Generics360 – Generic Drugs in Canada, 2014

Acknowledgements

This report was prepared by the Patented Medicine Prices Review Board (PMPRB) as part of the National Prescription Drug Utilization Information System (NPDUIS).

The PMPRB would like to acknowledge the contributions of:

- The members of the NPDUIS Advisory Committee, for their expert oversight and guidance in the preparation of this report.

- The PMPRB staff for their contribution to the analytical content of the report:

- Orlando Manti – Senior Economist

- Tanya Potashnik – Director, Policy and Economic Analysis

- Elena Lungu – Manager, NPDUIS

- Carol McKinley – Communications Advisor

- The PMPRB scientific and communication groups

Disclaimer

NPDUIS is a research initiative that operates independently of the regulatory activities of the Board of the PMPRB. The statements and opinions expressed in this NPDUIS report do not represent the official position of the PMPRB.

Although based in part on data obtained under license from IMS AG’S MIDAS™ database, the statements, findings, conclusions, views and opinions expressed in this report are exclusively those of the PMPRB and are not attributable to IMS AG.

Contact Information

Patented Medicine Prices Review Board

Standard Life Centre

Box L40

333 Laurier Avenue West

Suite 1400

Ottawa, ON K1P 1C1

Telephone: 1-877-861-2350

TTY: 613-288-9654

Email: PMPRB.Information-Renseignements.CEPMB@pmprb-cepmb.gc.ca

Executive Summary

Canadian generic prices have been relatively high historically compared to international levels. Through the implementation of generic pricing policies, the provinces have reduced the price of generic drugs for all Canadians, realizing important cost savings. While these policies have narrowed the gap in generic prices between Canadian and international markets, prices in other countries continue to be lower.

Generics360 is a Patented Medicine Prices Review Board (PMPRB) report series that monitors and reports on the latest developments in generic drug pricing and markets in Canada and compares them with those of other industrialized countries. This series takes a comprehensive approach, covering a broad array of drugs and countries, and analyzes the issue of generic pricing in Canada from various angles, including reference brand-name prices, international generic prices and market segmentation. This report updates previous PMPRB research (PMPRB 2014), highlighting the recent trends in Canadian generic pricing at a national level, which combines all market segments: public, private and out-of-pocket.

The reporting provides insight into the factors influencing these trends by examining market dynamics, such as exchange rates, foreign price reductions and the shifting mix and sales weights of drugs, to isolate the impact of reduced domestic generic price levels on the gap between Canadian and foreign prices.

While provincial generic pricing policies have been at the center of the generic price reductions in Canada, their impact is not fully reflected in this report due to the limited time frame examined, the analysis of data at a national level, and the broad basket of drugs included in the analysis. The national prices examined do not necessarily correspond to the prices in the public sector, particularly for drugs that fell outside the generic pricing policies.

Background

Since 2010, most provincial governments have implemented generic pricing policies, which have reduced the price of generic drugs in Canada and have resulted in important cost savings for all Canadians.

Provincial and territorial governments are also working together through the pan-Canadian Pharmaceutical Alliance (pCPA) to develop collaborative policies related to generic drug prices for their publicly funded drug programs. As of April 1, 2015, the prices of 14 commonly used generic drugs were reduced to 18% of the brand-name reference price, with the prices for another four drugs anticipated to be reduced by April 1, 2016.

In addition, a pan-Canadian Tiered Pricing Framework was developed that sets the prices of new generic products based on the number of products available in the Canadian market.

Methods

The analysis covers a set of 554 leading generic drugs, which accounted for 81.9% of all Canadian generic manufacturer-level sales ($1,006.1 million) in the last quarter of 2014. Price comparisons were conducted using generic manufacturer-level retail prices from IMS AG’s MIDAS™ database, which includes generic drug sales in the public, private and out-of-pocket markets. International multilateral price comparisons encompass the seven countries the PMPRB considers in reviewing the prices of patented drugs (PMPRB7): France, Germany, Italy, Sweden, Switzerland, the United Kingdom and the United States. Four other countries are also included in the bilateral price comparisons: the Netherlands, Spain, Australia and New Zealand.

Key Findings

The period from 2010 to 2014 was marked by significant declines in domestic generic price levels.

Canadian generic prices fell, on average, by 45%, exceeding the generic price declines in all other foreign markets analyzed. Relative to their brand-name counterparts, average generic prices in Canada declined from 63% to 36% over this time period.

While the declines in domestic generic price levels reduced the gap between Canadian and foreign prices by more than half, average Canadian generic prices remained relatively high in 2014.

The difference between generic prices in Canadian and foreign markets gradually decreased from 40% in 2010 to 19% in 2014. Generic prices also declined in foreign markets over the period of analysis, which reduced the impact of lower Canadian prices.

The reduction in the generic price differential between Canadian and foreign markets was mainly the result of provincial generic pricing policies.

While the weakening of the Canadian dollar in recent years contributed to an improvement in Canada’s relative position, this change was nearly offset by the price reductions that took place in foreign markets, with most of the remaining gains being accounted for by domestic generic price reductions.

The gap between foreign and Canadian prices was wider for molecules with higher sales and a greater number of domestic suppliers.

Generic price differences were more pronounced for drugs with estimated annual Canadian sales of more than $10 million and for drugs with six or more suppliers, with foreign mean international prices 25% and 21% lower than in Canada, respectively. These markets accounted for a large proportion of generic sales.

Introduction

Canadian generic prices have been relatively high historically compared to international levels. Through the implementation of generic pricing policies, the provinces have reduced the price of generic drugs for all Canadians, realizing important cost savings. While these policies have narrowed the gap in generic prices between Canadian and international markets, prices in other countries continue to be lower.

Through the newly named Generics360 report series, the Patented Medicine Prices Review Board (PMPRB) monitors and reports on the latest developments in generic drug pricing and markets in Canada and compares them with those of other industrialized countries. This series takes a comprehensive approach, covering a broad array of drugs and countries, and analyzes the issue of generic pricing in Canada from various angles, including comparisons to brand-name and international generic prices and a breakdown by market segmentation.

This report updates previous PMPRB research (PMPRB 2010a, 2010b, 2011, 2013, 2014), highlighting the recent trends in Canadian generic pricing at the national level. The results reflect pricing in the public, private and out-of-pocket market segments and provide background information on the factors influencing the trends, including the impact of recent provincial generic pricing policies.

The effects of recent provincial policy changes are partially captured in this report by examining the trends in Canadian generic prices over time. Since 2010, most provincial governments have implemented generic pricing policies, which have reduced the price of generic drugs in Canada and have resulted in important cost savings for all Canadians. Provincial and territorial governments are also working together through the pan-Canadian Pharmaceutical Alliance (pCPA) to develop collaborative policies related to generic drug prices for their publicly funded drug programs. As of April 1, 2015, the prices of 14 commonly used generic drugs were reduced to 18% of the brand-name reference price, with the prices for another four drugs anticipated to be reduced by April 1, 2016. In addition, a pan-Canadian Tiered Pricing Framework was developed that sets the prices of new generic products based on the number of products available in the Canadian market. The full impact of the pCPA initiative is not reflected in this analysis due to the time frame examined; however, important trends do emerge.

Provincial pricing policies have had a pronounced and widespread impact on the overall generic price levels in Canada. Not only did the provincial public sector account for a sizable share of the national market in 2014 (36.0% of prescribed drug spending; CIHI 2015), but it also had a higher generic market capture (71% of prescriptions; PMPRB 2015) than the private sector (55% of prescriptions; PMPRB 2015). Moreover, the lower prices attained through provincial generic pricing policies for drugs covered by public drug plans were also realized in private markets, resulting in comparable generic prices across provincial public and private plans (PMPRB 2015).

While provincial pricing policies are at the center of the generic price reductions in Canada, their impact is not fully reflected in this report due to the limited time frame examined, the depth of analysis at the national level, and the broad basket of drugs included in the analysis. The national prices examined do not necessarily reflect the prices in the public sector, particularly for drugs that fell outside the generic pricing policies.

The first section of this report examines how generic prices in Canada have evolved in recent years relative to brand-name product levels. This is followed by an analysis of the trends in foreign-to-Canadian price ratios for a variety of bilateral and multilateral measures of foreign price from 2010 to 2014 (Section 2). Further insight into these differentials is provided through a breakdown of the factors driving variations in international generic prices (Section 3). Finally, the report explores the influence of market size and the number of suppliers on average foreign-to-Canadian price ratios (Section 4). A description of the methods, the selection criteria for the generic drugs examined in this report and the limitations of the analysis follows the introduction.

