Final Report

June 30, 2012

Submitted by:

Mira Svoboda, Managing Partner

Beechwood Consulting and Research

Ellie Beals, Principal

Beals, Lalonde & Associates

Submitted to:

Marian Eagen and Pauline Lahey

Patented Medicine Prices Review Board

333 Laurier West, Suite 1400

Ottawa, ON K1P 1C1

Table Of Contents

List of abbrs

- EBP: Employee Benefits Plan

- CADTH: Canadian Agency for Drugs and Technology in Health

- CDR: Common Drug Review

- CEO: Chief Executive Officer

- CIHI: Canadian Institute for Health Information

- CPI: Consumer Price Index

- F/P/T: Federal/Provincial/Territorial

- FTE: Full-time Equivalent

- HC: Health Canada

- HDAP: Human Drug Advisory Panel

- NGO: Non-government Organization

- NPDUIS: National Prescription Drug Utilization Information System

- OECD: Organization for Economic Cooperation and Development

- OTC: Over the counter (drug)

- PLA: Product Listing Agreement

- PMPI: Patented Medicines Price Index

- PMPRB: Patented Medicine Prices Review Board

- PMS: Performance Measurement Strategy

- R&D: Research and Development

- Rx&D: Canada's Research-Based Pharmaceutical Companies (Industry Association)

- SR&ED: Scientific Research and Experimental Development

- SPA: Special Purpose Allotment

- TBS: Treasury Board Secretariat

- VCU: Voluntary Compliance Undertaking

Executive Summary

This Evaluation

Objectives

This evaluation addresses the relevance and performance of both the Patented Medicine Prices Regulation Program and the Pharmaceutical Trends Program, during the period from 2008-09 to 2011-12. Along with the issues and questions shown below, it addresses the extent to which increased resources granted by Treasury Board Secretariat in 2008-09 allowed PMPRB to effectively deliver on its mandate.

| Relevance |

| Issue 1: Continued Need for Program(s) |

Assessment of the extent to which the program(s) continues to address a demonstrable need and is responsive to the needs of Canadians. |

| Issue 2: Alignment with Government Priorities |

Assessment of the linkages between program objectives and (i) federal government priorities and (ii) departmental strategic outcomes. |

| Issue 3: Alignment with Federal Roles and Responsibilities |

Assessment of the role/responsibilities for the federal government in delivering the program. |

| Performance |

| Issue 4: Achievement of Expected Outcomes |

Assessment of progress toward expected outcomes with reference to performance targets and program reach and design. |

| Issue 5: Demonstration of Efficiency and Economy |

Assessment of resource utilization in relation to the production of outputs and progress toward expected outcomes. |

Source: Patented Medicine Prices Review Board Performance Measurement Strategy (January 2011).

Methodology

The methodologies employed in conducting evaluation research included:

- Interviews with 46 stakeholders, including PMPRB managers and Board Members, and representatives from patentee organizations and associations, patient advocacy groups, health insurance firms, provincial and territorial governments, Health Canada, and researchers from agencies and think-tanks;

- A stakeholder survey. Invitations were extended to 700 individuals. 74 responses were received;

- A document and literature review; and

- An analysis of PMPRB performance data.

These multiple lines of inquiry were used in order to yield a high level of confidence in the findings that emerged. However, survey results have had to be treated with considerable caution because overall results were dominated by patentees. This was not problematic for the Regulation Program, for which patentees are the principal target audience. It was problematic for the Pharmaceutical Trends Program, which is designed primarily for policy-makers, whose interests often are very different and sometimes opposed to those for patentees.

Relevance

A program's relevance must be assessed relative to the environment in which that program operates. Thus, changes that have occurred in the environment since programs were initiated must be articulated and understood. There have been significant changes in the pharmaceutical environment in the past three to five years. Those changes include:

- The end of the era of “blockbuster” drugs, and the emergence of lower-cost generics introduced when patents on blockbusters expire;

- The emergence of (often very costly) drugs/treatments for niche markets;

- Burgeoning drug costs and assertive drug plan efforts to control those costs;

- Increased globalization; and

- Changes in the pharmaceutical industry, which include reduced price transparency as a result of post-purchase rebates.

For the Regulation Program, the changes in the pharmaceutical environment have had an impact. But as shown below, the most significant of those impacts tend to balance one another out so that the program remains relevant:

- The rise of generics and the aggressive provincial cost-containment efforts have reduced the relevance of the program for people covered by public plans. However, only 32% of patented medicine expenses are covered by public plans.

- The emergence of very costly drugs for the niche markets has increased the need for and relevance of the program.

The Pharmaceutical Trends Program is also still relevant but its relevance could be improved. The factors most implicated in diminishing the relevance of this program is a lack of timeliness in developing and disseminating information products, and significant patentee concerns over the appropriateness of aspects of the program which are mandated by law (i.e. reporting on patentee research and development expenditures).

Both the Regulation and the Pharmaceutical Trends Programs are appropriate for delivery by a federal agency and are well-aligned with government priorities and with PMPRB's Strategic Outcome.

Outcome Achievement: The Regulation Program

The Regulation Program has performed well. The extent to which the PMPRB has achieved each of the program's intended outcomes is detailed below:

- Building knowledge and awareness: PMPRB efforts have been successful in regard to this outcome. The PMPRB has taken numerous measures to build knowledge and awareness of the Act, Regulations, policies and Guidelines and consequences of non-compliance. A large proportion of stakeholders are satisfied with PMPRB efforts to enhance their knowledge/awareness of the legislative framework, Guidelines and policies.

