39.3 |

3.5 |

10.9 |

| L: Antineoplastics and Immunomodulating Agents |

1,677.6 |

13.6 |

120.1 |

7.7 |

33.2 |

| M: Musculo-skeletal System |

495.0 |

4.0 |

29.0 |

6.2 |

8.0 |

| N: Nervous System |

1,600.5 |

13.0 |

-202.1 |

-11.2 |

-55.9 |

| R: Respiratory System |

947.7 |

7.7 |

132.5 |

16.3 |

36.7 |

| S: Sensory Organs |

161.1 |

1.3 |

12.1 |

8.1 |

3.4 |

| V: Various |

59.3 |

0.5 |

7.1 |

13.6 |

2.0 |

| All Therapeutic Classes |

12,347.4 |

100.0* |

361.5 |

3.0 |

100.0* |

Source: PMPRB

* Values in this column may not add to 100.0 due to rounding.

9 Throughout this chapter the term “patented drug” denotes products currently subject to the PMPRB price review.

10 All statistical results for 2007 are based on data submitted by patentees as of March 2008. On occasion, patentees report revisions to previously submitted data or provide data not previously submitted. New data of this sort can appreciably affect the statistics on which this chapter reports. To account for this possibility, the PMPRB has adopted the practice of reporting recalculated sales figures (Trends in Sales of Patented Drugs), price and quantity indices (Price Trends, on page 27; Utilization of Patented Drugs, on page 36) and foreign-to-Canadian price ratios (Comparison of Canadian Prices to Foreign Prices, on page 32) for the five years preceding the current Annual Report year. All such recalculated values reflect currently available data. Consequently, where data revisions have occurred, values reported here may differ from those presented in earlier Annual Reports.