This analysis will inform policy discussions, aid in evidence-based decision making and provide all Canadians with a comprehensive overview of the state of generic pricing in Canada since 2010.

Methods

The data source for Canadian and international generic and brand-name prices is IMS AG’s MIDAS™ database (All rights reserved) for the period beginning with the first quarter of 2010 (Q1-2010) and ending with the fourth quarter of 2014 (Q4-2014). This data reflects the national market and includes generic drug sales in the public, and private and out-of-pocket market segments. Results generally focus on the last quarter of any given year.

The Canadian and international prices reported in IMS AG’s MIDAS™ database are manufacturer ex-factory prices and reflect all sales to the retail sector. These are average prices for all generic versions of a drug, encompassing all generic trade names available in a particular country. Market spot exchange rates were used to convert foreign currency prices into their Canadian dollar equivalents.

Eleven countries were included in the international price comparisons: the seven countries that the PMPRB considers when reviewing the prices of patented drug products (PMPRB7)—France, Germany, Italy, Sweden, Switzerland, the United Kingdom and the United States; and four other countries whose pharmaceutical markets are comparable in scale to Canada’s—the Netherlands, Spain, Australia and New Zealand. These countries were also included in previous PMPRB studies (PMPRB 2010a, 2010b, 2011, 2013, 2014).

Average foreign-to-Canadian price ratios were calculated for a variety of bilateral and multilateral measures. Bilateral price ratios compare the generic prices for each individual country to prices available in Canada and are reported for all 11 countries. Multilateral price ratios report the minimum, mean, median and maximum prices available for the foreign markets analyzed. These are Canadian sales-weighted arithmetic averages of the corresponding foreign-to-Canadian price ratios for individual drugs. The multilateral analyses only consider prices from the PMPRB7.

Appendix B describes how the average foreign-to-Canadian price ratios are calculated. Additional methodological notes are provided in Appendix A.

Selection Criteria for Generic Drugs

The analysis covers oral solid prescription drugs (see definition) with estimated annual Canadian generic sales of at least $1 million in 2014. The results are only based on retail sales; hospital sales are excludedFootnote 1.

The analysis is restricted to “mature markets”, which refers to generic drugs that have been on the market for at least one year. This excludes newly genericized drugs where the market structure and the extent of market competition are still in flux, and generic prices may not have reached a stable level.

This report examines 554 leading generic drugs in Canada with prices available in foreign markets. These drugs accounted for Canadian manufacturer ex-factory retail sales of $1,006.1 million in Q4-2014, representing 81.9% of all generic ex-factory sales.

Summary Table: All generic drugs in Canada versus the generic drugs selected for analysis, Q4-2014

|

Number of drugs |

Manufacturer ex-factory sales ($million) |

| All generic drugs |

1,064 |

$1,235.0 |

| Selected generic drugs |

554 |

$1,006.1 |

| Share of selected generic drugs |

34.5% |

81.9% |

| Source: MIDAS™ database, October–December 2014, IMS AG. All rights reserved. |

The selection of drugs reported in the study represents a significant component of the generic market in Canada. While the analysis is designed to account for as much of the generic drug market as possible, complete market representation was not possible, and an important generic market segment was not captured due to unavailable or inconclusive data.

The process for drug selection entailed:

- Eliminating drugs in non-oral solid form and those with small markets, i.e., less than $1 million in annual Canadian sales, as they most likely would have had low matching with foreign markets and would not have impacted the overall results due to their low market representation;

- Limiting drug matching with foreign markets, i.e., restricting the selection to molecules with the same form and strength in international markets; and

- Restricting multilateral measures to include drugs that have three or more foreign markets with available prices for the foreign-to-Canadian comparison of the median and mean.

Definitions

Drug: any unique combination of active ingredient, strength and form.

Product: a version of a drug sold by a particular manufacturer.

Generic: a product sold under the name of its active ingredient and classified according to the IMS definition of a generic/non-generic product.

Brand: a product sold under a trade name that differs substantially from that of its ingredient.

Supplier: a pharmaceutical corporation with available sales for a generic drug included in the analysis over the time period examined.

Limitations

The data in this study represents a snapshot in time. Canadian generic prices and foreign-to-Canadian price comparisons are reported for the last quarter of 2014. Additional generic pricing policies that have been implemented since then are not reflected in the results (Appendix C).

The international prices available in IMS AG’s MIDAS™ database are estimated manufacturer ex-factory prices. They do not capture off-invoice price rebates and allowances, which manufacturers may provide to retailers to stock their interchangeable products. Consequently, the prices reported do not necessarily reflect the net revenue to manufacturers.

The analysis reports the estimated manufacturer prices. These prices may be different from other price points in the distribution chain, such as wholesaler or pharmacy retail prices. Therefore, the reported prices may not reflect the prices the consumer paid or what public and private plans reimbursed.

The methodology that MIDAS™ uses for estimating drug prices varies by country. It depends on the distribution system and the availability of public data at various points in the distribution chain. This data includes the manufacturer´s price, the wholesale price, and the pharmacy price in specific markets. Depending on the country, manufacturer, wholesale or retail prices may represent estimates based on assumed regulated margins and/or markups.

Generic prices reported for the Canadian marketplace reflect the mixture of varying provincial generic pricing policies and the timing of implementation of these policies. They also include prices paid by private insurers and consumers paying out-of-pocket. Therefore, Canadian national prices examined do not necessarily correspond to public sector prices, particularly for drugs that fall outside generic pricing policies. The impact of these policies is not fully reflected in this report due to the time frame examined, the nature of the national-level analysis and the broad basket of drugs included in the analysis.

The analysis in this report is not intended to evaluate the provincial generic pricing policies or the pCPA generic Tiered Pricing Framework. A different analytical approach would be required for this exercise.

1. Generic-to-Brand Price Comparisons

The period from 2010 to 2014 was marked by significant declines in domestic generic prices, with levels falling, on average, by 45%. Average generic prices in Canada declined from 63% to 36% of their brand-name counterparts over this time period.

Figure 1.1 compares the quarterly time-series plots of the generic price index and the average generic-to-brand price ratio for Canada. Broadly speaking, both follow the same trend: remaining fairly flat until 2010, then entering a relatively rapid decline that continues to 2013 and appears to stabilize by 2014.

Generic prices have fallen, on average, by 46% since 2007, with a pronounced reduction of 45% occurring since 2010. The effect of policy changes on generic-to-brand price ratios is evident. In some cases it is possible to match a “kink” in the plot with a specific policy change adopted by a large reimbursement program; for example, the large drop occurring in the second half of 2010 coincides with the adoption of a “25% rule” in Ontario (see Appendix C).

Figure 1.1. Generic price index versus generic-to-brand price ratio, Canada, Q4-2007 to Q4-2014

Click on image for larger view

Note: Results for Canada reflect generic drug prices in all Canadian markets: public, private and out-of-pocket.

Source: MIDAS™ database, October–December 2007 to October–December 2014, IMS AG. All rights reserved.

Figure description

This line graph compares the trend in the generic price index to the trend in the generic-to-brand price ratio in Canada from the fourth quarter of 2007 to the fourth quarter of 2014.