- Compliance with Regulations: PMPRB has achieved a very high level of success at achieving this outcome. There has been a very high level of patentee compliance during the evaluation period.

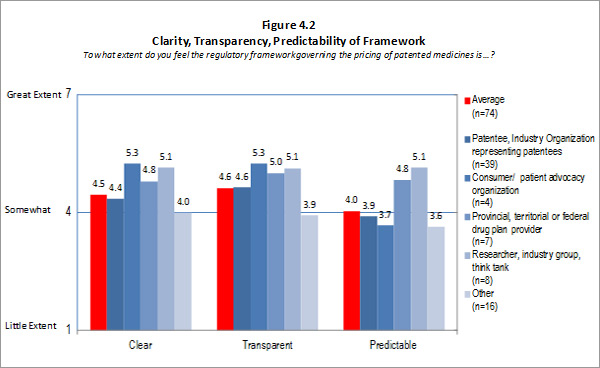

- Clarity, Transparency and Predictability: The PMPRB has experienced a good level of success at attaining the clarity aspect of this intermediate outcome. Stakeholders found that the clarity provided by the PMPRB (timely and coherent explanations/interpretations) was good. However, the Guidelines and procedures need to be simplified to be more transparent. This lack of transparency has resulted in industry being less able to predict outcomes which affect them. Thus, the existing level of complexity has impeded the PMPRB's ability to fully achieve the outcome of providing industry with a transparent and predictable regulatory environment.

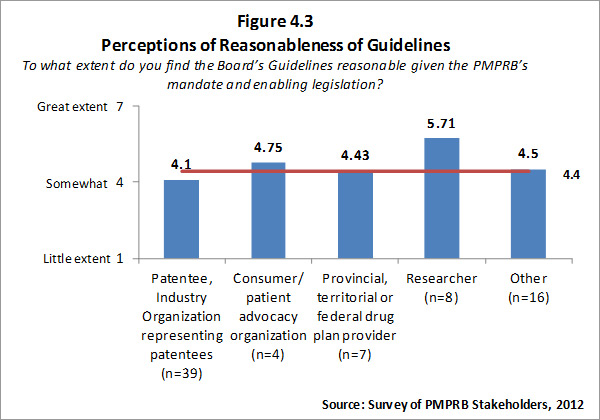

- Reasonableness of Guidelines: The PMPRB has experienced moderate success at achieving this outcome. Though stakeholders input on the revised Guidelines was good, there was still considerable stakeholder concern over the appropriateness and/or complexity of the revised Guidelines. Some of this concern is occasioned by aspects of mandate and methodology established by law. However, there does appear to be some potential for and value in the PMPRB seeking to further simplify the Guidelines to the extent possible.

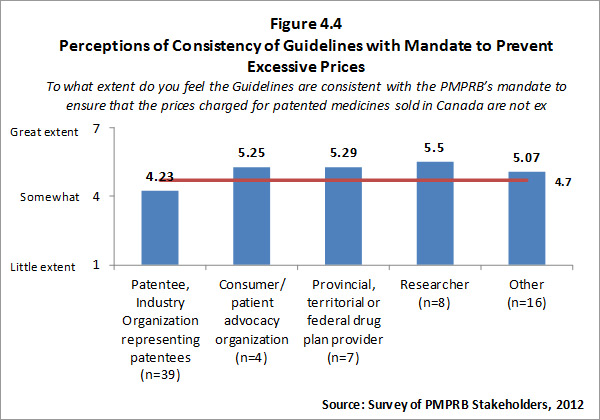

- Prices Not Excessive: The PMPRB has been highly successful at achieving its ultimate outcome - that of ensuring that prices charged by patentees for patented medicines sold in Canada are not excessive, as specified in the Act.

Outcome Achievement: The Pharmaceutical Trends Program

The Pharmaceutical Trends Program has been successful in working towards some of its intended outcomes and less successful in regard to others.

- Accessibility, Comprehensiveness, Timeliness and Accuracy: Legislative constraints result in the PMPRB having little control over the accessibility, comprehensive, timeliness and accuracy of Research and Development spending information. The PMPRB has done reasonably well at providing accessible, comprehensive and accurate information products for the products it can control: NPDUIS and Price Trends Information products. However, none of these products are sufficiently timely.

- Utility of the PMPRB Research Products: None of the Pharmaceutical Trends Program's information products are well-utilized. For research and development spending information, once again legislative constraints are implicated. In the case of NPDUIS and Price Trends Information, the poor utilization appears to be at least partially predicated on the lack of timeliness, and it seems likely that these products would be better utilized for policy and decision-making if they were timelier. The fact that there has been a trend toward more rather than less utilization in recent years reinforces this likelihood.

- Trend Awareness: Though stakeholders claim and demonstrate a high awareness of trends in the pharmaceutical sector, the Pharmaceutical Trends Program offerings do not appear to have contributed to building that awareness in any significant fashion.

Efficiency and Economy

The evaluation findings support the current level of funding for salaries and operating expenses at the PMPRB. Based on the evaluation findings, the incremental funding approved by Treasury Board Secretariat in 2008 has been appropriately utilized to achieve the results for which it was authorized.

Lacking any similar programs to which the PMPRB programs could be compared, the only valid conclusions that can be drawn about the efficiency and economy of the programs being evaluated, is that none of the data occasions any concern or alarm. There are no indications that PMPRB is not operating in a cost-effective way. While no formal cost-benefit analyses were conducted as part of this evaluation, anecdotal evidence suggests a reasonable cost/benefit balance.