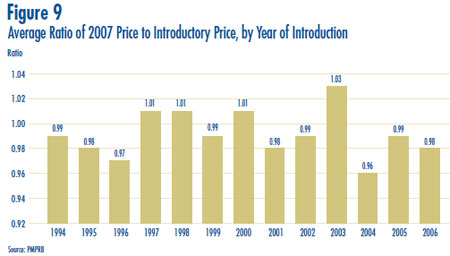

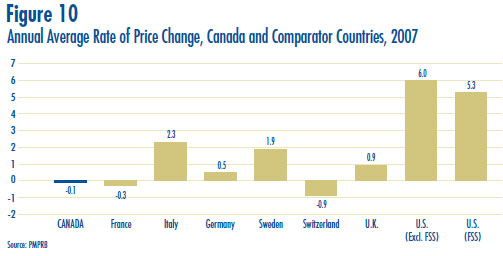

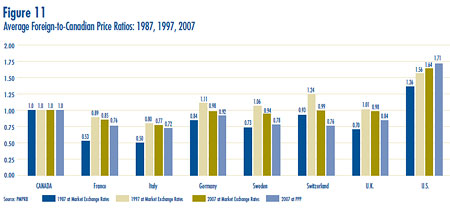

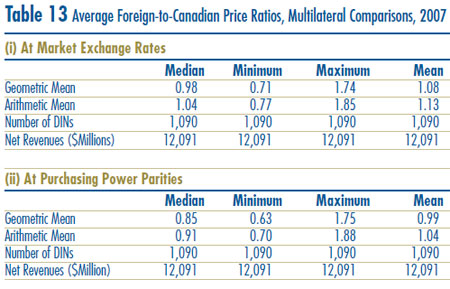

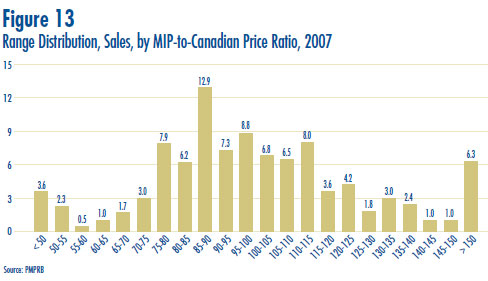

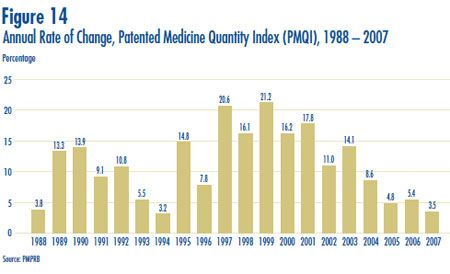

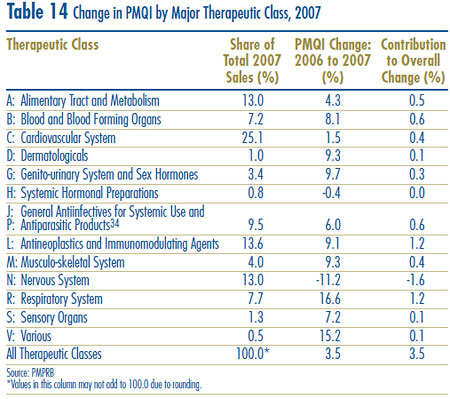

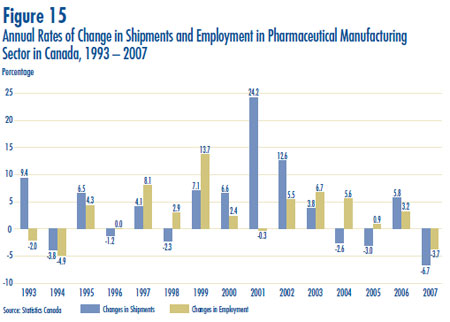

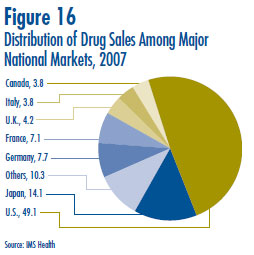

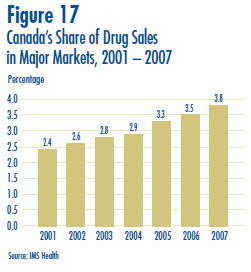

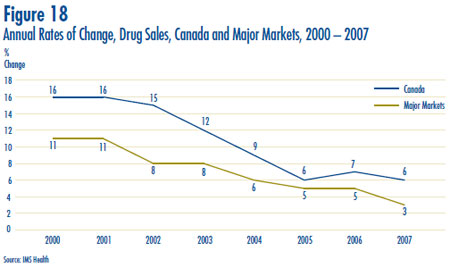

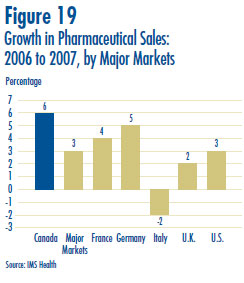

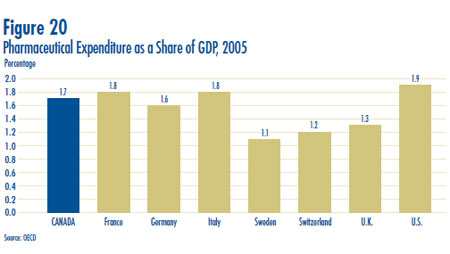

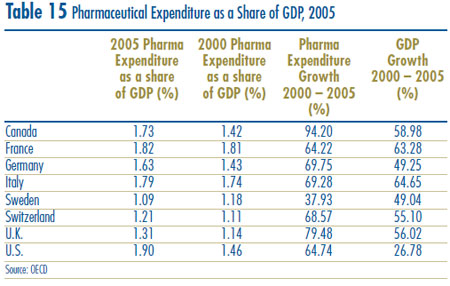

11 Studies conducted by the PMPRB of public pharmaceutical insurance plans indicate that increased utilization of existing and new drugs accounts for most of the recent growth in expenditures. PMPRB, Provincial Drug Plan Overview Report: Pharmaceutical Trends, 1995/96 -1999/00, September 2001.