|

Generic price index |

Generic-to-brand price ratio |

| 2007: fourth quarter |

1.0000 |

0.6524 |

| 2008: first quarter |

0.9805 |

0.6494 |

| 2008: second quarter |

0.9697 |

0.6421 |

| 2008: third quarter |

0.9633 |

0.6352 |

| 2008: fourth quarter |

0.9611 |

0.6241 |

| 2009: first quarter |

0.9602 |

0.6319 |

| 2009: second quarter |

0.9632 |

0.6303 |

| 2009: third quarter |

0.9630 |

0.6253 |

| 2009: fourth quarter |

0.9592 |

0.6237 |

| 2010: first quarter |

0.9729 |

0.6259 |

| 2010: second quarter |

0.9692 |

0.6260 |

| 2010: third quarter |

0.8810 |

0.5532 |

| 2010: fourth quarter |

0.8553 |

0.5358 |

| 2011: first quarter |

0.8368 |

0.5225 |

| 2011: second quarter |

0.7763 |

0.4691 |

| 2011: third quarter |

0.7575 |

0.4557 |

| 2011: fourth quarter |

0.7534 |

0.4510 |

| 2012: first quarter |

0.7470 |

0.4462 |

| 2012: second quarter |

0.6940 |

0.4147 |

| 2012: third quarter |

0.6523 |

0.3877 |

| 2012: fourth quarter |

0.6448 |

0.3851 |

| 2013: first quarter |

0.6387 |

0.3814 |

| 2013: second quarter |

0.5792 |

0.3648 |

| 2013: third quarter |

0.5637 |

0.3508 |

| 2013: fourth quarter |

0.5630 |

0.3521 |

| 2014: first quarter |

0.5590 |

0.3564 |

| 2014: second quarter |

0.5426 |

0.3528 |

| 2014: third quarter |

0.5412 |

0.3539 |

| 2014: fourth quarter |

0.5389 |

0.3558 |

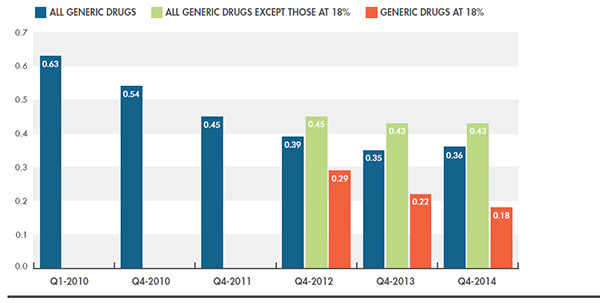

Figure 1.2 takes a closer look at the evolution of Canadian generic-to-brand price ratios from 2010 to 2014 for (i) all generic drugs included in the analysis, (ii) all generic drugs except those subject to the 18% ruleFootnote 2, and (iii) only the generic drugs subject to the 18% rule. The results reflect the impact of the major policy changes up to 2014 (see Appendix C).

From 2010 to 2014, generic prices fell, on average, from 63% to 36% of the corresponding brand-name price levels. The generic drugs that were subject to the 18% rule decreased the most from 2012 to 2014, to levels reflecting the policy. The prices of all other drugs had a less pronounced decline over the same time period, falling from 45% to 43%. Note that these average results encompass generic drugs and prices in all three market segments, public, private and out of pocket, and are inclusive of drugs that fall outside the generic pricing policies.

Figure 1.2. Average* generic-to-brand price ratios, Canada, Q1-2010 to Q4-2014

Click on image for larger view

*Sales-weighted averages of drug-level ratios, with weights based Canadian generic sales in the indicated year.

Note: Results reflect generic drug prices in all markets: public, private and out-of-pocket.

Generic drugs at 18% include: atorvastatin, ramipril, venlafaxine, amlodipine, omeprazole, rabeprazole (effective April 1, 2013); and rosuvastatin, pantoprazole, citalopram, simvastatin (effective April 1, 2014).

Drugs included: 554

Canadian generic ex-factory sales analyzed: $1,006.1 million

Source: MIDAS™ database, January–March 2010 to October–December 2014, IMS AG. All rights reserved.

Figure description

This bar graph depicts the decreasing trend in the average generic-to-brand price ratio in Canada from 2010 to 2014 based on all generic drugs included in the analysis. Values are given for the first and fourth quarter of 2010 and for the fourth quarter of all other years (2011 to 2014).

For 2012 to 2014, values are also broken out to give the generic-to-brand price ratios for generic drugs subject to the 18% rule and for the rest of the drugs not at 18%.

Generic-to-brand ratios for all drugs included in the analysis

- First quarter of 2010: 0.63

- Fourth quarter of 2010: 0.54

- Fourth quarter of 2011: 0.45

- Fourth quarter of 2012: 0.39

- Fourth quarter of 2013: 0.35

- Fourth quarter of 2014: 0.36

Generic-to-brand ratios for drugs at 18%

- Fourth quarter of 2012: 0.29

- Fourth quarter of 2013: 0.22

- Fourth quarter of 2014: 0.18

Generic-to-brand ratios for all drugs except those at 18%

- Fourth quarter of 2012: 0.45

- Fourth quarter of 2013: 0.43

- Fourth quarter of 2014: 0.43

While public plans cover a broad range of generic drugs, the private sector may cover generic drugs that are not reimbursed by public plans, or with pricing that falls outside the provincial policies. These drugs may be priced at a relatively high percentage of the brand-name prices. This may explain the generic-to-brand ratio of 43% in Q4-2014 (Figure 1.1), which exceeds the provincial policy limits of 25%. This report does not measure the extent of the generic price differentials across provinces and payers, or the variations in the types of generic drugs reimbursed.

Appendix D and E report the foreign-to-Canadian price ratios, by bilateral and multilateral comparator, for top-selling drugs. For example, the national average manufacturer ex-factory price for the generic version of esomeprazole 40 mg, a top-selling generic drug in Canada in Q4-2014, was $1.6575, which represented 78% of the reference brand-name price. At the time, this drug was not generally reimbursed by pCPA participating provinces and did not meet provincial generic pricing policies. Other top-selling drugs listed in these appendices (montelukast and levetiracetam) may also have fallen outside provincial policies or may not have met the policy criteria at the time. The list of 25 top-selling generic drugs reported in these appendices reflects the ranking of drugs at the national level and includes public, private and out-of-pocket market segments. Thus it reflects a different mix of drugs and sales weights than the top sellers for the public market segment.

2. Foreign-to-Canadian Price Comparisons

While the declines in domestic generic price levels reduced the gap between Canadian and foreign prices by more than half, Canadian generic prices remained relatively high. The difference in generic prices between Canadian and foreign markets gradually decreased from 40% in 2010 to 19% in 2014.

This section reports the average foreign-to-Canadian generic price ratios calculated for a variety of bilateral and multilateral measures of foreign price. Bilateral price ratios compare the generic price levels for an individual country to prices available in Canada, while multilateral ratios compare the prices across all countries to those available in Canada. A brief description of how to interpret price ratios follows, while Appendix B provides a more in-depth description of how the average foreign-to-Canadian price ratios are calculated.

How to interpret price ratios

The results reported in this study are Canadian sales-weighted arithmetic averages of the corresponding foreign-to-Canadian price ratios for individual drugs, with sales weights based on Canadian generic sales. This analysis is restricted to generic prices.

The foreign-to-Canadian price differentials calculated in this way provide exact answers to questions such as:

How much more or less would Canadians have paid for the generic drugs they purchased in 2014 had they paid prevailing international prices (multilateral measures) or the prices in comparator country X (bilateral measures)?

For the analysis, the Canadian generic price level is set to a value of 1. An average foreign-to-Canadian price ratio below 1 indicates a lower average foreign price, while a ratio above 1 indicates a higher price. For a definition of the measures reported, see Appendix B.

More precisely, a foreign-to-Canadian ratio reported for comparator country X that is less than 1 indicates that Canadians would have paid less for the “basket” of generic drugs they purchased in 2014 had they paid comparator country X prices; conversely, if the ratio is greater than 1, they would have paid more. For example, a foreign-to-Canadian ratio of 0.81 indicates that spending on generics at comparator country X prices would have been 81% of what was actually spent at Canadian prices. In other words, this indicates that the international prices were 19% lower than Canadian prices. In this respect, the average price ratios reported provide a meaningful answer to the broader question:

Are generic drugs more or less costly in Canada than in comparator country X?

Note that this applies to both bilateral comparisons and multilateral comparisons.

Figures 2.1 and 2.2 provide multilateral foreign-to-Canadian ratios for the PMPRB7 countries: France, Germany, Italy, Sweden, Switzerland, the United Kingdom and the United States.

Figure 2.1 presents results for the period from Q4-2010 to Q4-2014 for two measures of central tendency—the mean and medianFootnote 3 of foreign prices—as well as for the minimum and maximum foreign prices. The results suggest that the difference between Canadian and foreign generic prices has decreased over the four-year period from 40% in 2010 to 19% in 2014. Nevertheless, Canadian generic prices remained relatively high compared to foreign prices. In 2014, the mean of PMPRB7 prices was, on average, 0.81 of the corresponding Canadian prices, while the median foreign price was 0.69 of the Canadian price.

Figure 2.1. Average multilateral foreign-to-Canadian generic price ratios – Generic drugs, PMPRB7*, Q4-2010 to Q4-2014

Click on image for larger view

*France, Germany, Italy, Sweden, Switzerland, the United Kingdom and the United States.

Note: The analysis was restricted to generic drugs that had been on the market for at least one year.

The minimum and maximum values were calculated for drugs with prices available in at least two foreign markets.

The mean and median values were calculated for drugs with prices available in at least three foreign markets.

Results for Canada reflect generic drug prices in all Canadian markets: public, private and out-of-pocket.

Source: MIDAS™ database, October–December 2010 to October–December 2014, IMS AG. All rights reserved.