Although operational efficiency appears to be adequate, there is potential for improving the PMPRB's internal efficiency by considering simplifying the Guidelines and revising them more often, and decreasing patentee reporting requirements from twice to once yearly. Beyond simplifying the Guidelines, the evaluation findings also suggest that it would be appropriate to reconsider some methodological aspects of the Guidelines to ensure that they are well-matched to the current environment in which the PMPRB operates.

Overall Summary Conclusions

The overall summary conclusions presented below are derived from the topic-specific conclusions presented above. These summary conclusions address the key evaluation issues and questions identified earlier in this Executive Summary.

Relevance

Continued Relevance of the PMPRB Programs

The Regulation Program continues to be relevant. Though the pharmaceutical environment has changed considerably, the Regulation Program continues to meet the needs it was established to address.

The Pharmaceutical Trends Program is also still relevant, but less so than the Regulation Program. Some of its reduced relevance is attributable to the evolution of the pharmaceutical sector, which is no longer consistent with important program parameters like the definition of Research and Development. Another significant factor in the program's reduced relevance is a lack of timeliness in product development and dissemination.

Alignment with Government Priorities and Federal Roles and Responsibilities

Both PMPRB Programs are appropriate for delivery by a federal agency and are well-aligned with both government-wide priorities and with PMPRB's Strategic Outcome.

Performance

Achievement of Expected Outcomes for the Regulation Program

The Regulation Program has performed very successfully. It has achieved a high level of compliance and has ensured that prices are not excessive as determined by legislated criteria. In addition, the program has succeeded at enhancing stakeholder knowledge and awareness, and at creating a regulatory environment perceived by stakeholders to be increasingly clear and transparent. The program's success regarding the predictability of the environment is more guarded, primarily because the Guidelines, which have been improved considerably, require further simplification.

Achievement of Expected Outcomes for the Pharmaceutical Trends Program

The PT Program has been quite successful in some aspects of its operations. When considering how well the program has met the needs of the policy-makers for whom it was designed, it has performed well in terms of the accessibility, comprehensiveness and accuracy of the products over which it has control - NPDUIS and Price Trends outputs. However, the program has not produced these products in a manner which is sufficiently timely for policy makers who are the key audience for these products.

The program has not been very successful at producing information utilized in policy-making and decision-making. The failure regarding timeliness is implicated here, and it is likely that utilization will improve significantly if and when the timeliness issue is addressed.

Efficiency and Economy

The evaluation supports the current level of funding for salaries and operating expenses at the PMPRB. The incremental funding received in 2008-09 has been well-utilized, having achieved the expected results for which it was approved. Though formal cost-benefit analyses were not undertaken, anecdotal evidence suggests that PMPRB operations are cost-effective.

Some gains in efficiency and economy are likely to be achieved by modernizing or streamlining aspects of both the PMPRB's operational and methodological framework. The most important of these is simplifying the Guidelines.

1. Introduction

1.1 Background

1.1.1 Mandate

The PMPRB is an independent, quasi-judicial body established by Parliament in 1987 as a result of revisions to the Patent Act (the Act) which were designed to provide patentees with a greater period of market exclusivity during the term of their patents. Subsequent amendments to the Act in 1993 effectively established that a patentee had market exclusivity for the entire term of its patent, except in cases of a national emergency and increased the PMPRB's remedial powers.

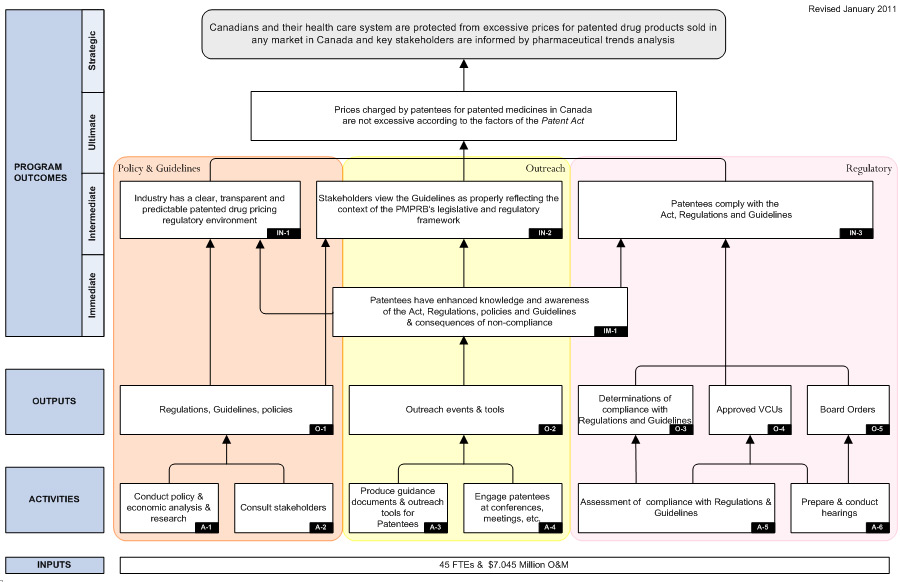

The PMPRB's mandate is two-fold:

- Regulatory – to ensure that prices charged by patentees for patented medicines sold in Canada are not excessive, thereby protecting consumers and contributing to Canadian health care; and

- Reporting – to report on pharmaceutical trends of all medicines, and on research and development (R&D) spending by pharmaceutical patentees, thereby contributing to informed decisions and policy making.

1.1.2 Jurisdiction

a. The Regulatory Function

Under the Act and the Patented Medicines Regulations, patentees are required to inform the PMPRB of their intention to sell a new patented drug product, and to file relevant price and sales information. The PMPRB is responsible for ensuring that the average prices that patentees charge for prescription and non-prescription patented drugs sold in Canada to wholesalers, hospitals, pharmacies or others, for human and veterinary use, are not excessive. To make this determination, staff in the Regulatory Affairs and Outreach Branch review information submitted by patentees to ensure that prices they charge comply with the regulatory framework.

Although patentees are not required to obtain the PMPRB's approval of the price of a patented drug before it is sold, they are required to comply with the Act to ensure that prices of patented medicines sold in Canada are not excessive. If the PMPRB finds, after a public hearing, that a price is or was excessive, it may order the patentee to reduce the price and take measures to offset any excess revenues it may have generated.

b. The Reporting Function

Section 88 of the Act requires pharmaceutical patentees to report their research and development spending for the year to the PMPRB. Section 90 of the Act authorizes the Minister of Health to request that other inquiries be undertaken by the PMPRB.

The PMPRB reports annually to Parliament through the Minister of Health on pharmaceutical trends and research and development spending by pharmaceutical patentees. The reports on research and development spending are intended for government policy makers.

Through the National Prescription Drug Utilization Information System (NPDUIS) initiative, the PMPRB collaborates with federal, provincial and territorial stakeholders and the Canadian Institute for Health Information (CIHI) to produce critical analyses of price, utilization and cost trends for both patented and non-patented prescription drugs. The PMPRB also publishes specific NPDUIS reports based on the research priorities identified by the NPDUIS Steering Committee consisting of representatives of provincial/territorial public drug plans and Health Canada.

Through its studies and analysis of pharmaceutical price trends, the PMPRB aims to contribute to informed health policy making at the federal and provincial levels.

1.1.3 Organizational Structure and Programs

The Board consists of not more than five members who serve on a part-time basis, appointed by the Governor-in-Council, including a Chairperson and a Vice-Chairperson. The Chairperson is also designated under the Act as the Chief Executive Officer of the PMPRB with the authority and responsibility to supervise and direct its work.

The Executive Director is responsible for overall advice to the Board and for the leadership and management of the Staff.

The Senior Management team reports to the Executive Director. The members of the Senior Management team are: the Director of Regulatory Affairs and Outreach Branch, the Director of Policy and Economic Analysis Branch, the Director of Corporate Services Branch, the Director, Board Secretariat and Communications and the Director of Legal Services and General Counsel.

The Regulatory Affairs & Outreach Branch is responsible for the operational aspects of the Patented Medicine Prices Regulation Program (the Regulation Program). The Branch reviews the prices of patented drug products to ensure that they are not excessive; encourages patentees to comply voluntarily with the Board's Guidelines; implements related compliance policies and investigates complaints into the prices of patented medicines. This Branch also informs and educates patentees on the Board's Guidelines and filing requirements.

The Policy and Economic Analysis Branch is responsible for policy and economic analysis related to the Patented Medicine Prices Regulation Program, which includes maintaining the Guidelines that delineate the scientific review, price review, and investigative processes, conducting policy analyses, providing policy advice, and preparing economic analysis. The Branch also undertakes the majority of the activity related to the PMPRB's second program activity, the Pharmaceutical Trends Program which consists of the reporting on the analyses described above. The Legal Services Branch advises the PMPRB on legal matters and leads the prosecution team in proceedings before the Board.

The Board Secretariat and Communications Branch manage the Board's meeting and hearing process, including the official record of proceedings in support of the Hearing Panels. The Branch also develops and manages the PMPRB's communications program, media relations and public enquiries, including the production of the PMPRB's quarterly publication, Annual Report and Pharmaceutical Trends Reports.

The Corporate Services Branch provides management advice and services including strategic and financial planning and reporting, human resources, information management and technology services.

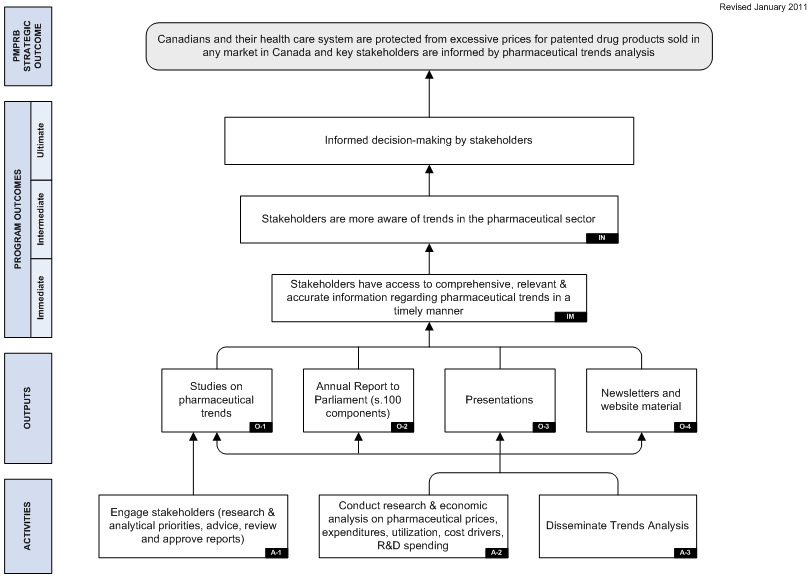

Detailed descriptions of both PMPRB programs are provided in the Patented Medicine Prices Review Board Performance Measurement Strategy. The logic models included in that document are included as Appendix A to this report.