Figure description

This bar graph gives the mean, median, minimum and maximum average foreign-to-Canadian generic price ratios for the fourth quarters of 2010 to 2014. The Canadian generic price level is set to one. Ratios greater than one indicate higher average foreign prices, while ratios less than one indicate lower foreign prices.

The mean foreign-to-Canadian price ratio was 0.60 in 2010, 0.62 in 2011, 0.67 in 2012, 0.80 in 2013, and 0.81 in 2014.

The median foreign-to-Canadian price ratio was 0.51 in 2010, 0.54 in 2011, 0.57 in 2012, 0.69 in 2013, and 0.69 in 2014.

The minimum foreign-to-Canadian price ratio was 0.25 in 2010, 0.26 in 2011, 0.26 in 2012, 0.30 in 2013, and 0.31 in 2014.

The maximum foreign-to-Canadian price ratio was 1.14 in 2010, 1.15 in 2011, 1.20 in 2012, 1.64 in 2013, and 1.70 in 2014.

The table below the graph lists the number of selected drugs included in the calculations for the fourth quarter of 2014; the total Canadian generic sales for the selected drugs in millions of dollars; and the share of Canadian generic sales of the selected drugs in percent.

For the mean and the median, 343 drugs were included, representing $722.4 million in sales and 71.8% of Canadian generic sales.

For the minimum and the maximum, 397 drugs were included, representing $782.3 million in sales and 77.8% of Canadian generic sales.

The table below the figure reports the number of drugs included in the analysis, the corresponding Canadian generic sales ($million) and their respective share of total Canadian generic sales (%) for the selected drugs for Q4-2014. Drugs were selected at the ingredient, strength and form level where prices were available in three or moreFootnote 4 foreign markets for the two measures of central tendency (mean and median) and in two or more foreign markets for the minimum and the maximum measures. For example, the “drugs included” value of 343 for the mean foreign price indicates that the ratio encompasses 343 drug-level mean foreign-to-Canadian price ratios. While these drugs accounted for a relatively small share of the (21.4%) of the number of generic drugs in Canada, they represented a relatively large share of the Canadian generic sales for the selected drugs (see Summary Table): 71.8% of the Canadian generic sales for all drugs included in the study and 59.6% of all generic drug sales in Canada, with sales of $722.4 million in Q4-2014.

Figure 2.2 provides bilateral price ratios for Q4-2010 and Q4-2014. These results indicate that while the gap between foreign and Canadian generic prices has decreased in all cases, Canadian generic prices remained higher than those in most other industrialized countries for the drugs included in the analysis.

Figure 2.2. Average bilateral foreign-to-Canadian generic price ratios – Generic drugs, by comparator, Q4-2010 and Q4-2014

Click on image for larger view

*France, Germany, Italy, Sweden, Switzerland, the United Kingdom and the United States.

Note: The analysis was restricted to generic drugs that had been on the market for at least one year. Results for Canada reflect generic drug prices in all Canadian markets: public, private and out-of-pocket.

Source: MIDAS™, October–December 2010 and October–December 2014, IMS AG. All rights reserved.

Figure description

This bar graph compares the average bilateral foreign-to-Canadian generic price ratios for the fourth quarters of 2010 and 2014. The Canadian generic price level is set to one; ratios greater than one indicate higher average foreign prices, while ratios less than one indicate lower foreign prices. Average prices in 11 foreign countries are compared to prices in Canada. This includes the PMPRB comparator countries (France, Germany, Italy, Sweden, Switzerland, the United Kingdom, and the United States), as well as Australia, Spain, the Netherlands and New Zealand.

| Country |

Foreign-to-Canadian price ratio in 2010 |

Foreign-to-Canadian price ratio in 2014 |

| France |

0.57 |

0.77 |

| Germany |

0.50 |

0.67 |

| Italy |

0.50 |

0.71 |

| Sweden |

0.47 |

0.52 |

| Switzerland |

0.87 |

1.40 |

| United Kingdom |

0.50 |

0.72 |

| United States |

0.80 |

0.94 |

| Australia |

0.94 |

1.04 |

| Spain |

0.48 |

0.82 |

| The Netherlands |

0.33 |

0.39 |

| New Zealand |

0.30 |

0.36 |

The corresponding table below the graph lists the number of drugs included in the calculations for the fourth quarter of 2014 by country; the total Canadian generic sales of the selected drugs in millions of dollars; and the percentage share of Canadian generic sales of the selected drugs.

| Country |

Drugs included for the

fourth quarter of 2014 |

Canadian generic sales for the

selected drugs in millions of dollars |

Share of Canadian generic sales

for the selected drugs in percent |

| Canada (total) |

544 |

1006.1 |

100 |

| France |

240 |

557.3 |

55.4 |

| Germany |

336 |

657.9 |

65.4 |

| Italy |

237 |

600.4 |

59.7 |

| Sweden |

226 |

490.4 |

48.7 |

| Switzerland |

231 |

593.5 |

59.0 |

| United Kingdom |

292 |

627.9 |

62.4 |

| United States |

366 |

625.8 |

62.2 |

| Australia |

264 |

585.0 |

58.1 |

| Spain |

273 |

602.4 |

59.9 |

| The Netherlands |

268 |

558.9 |

55.6 |

| New Zealand |

138 |

316.5 |

31.5 |

The 2014 foreign-to-Canadian price ratios are substantially higher than those in 2010. In countries like Sweden, the Netherlands and New Zealand, which have relatively low generic prices, the foreign-to-Canadian price ratios have only slightly improved since 2010.

Of the 11 countries considered here, only Swiss prices, on average, exceeded the Canadian generic prices, while prices in Australia and the United States were comparable to Canadian prices. Foreign-to-Canadian price ratios below 1 were obtained for the other eight countries.

The results should be interpreted with caution for countries where the drug match with Canada is relatively low (e.g., for New Zealand, with 138 drugs accounting for 31.5% of the sales analyzed). A low drug match could indicate that there is limited generic availability in the respective foreign market or that there are differences in the available strengths and forms between Canada and the foreign market. Thus, the results may not be as representative of the overall market.

Appendix D and Appendix E provide the drug-level foreign-to-Canadian bilateral and multilateral price ratios, respectively, for the 25 top-selling generic drugs included in this analysis.

3. Drivers of Variations in International Generic Prices

The reduction in the generic price differential between Canadian and foreign markets was mainly the result of provincial generic pricing policies. While the weakening of the Canadian dollar in recent years contributed to an improvement in Canada’s relative position, this change was nearly offset by the price reductions that took place in foreign markets, with most of the remaining gains being accounted for by domestic price reductions.

Generic prices declined in foreign markets over the period of analysis, which reduced the impact of lower Canadian prices. Price reductions in Canada were greater than in all other countries included in the comparison.

The changes in foreign-to-Canadian price ratios over time, as reported in the previous section, are driven by four main factors: price changes in Canada; price changes in foreign markets; changes in currency exchanges rates; and changes in the generic mix (that is, changes in the mix and the weights of generic drugs being compared).

This section examines recent trends in these factors and measures their impact on the variations in international generic prices.

Figure 3.1 shows how generic prices have evolved in Canada and in the PMPRB7 since 2007. The time-series plots in this figure represent quarterly price indices for each country. The series has been normalized to start at the same base value of unity: each point along each plot represents the cumulative change in the corresponding price index since 2007. The price index for each country was based on local currency and does not capture variations in exchange rates.

Figure 3.1. Price indices, generic drugs, Canada and the PMPRB7*, Q4-2007 to Q4-2014

Click on image for larger view

*France, Germany, Italy, Sweden, Switzerland, the United Kingdom and the United States.

Note: The price index for each country was determined based on local currency and by using country-specific sale weights for the drugs.

Results for Canada reflect generic drug prices in all Canadian markets: public, private and out-of-pocket.

Source: MIDAS™ database, October–December 2007 to October–December 2014, IMS AG. All rights reserved.