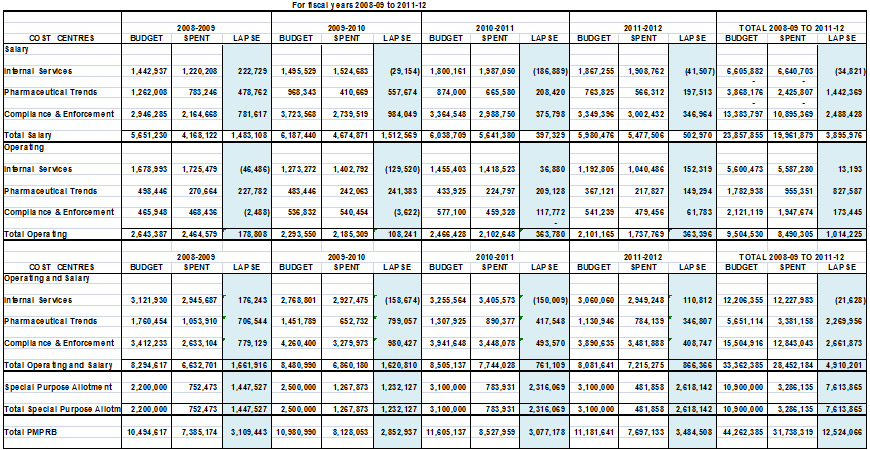

1.1.4 Program Resources

The total Budget allocated to the PMPRB for the four fiscal years from 2008-09 to 2011-12 excluding the Special Purpose Allotment (SPA), Employee Benefits Plans (EBP) and accommodation charges is $33.4M of which:

- $15.5M was allocated to the Regulation Program;

- $5.7M was allocated to the Pharmaceutical Trends Program; and

- $12.2M was allocated to Internal Services.1

The SPA funds available range from $2.2M in 2008-09 to $3.1M in 2010-11 onwards. The total Budget allocated to the SPA for the same period is $10.9M. The ability to hold public hearings when needed is a core component of the PMPRB's mandate and authority. Due to the difficulty in forecasting the number and complexity of hearings in any given year, the amounts related to external hearing costs (legal counsel, expert witnesses, etc.) are placed in the SPA so that they are reserved strictly for that purpose. Any unspent amount lapses at year end and is returned to the Consolidated Revenue Fund.

The total budget for the PMPRB and each of its three activity areas is summarized for 2008-09 to 2011-12 and shown in Table 1.1. A more detailed comparison of the total PMPRB's budget and actual spending is provided in Appendix B.

Table 1.1 PMPRB Budget by Activity Area, 2008-09 to 2011-12

| |

2008-09 |

2009-10 |

2010-11 |

2011-12 |

| Programs |

FTEs |

Budget |

FTEs |

Budget |

FTEs |

Budget |

FTEs |

Budget |

| Operating and Salary |

|

|

|

|

|

|

|

|

| Internal Services |

16.8 |

3,121,930 |

18 |

2,768,801 |

19 |

3,255,564 |

19 |

3,060,060 |

| Pharmaceutical Trends |

16.0 |

1,760,454 |

13 |

1,451,789 |

13 |

1,307,925 |

13 |

1,130,946 |

| Compliance and Enforcement |

37.8 |

3,412,232 |

45 |

4,260,400 |

44 |

3,941,648 |

44 |

3,890,635 |

| Total Operating and Salary |

70.6 |

8,294,616 |

76 |

8,480,990 |

76 |

8,505,137 |

76 |

8,081,641 |

| Special Purpose Allotment |

|

2,200,000 |

|

2,500,000 |

|

3,100,000 |

|

3,100,000 |

| Total PMPRB |

70.6 |

10,494,616 |

76 |

10,980,990 |

76 |

11,605,137 |

76 |

11,181,641 |

Source: PMPRB financial data, May 2012.

1.1.5 Governance

The PMPRB reports to Parliament through the Minister of Health. The Minister of Health is responsible for the pharmaceutical provisions of the Act as set out in sections 79 to 103. The PMPRB is part of the Health Portfolio, which also includes Health Canada, the Public Health Agency of Canada, the Canadian Institutes of Health Research, the Hazardous Materials Information Review Commission, and Assisted Human Reproduction Canada. The Health Portfolio supports the Minister of Health in maintaining and improving the health of Canadians. The PMPRB contributes to the federal government's strategic outcome of “Healthy Canadians.”

Although part of the Health Portfolio, the PMPRB carries out its mandate at arm's length from the Minister of Health. It also operates independently of the other organizations which are part of the overall Health Portfolio.

The Members of the Board are collectively responsible for the implementation of the applicable provisions of the Act. Together, they establish the guidelines, rules, by-laws and other policies of the Board as provided by the Act and consult as necessary with stakeholders including provincial and territorial ministers of Health, representatives of consumer groups, the pharmaceutical industry and others.

1.1.6 Stakeholders

The PMPRB's key stakeholders include:

- Consumers;

- The pharmaceutical industry (in particular companies selling patented medicines in Canada whether they be in the brand, generic or biotech sectors);

- Provincial, territorial and federal public drug plans;

- Private health insurance firms;

- Wholesalers, pharmacies, and hospitals;

- NGOs such as (but not limited to) advocacy groups for patients (such as Patients Canada, the Canadian Health Coalition and Best Medicines Coalition, Canadian Diabetes Association), the disabled, and seniors;

- Researchers and think tanks (e.g., Fraser Institute, Canadian Centre for Policy Alternatives, Pharmaceutical Policy Research Collaboration);

- Parliamentarians, to whom the PMPRB reports through the Minister of Health; and

- Foreign government and international organizations such as the Organization for Economic Cooperation and Development (OECD); who in the past, have sometimes incorporated PMPRB Pharmaceutical Trends Program findings and analyses into their decision-making.