Figure description

This line graph depicts the trend in the quarterly price indices for generic drugs in Canada and the seven PMPRB comparator countries (France, Germany, Italy, Sweden, Switzerland, the United Kingdom, and the United States) from the fourth quarter of 2007 to the fourth quarter of 2014. The trend for each country is represented by a separate line, with each starting at a normalized value of one. All of the price indices drop over this time period. Canada had the greatest decrease from 1.00 to 0.54.

| Date |

Canada |

France |

Germany |

Italy |

Sweden |

Switzerland |

United Kingdom |

United States |

| 2007: fourth quarter |

1.0000 |

1.0000 |

1.0000 |

1.0000 |

1.0000 |

1.0000 |

1.0000 |

1.0000 |

| 2008: first quarter |

0.9805 |

0.9981 |

0.9789 |

0.9937 |

0.9394 |

0.9993 |

0.9928 |

0.9505 |

| 2008: second quarter |

0.9697 |

0.9599 |

0.9546 |

0.9781 |

0.9470 |

0.9946 |

0.9839 |

0.9525 |

| 2008: third quarter |

0.9633 |

0.9386 |

0.9039 |

0.9721 |

0.8971 |

0.9906 |

0.9748 |

0.9418 |

| 2008: fourth quarter |

0.9611 |

0.9330 |

0.8938 |

0.9680 |

0.8607 |

0.9876 |

0.9163 |

0.9031 |

| 2009: first quarter |

0.9602 |

0.9278 |

0.8757 |

0.9656 |

0.8580 |

0.9855 |

0.9068 |

0.9062 |

| 2009: second quarter |

0.9632 |

0.9246 |

0.8597 |

0.9043 |

0.9052 |

0.9827 |

0.8943 |

0.8932 |

| 2009: third quarter |

0.9630 |

0.9243 |

0.8400 |

0.8358 |

0.8040 |

0.9812 |

0.8983 |

0.8884 |

| 2009: fourth quarter |

0.9592 |

0.9185 |

0.8326 |

0.8355 |

0.7558 |

0.9800 |

0.8568 |

0.8918 |

| 2010: first quarter |

0.9729 |

0.9050 |

0.8238 |

0.8596 |

0.7334 |

0.9524 |

0.8527 |

0.8769 |

| 2010: second quarter |

0.9692 |

0.8829 |

0.7789 |

0.8478 |

0.7235 |

0.9104 |

0.9029 |

0.8836 |

| 2010: third quarter |

0.8810 |

0.8816 |

0.7495 |

0.8333 |

0.7417 |

0.9086 |

0.9403 |

0.8847 |

| 2010: fourth quarter |

0.8553 |

0.8810 |

0.7119 |

0.8320 |

0.7246 |

0.9080 |

0.8198 |

0.8713 |

| 2011: first quarter |

0.8368 |

0.8770 |

0.6994 |

0.8523 |

0.7189 |

0.9045 |

0.8256 |

0.8386 |

| 2011: second quarter |

0.7763 |

0.8759 |

0.6936 |

0.8096 |

0.6947 |

0.9000 |

0.7984 |

0.8183 |

| 2011: third quarter |

0.7575 |

0.8754 |

0.6809 |

0.7897 |

0.6751 |

0.8878 |

0.8359 |

0.7529 |

| 2011: fourth quarter |

0.7534 |

0.8714 |

0.6775 |

0.7813 |

0.6655 |

0.8866 |

0.7556 |

0.7572 |

| 2012: first quarter |

0.7470 |

0.8641 |

0.6698 |

0.7748 |

0.6719 |

0.8847 |

0.7404 |

0.7621 |

| 2012: second quarter |

0.6940 |

0.8482 |

0.6594 |

0.7721 |

0.6704 |

0.8821 |

0.7208 |

0.7403 |

| 2012: third quarter |

0.6523 |

0.8436 |

0.6226 |

0.7712 |

0.6612 |

0.8820 |

0.6975 |

0.7273 |

| 2012: fourth quarter |

0.6448 |

0.8414 |

0.6166 |

0.7700 |

0.6268 |

0.8434 |

0.6038 |

0.7194 |

| 2013: first quarter |

0.6387 |

0.8235 |

0.6122 |

0.7685 |

0.6655 |

0.8274 |

0.6098 |

0.7315 |

| 2013: second quarter |

0.5792 |

0.7901 |

0.6054 |

0.7690 |

0.6587 |

0.8251 |

0.6257 |

0.7532 |

| 2013: third quarter |

0.5637 |

0.7902 |

0.5972 |

0.7685 |

0.6439 |

0.8239 |

0.6495 |

0.7805 |

| 2013: fourth quarter |

0.5630 |

0.7809 |

0.5945 |

0.7626 |

0.6214 |

0.8056 |

0.6352 |

0.7892 |

| 2014: first quarter |

0.5590 |

0.7546 |

0.5921 |

0.7581 |

0.5994 |

0.7971 |

0.6311 |

0.8044 |

| 2014: second quarter |

0.5426 |

0.7326 |

0.5815 |

0.7586 |

0.6173 |

0.7953 |

0.6087 |

0.7622 |

| 2014: third quarter |

0.5412 |

0.7321 |

0.5507 |

0.7575 |

0.6806 |

0.7939 |

0.6235 |

0.7501 |

| 2014: fourth quarter |

0.5389 |

0.7217 |

0.5471 |

0.7572 |

0.6501 |

0.7688 |

0.6602 |

0.7569 |

Since 2008 generic prices have declined in all eight of these major pharmaceutical markets. Note, however, that the relative price decline in Canada exceeded all other markets. Canadian generic prices have fallen, on average, by 46% over this time period. Only German prices come close to matching this result. Almost all of the decline in Canadian prices has occurred since 2010.

To examine the impact of recent policy changes in more depth, Figure 3.2 provides an analysis of the four main factors that influenced the mean foreign-to-Canadian price ratio reported in Figure 2.1: generic mix, exchange rates, foreign prices, and Canadian prices. The analysis measures the impact of the individual factors from Q4-2012 to Q4-2014. The effect of each factor is isolated by measuring its change between 2012 and 2014 while keeping all other factors constant at their 2012 values.

The results provide an answer to the following question:

How much would the gap in foreign and Canadian prices been reduced (positive result) or increased (negative result) between Q4-2012 and Q4-2014 if only one factor (e.g., the exchange rates) changed while all the others remained the same?

Figure 3.2. Drivers of change in the mean foreign*-to-Canadian price ratios, Q4-2012 to Q4-2014

*France, Germany, Italy, Sweden, Switzerland, the United Kingdom and the United States.

Note: Numbers may not add due to rounding. Also the cumulative effect of the individual factors does not add up to the difference between the 2012 and the 2014 foreign-to-Canadian ratios, as there is a small residual amount resulting from the interaction between the factors. Molecules at 18% include: atorvastatin, ramipril, venlafaxine, amlodipine, omeprazole, rabeprazole (effective April 1, 2013); and rosuvastatin, pantoprazole, citalopram, simvastatin (effective April 1, 2014).

Results for Canada reflect generic drug prices in all Canadian markets: public, private and out-of-pocket.

Source: MIDAS™ database, October–December 2012 and October–December 2014, IMS AG. All rights reserved.

Figure description

This bar graph illustrates the impact of the key factors on the change in mean foreign-to-Canadian price ratios from the fourth quarter of 2012 to the fourth quarter of 2014. Over this time period, the mean foreign-to-Canadian price ratio increased from 0.67 to 0.81 (decreasing the gap between foreign and Canadian prices). Isolating the factors responsible for this change, results in the following: generic mix was responsible for an increase of 0.01; exchange rates were responsible for an increase of 0.05; foreign prices were responsible for a decrease of 0.04; and Canadian prices were responsible for an increase of 0.10, with 0.06 attributable to molecules at 18%. Taken together, the impact of exchange rates and foreign prices together almost cancelled one another out, representing a total increase of 0.02.

Generic mix

This factor reflects the extent to which changes in expenditure weights and the set of drugs included in the calculations accounted for the variation in average foreign-to-Canadian price ratios.

Using 2014 expenditure weights instead of 2012 expenditure weights has a negligible effect of lower than 0.01 on the average price ratio.

Exchange rates

This factor reflects the extent to which changes in the exchange rates accounted for the variation in average foreign-to-Canadian price ratios.

The gap between foreign and Canadian prices would have decreased if only the exchange rates had changed while Canadian and foreign generic prices had remained the same. Exchange rates accounted for a change in the foreign-to-Canadian price ratio from 0.67 in Q4-2012 to 0.72 in Q4-2014, a factor of 0.05. Although this is an appreciable change, it is still far less than the overall change from 2012 to 2014 (from 0.67 to 0.81).

Foreign prices

This factor reflects the extent to which changes in foreign prices accounted for the variation in average foreign-to-Canadian price ratios.

The gap between foreign and Canadian prices would have increased from 0.67 in Q4-2012 to 0.63 in Q4-2014, a factor of -0.04, if only the foreign generic prices reductions are considered. This is also an appreciable change.

Canadian prices

This factor reflects the extent to which changes in Canadian prices accounted for the variation in average foreign-to-Canadian price ratios.

The gap between foreign and Canadian prices would have decreased from 0.67 in Q4-2012 to 0.77 in Q4-2014, a factor of 0.10, if only the Canadian generic prices had been reduced while exchange rates and foreign generic prices had remained the same. Of the 0.10 reduction in the price differential, 0.06 resulted from the price of the drugs subject to the 18% rule.

Hence, declining Canadian prices explain almost all of the 2012–2014 change in the average foreign-to-Canadian price ratios, with the majority attributable to the drugs subject to the 18% rule. This price decline is mainly the result of recent generic pricing policies adopted by provincial drug plans. In the absence of exchange rate fluctuations and the reduction in foreign prices, the provincial generic pricing policies alone would have reduced the gap between Canadian and foreign prices by approximately 10%.

The effects of recent changes in exchange rates (0.05) and foreign prices (-0.04) on the average foreign-to-Canadian generic price ratios almost offset one another, and have a net impact of less than 0.02, suggesting that the reduction in the price gap between Canadian and foreign markets due to a weaker Canadian dollar has been offset by lower foreign prices. This means that in the absence of generic pricing policies in Canada, the foreign-to-Canadian price differential would have remained virtually unchanged.

At constant exchange rates, the impact of the generic price reductions in Canada (0.10) would have been partially offset (-0.4) by the reduction in foreign prices. This would have increased the gap between foreign and Canadian prices from 19% to 24% in 2014. Conversely, if foreign prices remained unchanged, the cumulative effect of the Canadian generic price reductions and the depreciation of the Canadian dollar would have reduced the gap between Canadian and foreign prices to 15%.

Note that the cumulative effect of these individual factors does not add up to the difference between the 2012 and the 2014 foreign-to-Canadian ratios, as there is a small residual amount resulting from the interaction between the factors.

4. International Price Comparisons by Market Size and Number of Suppliers

The gap between foreign and Canadian prices was wider for molecules with higher sales and a greater number of domestic suppliers. Generic price differences were more pronounced for drugs with estimated annual Canadian sales of more than $10 million and for drugs with six or more suppliers, with foreign mean international prices 25% and 21% lower than in Canada, respectively. These markets accounted for a large proportion of generic sales.

A pan-Canadian Tiered Pricing Framework was developed that sets the prices of new generic products based on the number of products available in the Canadian market. The full impact of this framework is not reflected in this analysis due to the time frame examined; however, important trends do emerge.

The analysis in this section builds on previous PMPRB reporting (PMPRB 2014) and provides insight into the evolving foreign-to-Canadian price ratios by market segments. Additional insight is provided by reporting on trends in market concentration in Canada and the number of suppliers for newer versus older generic drugs.

Figure 4.1 reports average foreign-to-Canadian generic price ratios by market size in Canada. These ratios were obtained in the same way as those reported in Figure 2.1, except in each instance calculations were restricted to drugs whose Q4-2014 Canadian generic sales fell into the specific ranges indicated in the table: $1–$5 million, $5–$10 million and ›$10 million.

Figure 4.1. Average multilateral foreign*-to-Canadian price ratios – Generic drugs, by market size†, Q4-2014

Click on image for larger view

*France, Germany, Italy, Sweden, Switzerland, the United Kingdom and the United States.

†The size of the market was based on the annual Canadian sales for the molecule.

Note: The analysis was restricted to generic drugs that had been on the market for at least one year.

Results for Canada reflect generic drug prices in all Canadian markets: public, private and out-of-pocket.

Source: MIDAS™ database, October–December 2014, IMS AG. All rights reserved.

Figure description

This bar graph gives the minimum, mean, median, and maximum average foreign-to-Canadian generic price ratios by market size for the fourth quarter of 2014. The Canadian generic price level is set to one. Ratios greater than one indicate higher average foreign prices, while ratios less than one indicate lower foreign prices.

The three markets analyzed were defined as follows: generic drugs with fourth quarter sales in 2014 of 1 to 5 million dollars; drugs with sales of 5 to 10 million dollars; and drugs with sales of over 10 million dollars.

Foreign-to-Canadian price ratios for generic drugs with sales of 1 to 5 million dollars: minimum 0.43; mean 0.99; median 0.80; and maximum 2.05.

Foreign-to-Canadian price ratios for generic drugs with sales of 5 to 10 million dollars: minimum 0.34; mean 0.84; median 0.76; and maximum 1.59.

Foreign-to-Canadian price ratios for generic drugs with sales of over 10 million dollars: minimum 0.26; mean 0.75; median 0.64; and maximum 1.62.

The corresponding table below the graph lists the number of drugs included in the calculations of the mean and the median; the total Canadian generic sales for the selected drugs in millions of dollars; and the share of Canadian generic sales for the selected drugs in each respective market segment as a percentage.

Overall, for the analysis of Canadian drugs, 343 drugs were selected, representing $722.4 million in sales and 71.8% of Canadian generic sales. In the first market segment, for drugs with sales of 1 to 5 million dollars, 203 drugs were included, representing $138.2 million in sales and 60.9% of Canadian generic sales. In the second market segment, for drugs with sales of 5 to 10 million dollars, 76 drugs were included, representing $135.6 million in sales and 68.4% of Canadian generic sales. In the third market segment, for drugs with sales of greater than 10 million dollars, 64 drugs were included, representing $448.5 million in sales and 77.2% of Canadian generic sales.

These results suggest that the difference between Canadian and foreign generic prices was greater in larger markets. In Q4-2014, Canadian prices in generic markets with ex-factory sales of $1 to $5 million were, on average, approximately the same as mean foreign prices. In contrast, for generic markets with Canadian ex-factory sales of more than $10 million, mean foreign prices were, on average, approximately 25% lower than the corresponding mean Canadian prices. For markets with Canadian ex-factory sales of $5 to $10 million, foreign prices were, on average, approximately 16% lower.

Markets with ex-factory sales of $1 to $5 million and $5 to $10 million each accounted for roughly the same proportion of the total Canadian generic sales of drugs selected in this analysis (13% to 14%), whereas markets with ex-factory sales of at least $10 million accounted for a more substantial share of sales (45%). This large-sized market dominates the overall results reported in Figure 2.1.

Figure 4.2 compares the results of the average foreign-to-Canadian price ratios in Q1-2013 and Q4-2014 by market size in Canada. The results indicate that there was an improvement in the foreign-to-Canadian price differentials in all three market segments.

Figure 4.2. Average multilateral foreign*-to-Canadian price ratios – Generic drugs, by market size†, Q1-2013 and Q4-2014

Click on image for larger view

*France, Germany, Italy, Sweden, Switzerland, the United Kingdom and the United States.

†The size of the market was based on the annual Canadian sales for the molecule.

Note: The analysis was restricted to generic drugs that had been on the market for at least one year.

Results for Canada reflect generic drug prices in all Canadian markets: public, private and out-of-pocket.

Source: MIDAS™ database, January–March 2013 and October–December 2014, IMS AG. All rights reserved.

Figure description

This bar graph gives the average multilateral foreign-to-Canadian generic price ratios by market size for the first quarter of 2013 and the fourth quarter of 2014. The Canadian generic price level is set to one. Ratios greater than one indicate higher average foreign prices, while ratios less than one indicate lower foreign prices.

The three markets analyzed were defined as follows: generic drugs with annual Canadian sales of 1 to 5 million dollars in 2014; drugs with sales of 5 to 10 million dollars; and drugs with sales of over 10 million dollars.

For the first quarter of 2013, the foreign-to-Canadian generic price ratios by market size were 0.91 for drugs with sales of 1 to 5 million dollars; 0.74 for drugs with sales of 5 to 10 million dollars; and 0.61 for drugs with sales of over 10 million dollars.

For the fourth quarter of 2014, the foreign-to-Canadian generic price ratios by market size were 0.99 for drugs with sales of 1 to 5 million dollars; 0.84 for drugs with sales of 5 to 10 million dollars; and 0.75 for drugs with sales of over 10 million dollars.

The corresponding table below the graph lists the number of drugs included in each market segment. Overall, for the analysis of Canadian drugs, 273 drugs were included for the first quarter of 2013 and 343 drugs were included for the fourth quarter of 2014. In the first market segment, for drugs with sales of 1 to 5 million dollars, 162 drugs were included in 2013 and 203 drugs were included in 2014. In the second market segment, for drugs with sales of 5 to 10 million dollars, 54 drugs were included in 2013 and 76 drugs were included in 2014. In the third market segment, for drugs with sales of greater than 10 million dollars, 57 drugs were included in 2013 and 64 drugs were included in 2014.