1 Internal Services are groups of related activities and resources that are administered to support the needs of programs and other corporate obligations of an organization. These groups are: Management and Oversight Services; Communications Services; Legal Services; Human Resources Management Services; Financial Management Services; Information Management Services; Information Technology Services; Real Property Services; Materiel Services; Acquisition Services; and Travel and Other Administrative Services. Internal Services include only those activities and resources that apply across an organization and not to those provided specifically to a program.

2. This Evaluation

2.1 Need for this Evaluation

In 2008-09, the Treasury Board Secretariat (TBS), after having funded the increased workload at PMPRB through Program Integrity Funding for two years approved additional permanent funding of approximately $6 million per year, in order to allow the Board to deliver activities deemed essential to the PMPRB mandate. TBS approval included a condition requiring that an evaluation be conducted in fiscal year 2011-12 in order to assess the extent to which the increased resources allowed PMPRB to more effectively deliver on its mandate.

2.2 Scope of the Work

This evaluation is intended to assess the relevance and performance of both the Patented Medicine Prices Regulation Program and the Pharmaceutical Trends Program, during the period from 2008-09 through 2011-12. Detailed information on the evaluation plan for this study is contained in the Patented Medicine Prices Review Board Performance Measurement Strategy (January 2011). Though no part of the additional TBS funding described above was directed toward PMPRB's NPDUIS-related efforts that work has still been addressed in this evaluation in order to yield a more comprehensive assessment of how the PMPRB has performed in recent years.

In October of 2011, the Principals of Beechwood Consulting and Beals, Lalonde & Associates were contracted by PMPRB's Corporate Services Group (the Project Authority) to conduct this evaluation. The evaluation was conducted in accordance with Treasury Board Secretariat's Policy on Evaluation and the Directive on the Evaluation Function, which was implemented April 1, 2009. Under Treasury Board requirements, federal government evaluations must address relevance and performance. The table below shows the five key issues that were addressed by this evaluation.

Table 2.1 Key Evaluation Issues and Questions

| Relevance |

| Issue 1: Continued Need for Program(s) |

Assessment of the extent to which the program(s) continues to address a demonstrable need and is responsive to the needs of Canadians. |

| Issue 2: Alignment with Government Priorities |

Assessment of the linkages between program objectives and (i) federal government priorities and (ii) departmental strategic outcomes. |

| Issue 3: Alignment with Federal Roles and Responsibilities |

Assessment of the role/responsibilities for the federal government in delivering the program. |

| Performance |

| Issue 4: Achievement of Expected Outcomes |

Assessment of progress toward expected outcomes with reference to performance targets and program reach and design. |

| Issue 5: Demonstration of Efficiency and Economy |

Assessment of resource utilization in relation to the production of outputs and progress toward expected outcomes. |

Source: Patented Medicine Prices Review Board Performance Measurement Strategy (January 2011)

The evaluation team worked with the Project Authority to update the evaluation matrix included in the Patented Medicine Prices Review Board Performance Measurement Strategy to yield the matrix shown in Appendix C.

The anticipated primary audience for this evaluation report includes:

- The Chairperson, Board members and staff of the PMPRB;

- Treasury Board Secretariat - which was consulted during the orientation phase of the study to ensure that its expectations were factored into the planning and conduct of the study; and

- Health Canada.

2.3 Methodology

This evaluation featured multiple lines of evidence. This approach facilitates assessing the evaluation issues from a variety of perspectives and using a range of data collection and analysis approaches, and is consistent with Treasury Board standards for evaluation. Using multiple sources and multiple methods provides a more rounded assessment with the potential for greater confidence in the results. In Chapters 3 -6 of this report, findings from all lines of inquiry are woven together to provide a balanced analysis. The combination of qualitative and quantitative evidence establishes a strong foundation to support conclusions and recommendations.

2.3.1 Interviews

Interviews with stakeholders contributed to a nuanced understanding of the perceptions and opinions of individuals who have had a significant role in or experience with the PMPRB, or who have a key stake in it. A separate interview guide was developed for each of the following categories of interviewees. In total, 46 interviews were conducted as follows:

- Board members (current and former), selected PMPRB senior managers and staff (9);

- Representatives from patentee organizations (11);

- Representatives from consumer groups/advocacy groups (5);

- Representatives from private health insurance firms (3);

- Provincial and territorial government representatives and representatives of Health Canada (14); and

- Researchers from agencies/groups anticipated to make use of PMPRB research products (4).

The interviewee categories are somewhat artificial since many individuals interviewed could fit into more than one of the above categories. In cases where interviewees self selected into more than one category they were asked with which category they identify best.

The Master Interview Guide, which shows the questions each category of interviewees were asked to address is included as Appendix D to this report.

2.3.2 Survey of Stakeholders

An Internet-based survey was developed to collect data from stakeholders. The survey questionnaire, attached as Appendix E to this report, included a combination of open and close-ended questions to address issues identified for this project and was pre-tested and refined as required prior to the time that potential survey respondents were invited to participate.

Email invitations to participate in the survey were directed to approximately 700 individuals, seventy-four (approximately 10%) of who completed the survey, broken into categories as follows:

- 39 patentees or organizations representing patentees;

- 4 consumer and/or patient advocacy organizations;

- 7 provincial, territorial or federal drug plan providers;

- 8 researchers from think tanks, universities, etc.; and

- 16 others who self-identified as consultants, lawyers, and pharmacists.