Figure 4.3 reports the average foreign-to-Canadian generic price ratios by the number of active suppliersFootnote 5 in the Canadian market in 2014 for the subset of drugs included in this report. These ratios were obtained in the same way as those reported in Figure 2.1, except that in each instance calculations were restricted to drugs where the number of Canadian suppliers fell into the specific ranges indicated in the table: 1–2 suppliers, 3–5 suppliers and 6 or more suppliers.

Figure 4.3. Average multilateral foreign*-to-Canadian price ratios – Generic drugs, by number of active suppliers†, Q4-2014

Click on image for larger view

* France, Germany, Italy, Sweden, Switzerland, the United Kingdom and the United States.

† Pharmaceutical corporations with available sales for the generic drugs included in the analysis, and over the time period examined. This measure was determined at molecule level.

Note: The analysis was restricted to generic drugs that had been on the market for at least one year.

Results for Canada reflect generic drug prices in all Canadian markets: public, private and out-of-pocket.

Source: MIDAS™ database, October–December 2014, IMS AG. All rights reserved.

Figure description

This bar graph gives the minimum, mean, median, and maximum average foreign-to-Canadian generic price ratios by the number of active suppliers for the fourth quarter of 2014. The Canadian generic price level is set to one. Ratios greater than one indicate higher average foreign prices, while ratios less than one indicate lower foreign prices.

The three markets analyzed were defined as follows: generic drugs with 1 to 2 suppliers in Canada in 2014; drugs with 3 to 5 suppliers; and drugs with 6 or more suppliers.

Foreign-to-Canadian price ratios for generic drugs with 1 to 2 suppliers: minimum 0.42; mean 0.79; median 0.64; and maximum 1.61.

Foreign-to-Canadian price ratios for generic drugs with 3 to 5 suppliers: minimum 0.44; mean 0.91; median 0.82; and maximum 1.77.

Foreign-to-Canadian price ratios for generic drugs with 6 or more suppliers: minimum 0.26; mean 0.79; median 0.67; and maximum 1.71.

The corresponding table below the graph lists the number of drugs included in the calculations of the mean and the median; the total Canadian generic sales for the selected drugs in millions of dollars; and the share of Canadian generic sales for the selected drugs in each respective market segment as a percentage.

Overall, for the analysis of Canadian drugs, 343 drugs were selected representing $722.4 million in sales and 71.8% of Canadian generic sales. In the first market segment, for drugs with 1 to 2 suppliers, 69 drugs were included, representing $79.9 million in sales, and 45.9% of Canadian generic sales. In the second market segment, for drugs with 3 to 5 suppliers, 88 drugs were included, representing $120.9 million in sales and 62.6% of Canadian generic sales. In the third market segment, for drugs with 6 or more suppliers, 186 drugs were included, representing $521.5 million in sales and 81.7% of Canadian generic sales.

The differences between foreign and Canadian prices were more pronounced for drugs with six or more suppliers, with mean foreign price levels 21% lower than in Canada. These markets accounted for the majority of the total Canadian generic sales for the drugs selected in this analysis (52%).

While the markets with one or two suppliers and those with three to five suppliers account for a relatively small proportion of the total Canadian generic sales of drugs selected in this analysis (8% and 12%, respectively), their share may be underrepresented due to the drug selection criteria (which excludes drugs with less than $1 million in sales) and limited matches with foreign markets that may be more common in smaller markets.

Figure 4.4 compares the results of the average foreign-to-Canadian generic price ratios by the number of active suppliers in the Canadian market for Q1-2013 and Q4-2014. The results indicate that the improvement in the foreign-to-Canadian price ratio occurred mostly in markets with the fewest number of suppliers (1–2 suppliers) as well as the markets with the greatest number of suppliers (6 or more suppliers).

Figure 4.4. Average multilateral foreign*-to-Canadian price ratios – Generic drugs, by number of active suppliers†, Q1-2013 and Q4-2014

Click on image for larger view

* France, Germany, Italy, Sweden, Switzerland, the United Kingdom and the United States.

† Pharmaceutical corporations with available sales for the generic drugs included in the analysis over the time period examined. This measure was determined at molecule level.

Note: The analysis was restricted to generic drugs that had been on the market for at least one year.

Results for Canada reflect generic drug prices in all Canadian markets: public, private and out-of-pocket.

Source: MIDAS™, January–March 2013 and October–December 2014, IMS AG. All rights reserved.

Figure description

This bar graph gives the average multilateral foreign-to-Canadian generic price ratios by the number of active suppliers for the first quarter of 2013 and the fourth quarter of 2014. The Canadian generic price level is set to one. Ratios greater than one indicate higher average foreign prices, while ratios less than one indicate lower foreign prices.

The three markets analyzed were defined as follows: generic drugs with 1 to 2 suppliers in Canada in 2014; drugs with 3 to 5 suppliers; and drugs with 6 or more suppliers.

For the first quarter of 2013, the foreign-to-Canadian generic price ratios by number of suppliers were 0.71 for drugs with 1 to 2 suppliers; 1.03 for drugs with 3 to 5 suppliers; and 0.62 for drugs with 6 or more suppliers.

For the fourth quarter of 2014, the foreign-to-Canadian generic price ratios by number of suppliers were 0.79 for drugs with 1 to 2 suppliers; 0.91 for drugs with 3 to 5 suppliers; and 0.79 for drugs with 6 or more suppliers.

The corresponding table below the graph lists the number of drugs included in each market segment. Overall, for the analysis of Canadian drugs, 273 drugs were included for the first quarter of 2013 and 343 drugs were included for the fourth quarter of 2014. In the first market segment, for drugs with 1 to 2 suppliers, 71 drugs were included in 2013 and 69 drugs were included in 2014. In the second market segment, for drugs with 3 to 5 suppliers, 70 drugs were included in 2013 and 88 drugs were included in 2014. In the third market segment, for drugs with 6 or more suppliers, 132 drugs were included in 2013 and 186 drugs were included in 2014.

Figure 4.5 compares the average two-supplier concentration ratio in generic markets in Q4-2014 for older and newer generic drugs. Older generics are defined as drugs with generic versions available in Canada prior to Q4-2011; whereas newer generics are drugs with generic versions available in Canada between Q4-2011 and Q4-2014.

Figure 4.5. Average two-supplier concentration ratio – Generic drugs, by market size*, Q4-2014

Click on image for larger view

*The size of the market was based on the annual Canadian sales for the molecule.

† Pharmaceutical corporations with available sales for the generic drugs included in the analysis over the time period examined. This measure was determined at molecule level.

Note: Older generics are generics available in Canada prior to Q4-2011.

Newer generics are generics available in Canada between Q4-2011 and Q4-2014.

The analysis was restricted to generic drugs that had been on the market for at least one year.

Results reflect supplier availability in all Canadian markets: public, private and out-of-pocket.

Source: MIDAS™ database, October–December 2014, IMS AG. All rights reserved.

Figure description

This bar graph compares the average two-supplier concentration ratio for older and newer generic drugs in Canada by market size. The market segments analyzed included drugs with sales of 1 to 5 million dollars in the fourth quarter of 2014; drugs with sales of 5 to 10 million dollars; drugs with sales of 10 to 20 million dollars; and drugs with sales of greater than 20 million dollars.

Two-supplier concentration ratio for drugs with sales of 1 to 5 million dollars: older generics 90%; newer generics 94%.

Two-supplier concentration ratio for drugs with sales of 5 to 10 million dollars: older generics 78%; newer generics 82%.

Two-supplier concentration ratio for drugs with sales of 10 to 20 million dollars: older generics 73%; newer generics 77%.

Two-supplier concentration ratio for drugs with sales of greater than 20 million dollars: older generics 66%; newer generics 77%.

There are two tables included in the graphic. The first gives the average active number of active suppliers for each market size.

Average number of suppliers for drugs with sales of 1 to 5 million dollars: older generics 3.3; newer generics 2.5.

Average number of suppliers for drugs with sales of 5 to 10 million dollars: older generics 5.9; newer generics 5.2.

Average number of suppliers for drugs with sales of 10 to 20 million dollars: older generics 7.7; newer generics 6.4.

Average number of suppliers for drugs with sales of greater than 20 million dollars: older generics 10.7; newer generics 8.2.

The second table gives the number of drugs included in each analysis along with the corresponding Canadian generic sales in millions of dollars.

For drugs with sales of 1 to 5 million dollars: older generics 460 drugs with sales of 2.5 million dollars; newer generics 51 drugs with sales of 2.5 million dollars.