2.3.3 Document and Literature Review

The document review component of the evaluation helped the evaluators develop a thorough understanding of the PMPRB and address many of the evaluation issues. The documents reviewed were gathered from the PMPRB, interviewees as well as through a range of targeted Internet searches.

The bibliography included as Appendix F to this report lists all of the documents reviewed for this study. The evaluators developed a working/technical document in which summaries or extracts from documents that were responsive to specific evaluation questions/performance indicators were maintained.

2.3.4 Analysis of PMPRB Performance Data

The PMPRB has a Performance Measurement Strategy (PMS) which was finalized in January 2011 and which has been, or is in the process of being implemented by most branches within the PMPRB. Given how recently the PMS was finalized, it yielded only limited performance measurement data. However, the PMS has been substantially bolstered by data provided in the PMPRB's Annual Reports and/or in a range of other PMPRB documents listed in the bibliography and by data maintained and provided by the various PMPRB activity areas.

2.3.5 Methodological Constraints/Limitations

All parties to this evaluation recognized from the outset that the numbers of both interviewees and survey participants would be too small to yield real statistical validity – either for the overall group or categories within it. This does not obviate the value of the information gathered. One of the merits of multiple lines of evidence is that it allows a higher degree of confidence if/when different lines of evidence yield consistent and congruent information. For this study, it was anticipated that the combination of input from interviews and surveys combined would provide a reasonable degree of confidence in the input received.

This anticipation proved accurate for the Regulation Program. However, the survey responses were dominated by patentees, which thus skewed results for the Pharmaceutical Trends Program (PT Program) because it is targeted at government policy-makers, not patentees. Given that these two groups (government policy-makers and patentees) may have conflicting priorities, overall survey input about the PT Program must be interpreted with caution.

For categories of interviewees/survey respondents other than patentees and F/P/T representatives, the very small number of responses may indicate a lack of connection between those groups and the PMPRB, perhaps because the PMPRB Price Regulation Program does not directly impact these groups. This is explored where possible and appropriate, in the chapters that follow.

2.4 This Report

The remainder of this report is structured as described below. In each of chapters 3, 4, 5, and 6, relevant findings are presented first and then conclusions drawn from those findings end the chapter.

- Chapter 3 – Relevance: Assesses the extent to which the two PMPRB programs are still relevant and needed, and the degree of their alignment with government and agency priorities and with federal roles and responsibilities.

- Chapter 4 – Achievement of Outcomes – Regulation Program: Assesses the extent to which the Regulation Program has achieved the intended outcomes for the program.

- Chapter 5 – Achievement of Outcomes – Pharmaceutical Trends Program: Assesses the extent to which the PT Program has achieved the intended outcomes for the program.

- Chapter 6 – Efficiency and Economy: Assesses the efficiency and economy of the performance of both programs.

- Chapter 7 – Summary Conclusions: Summary responses to the key evaluation issues and questions are presented. This chapter also identifies a number of issues that may warrant consideration by the PMPRB as it responds to this evaluation report.

3. Relevance

This chapter addresses evaluation issues and questions related to the on-going need for the PMPRB and its key programs – the Patented Medicine Prices Regulation Program and the Pharmaceutical Trends Program.

3.1 Changes in the Environment

The patented drug product environment is complex, international, and has evolved rapidly in recent years. Evidence from stakeholder interviews and the literature review converged to identify a number of major changes that have occurred in recent years, including:

- End of the Blockbusters/Emergence of Generics: In recent years, patents for some of the top-selling “blockbusters”2 have started to expire, leading to increased competition from less-costly generic versions. This was cited as a major factor driving change by most of the interviewees from the PMPRB, and by several of the other interviewees. Many of these interviewees established this “patent cliff” as the precipitating factor driving the emergence of less costly generics as alternatives to the brands going off patent.

- The Emergence of Drugs for Niche Markets: The recent past has also seen an emergence of very expensive drug products and more targeted testing and treatment for less common diseases. Niche market products include (but may not be limited to) biologics/small molecule products, enzymes, injectables, and vaccines. This was noted by the majority of interviewees from the PMPRB and federal/provincial/territorial representatives and by several others.

- Burgeoning Drug Costs and Drug Plan Responses: The high-cost of drugs in niche markets exacerbates demographic impacts described in Generic Drug Pricing and Access in Canada: What are the Implications? (2010)3 “An aging population, along with an increasing number of individuals living with multiple chronic conditions, means that many more Canadians will require access to prescription medications”. This demographic change, along with utilization trends and shifts in the therapeutic mix, are probably among the key factors resulting in burgeoning drug costs, as reported in The National Pharmaceuticals Strategy Progress Report (June 2006)4 “After hospital care, Canada spends more on drugs than any other major category of the health care system. Since 2000, the total public and private expenditure on prescription drugs has grown by approximately 12 per cent annually. This rapid escalation in drug costs threatens the sustainability of public drug programs”. These research findings are also echoed by CIHI's report titled Drug Expenditure in Canada, 1985 to 2011 with drug expenditures reported to have increased from 9.5% in 1985 to 16.2% in 2010.5 This reference is consistent with input from the majority of interviewees who are patentees, who cited aggressive formulary efforts to contain costs (particularly in regard to generics) as yet another major change in the environment.