For drugs with sales of 5 to 10 million dollars: older generics 116 drugs with sales of 6.9 million dollars; newer generics 25 drugs with sales of 6.8 million dollars.

For drugs with sales of 10 to 20 million dollars: older generics 50 drugs with sales of 14.0 million dollars; newer generics 10 drugs with sales of 14.2 million dollars.

For drugs with sales of greater than 20 million dollars: older generics 35 drugs with sales of 40.8 million dollars; newer generics 11 drugs with sales of 32.3 million dollars.

The two-supplier concentration ratio determines the average market share for the two largest suppliers (by sales) for drugs in each indicated market size. For instance, in Q4-2014, the two leading suppliers in a generic market with over $20 million in sales accounted for an average of 66% of the sales of older generics and 77% of the sales of newer generics.

While the higher concentration of newer generics was especially pronounced in markets with over $20 million in annual sales, this pattern was observed in smaller-sized market segments as well. This finding is supported by the lower average number of suppliers for newer generics, as reported in the table below the figure. The average number of suppliers for generic markets with over $20 million in sales was 10.7 for older generics and 8.2 for newer generics.

These results appear to suggest that, in general, newer generics have a higher market concentration in markets with fewer suppliers and fewer suppliers in total compared to older generics. Further in-depth analysis is required to draw definitive conclusions, as these results may be impacted by a number of factors, including the length of time normally taken by generic suppliers to penetrate the market for a newly genericized molecule.

References

PMPRB. 2010a. Generic Drugs in Canada: Market Structure – Trends and Impacts. Ottawa: Patented Medicine Prices Review Board. Available from: http://www.pmprb-cepmb.gc.ca/view.asp?ccid=949&lang=en (Accessed December 1, 2015).

PMPRB. 2010b. Generic Drugs in Canada: Price Trends and International Price Comparisons, 2007. Ottawa: Patented Medicine Prices Review Board. Available from: http://www.pmprb-cepmb.gc.ca/view.asp?ccid=868&lang=en (Accessed December 1, 2015).

PMPRB. 2011. Generic Drugs in Canada: International Price Comparisons and Potential Cost Savings. Ottawa: Patented Medicine Prices Review Board. Available from: http://www.pmprb-cepmb.gc.ca/view.asp?ccid=870&lang=en (Accessed December 1, 2015).

PMPRB. 2013. Analytical Snapshot: International Generic Price Comparison, Early 2011. Ottawa: Patented Medicine Prices Review Board. Available from: http://www.pmprb-cepmb.gc.ca/view.asp?ccid=487&lang=en (Accessed December 1, 2015).

PMPRB. 2014. Generic Drugs in Canada, 2013. Ottawa: Patented Medicine Prices Review Board. Available from: http://www.pmprb-cepmb.gc.ca/view.asp?ccid=1122&lang=en (Accessed December 1, 2015).

PMPRB. 2015. Private Drug Plans in Canada. Part 1: Generic Market 2005–2013. Ottawa: Patented Medicine Prices Review Board. Available from: http://www.pmprb-cepmb.gc.ca/view.asp?ccid=1200&lang=en (Accessed December 4, 2015).

Appendix A: Methodology

The statistical results reported in this study were derived from a large body of international data on pharmaceutical sales. This section describes key elements in this process.

MIDAS™ dataset: IMS AG’s MIDAS™ database is the source of most sales data used in this analysis. MIDAS™ summarizes data obtained from IMS AG’s detailed audits of pharmaceutical purchases made by retailers (in 70 countries) and hospitals (in 45 countries). MIDAS™ contains information on the sales of individual products, measured in both currency and physical units, as well as information on the product manufacturer, active ingredient, brand, form, strength, pack-size, patent status and therapeutic class. For any given country, this data reflects the national market, which combines all market segments: public, and private and out-of-pocket.

Identification of generics: MIDAS™ includes a field that identifies generic and brand-name products (GENPRD). This was used to distinguish entries representing generic products from those representing brand-name versions of a drug. In a small number of cases, GENPRD gives no information on a product’s status. In these cases, the product’s name was compared to the name of its active ingredient to determine if it was a generic.

Sales: Sales are measured at manufacturer ex-factory prices and reflect all sales to the retail sector. MIDAS™ estimates the sales by multiplying the unit price for every drug with the corresponding volume of units sold in a given country. The methodology that MIDAS™ uses for estimating drug prices varies by country. It depends on the distribution system and the availability of public data at various points in the distribution chain. MIDAS™ data includes the manufacturer's price, the wholesale price, and the pharmacy price in specific markets. Depending on the country, manufacturer, wholesale or retail prices may represent estimates based on assumed regulated margins and/or markups.

It is important to understand that the acquisition costs IMS AG uses are based on invoiced prices. Off-invoice discounts, free goods, rebates and other forms of price reductions are, therefore, not represented in the MIDAS™ data. To the extent that such undisclosed reductions exist, prices derived from these data do not represent “money in the manufacturer’s pocket”. Unpublished research conducted by PMPRB staff using price data obtained from independent sources—most notably, provincial formularies—indicates that MIDAS’s™ Canadian ex-factory prices reliably measure drug costs passed on to consumers and reimbursement programs by retailers.

Quantities: MIDAS™ provides a measure of physical quantity it calls standardized units (SU). This measure is used throughout the analysis. In general, SUs represent IMS AG’s estimate of the number of normal doses a given volume of physical units entails. This becomes the “number of pills”, that is, the number of tablets or capsules, in the case of oral solids.

Prices: To calculate a drug’s generic unit price, the value of sales and units sold are first summed across all generic suppliers. The price is then obtained by dividing the resulting sum of sales by the sum of units for that drug. Brand-name prices are calculated in the same way.

Currency conversion: As noted above, the MIDAS™ sales data used in this report is expressed in local currencies. Sales were restated in Canadian dollar equivalents to allow for meaningful international price comparisons. Quarterly average spot-market exchange rates (as reported by the Bank of Canada) were used for the currency conversions.

Appendix B: Foreign-to-Canadian Price Ratios

The average ratios reported are sales-weighted arithmetic averages of the corresponding foreign-to Canadian price ratios for individual drugs. These average price ratios provide exact answers to questions such as:

How much more or less would Canadians have paid for the generic drugs they purchased in Q4-2014 had they paid prices prevailing in country X?

The following multilateral measures are reported in this analysis based on the IMS AG’s MIDAS™ database:

Minimum international price—represents the lowest price available across the comparator countries.

Mean international price—represents a straight average of the prices available across the comparator countries.

Median International price—represents the price at the midpoint of the distribution of the foreign prices.

Maximum international price—represents the highest price available across the comparator countries.

Canadian price—represents the average national price based on all manufacturer ex-factory sales in the retail sector in Canada.

Measures of Central Tendency

Mean: The mean foreign price is the unweighted average of the foreign prices observed for a particular drug.

Median: The median foreign price is the price that divides the foreign prices observed for a particular drug into two sets of equal size, with half of foreign prices below the median and half above. Where the number of foreign prices is odd, the median is simply the middle price. Where the number of foreign prices is even, the median is the average of the two middle prices.

Example: Suppose again foreign prices for a certain drug are $0.25, $0.50, $0.50, $0.50, $1.75. Since the number of prices is odd, the median is the middle price, that is, $0.50.

Comparison: The mean and the median measures will return approximately the same value when foreign prices all lie within a narrow range, but the two measures can diverge dramatically when this is not the case. Extremely high or low prices will typically have more influence on the mean than the median, because extreme values seldom figure in the calculation of the latter.

Calculating Average Foreign-to-Canadian Price Ratios

This report presents a variety of average foreign-to-Canadian price ratios, similar to those published in PMPRB’s Annual Report. These ratios are constructed as sales-weighted arithmetic averages of the foreign-to-Canadian price ratios obtained at the level of individual drugs.

Algebraically, let

- i = 1 … N, each number identifying a drug included in the calculation

- p(i) = the Canadian price of drug i

- q(i) = the quantity of drug i purchased by Canadians

- X(i) = total amount spent on drug i by Canadians

- pf(i) = the foreign price of drug i (converted to Canadian dollars)

- w(i) = the proportion of Canadians’ expenditure on the drugs 1 to N accounted for by drug i

The sales-weighted arithmetic average of foreign-to-Canadian price ratios (FTC) is given by:

- (G1) FTC = ∑ w(i) [ pf(i) / p(i) ]

where ∑ signifies summation over drugs 1 to N.