- Increased Globalization: Several patentees also identified the contraction of the manufacturing sector, as mergers have resulted in fewer and larger manufacturers/patentees – most of which are international, as a major change. Some of them linked this to the impact of increased globalization, as described in an OECD document Pharmaceutical Pricing Policies in a Global Market6 “The market for pharmaceutical products is increasingly a global one, with trade policy practices making market segmentation and corresponding price differentiation by country difficult – particularly within Europe, where multinationals have encouraged their subsidiaries to set prices within narrow price corridors”.

- Changes in the Pharmacy Industry/Reduced Price Transparency: A number of interviewees also cited an evolution in how pharmacies operate as a significant change in the environment, and one which has reduced price transparency. They were referring most often to rebate arrangements between manufacturers and pharmacies, which result in list prices being unaffected because the rebate occurs post-purchase. This was mentioned by the majority of federal/provincial/territorial interviewees and by several patentees. Interviewees also noted the increased use of product listing agreements (PLAs) that provincial formularies negotiate with manufacturers.

3.2 Relevance of the Regulation Program

The implications of the changes identified above are well-described in two cogent extracts from the literature review:

- “Canada is faced with the challenge of optimizing the benefits of prescription drugs for Canadians while managing the risks and complexities associated with this rapidly evolving sector.”7

- “The importance of containing costs over the long term should not be understated given the projected impact of demographics on drug use.”8

This suggests that the Regulation Program remains relevant. The realities of federal/provincial responsibilities for health care reinforce that relevance. Under the federal system of health care, each province has its own formulary and each provincial formulary is free to negotiate prices directly with drug manufacturers. However, the provinces' negotiating power varies by size of the province, with larger provinces having a much stronger negotiating position than smaller provinces. Based on interview findings the PMPRB serves an important regulatory function for small provinces, even in the context of formularies seeking to negotiate drug prices directly with manufacturers. In fact, some interviewees reported that the PMPRB's pricing is often used by provinces as a starting point in their product listing agreements (PLA) negotiations with manufacturers.

The majority of interviewees supported the relevance of the Regulation program, though some of that support was qualified:

- Twelve of the 44 interviewees expressed relatively unqualified support for the need for and appropriateness of continued regulation at the federal level. This support was most pronounced among interviewees from the federal/provincial/territorial and patient advocacy categories, and least evident among patentees.

- A few interviewees felt that the program is more relevant than ever because of the emergence of high-cost niche-market products like biologics.

- Another few felt that the Regulatory function is less relevant than in the past because of the success public formularies have had in cost-containment, but that it remains very relevant for those not covered by public plans. According to the Impact of Federal Regulation of Patented Drug Prices9 – this is a large group. It reports that:

- 32% of total patented drug expenditures are public

- 56% are covered by third party payers and employee benefit plans

- 12% are assumed by cash-paying customers.

A few interviewees spread throughout the stakeholders categories, thought the relevance of the Regulation Program was reduced or negated by both concerns about the appropriateness of the basket of comparator countries (which they felt feature too narrow a price range), and by the impact of globalization. They felt that international manufacturers use these factors to their advantage when introducing drugs. This was noted in an OCED study10 which found that “….manufacturers have responded to the increasingly global market for their products in a strategic way. In response to external price referencing, they launch their products first in countries where they can set prices freely or can negotiate relatively high prices, delay or refrain from launching in relatively lower-price countries and maintain artificially high list prices, even when they are willing to consent to confidential rebates.”

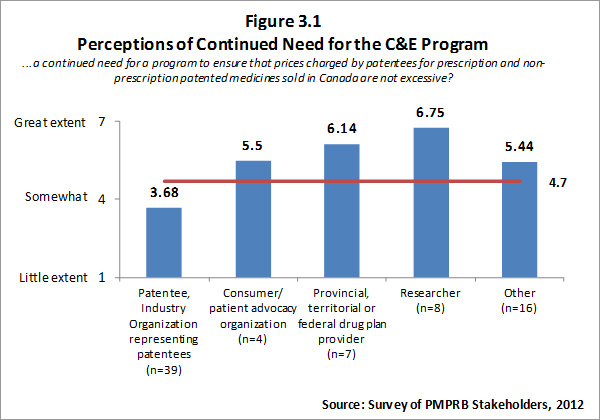

The input from survey respondents was reasonably consistent with the views of interviewees. Overall, survey respondents feel there is a need for a program to ensure that prices charged by patentees for patented medicines are not excessive. However, there is a clear split in opinion between patentees (i.e. the regulatees) and other groups of survey respondents with other groups of survey respondents indicating a high level of need for such a program. Respondents who self-identified as belonging to the researcher category indicated that there is a “great need” for such a program, likewise F/P/T drug plan representatives noted a great need. Survey results for this question are summarized in Figure 3.1.

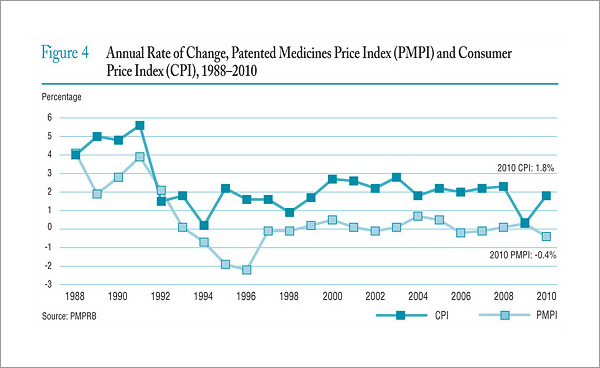

The literature review provided support for the on-going rational of the Regulation Program with the PMPRB's Annual Reports for 1995 to 2003 indicating that sales of patented drugs grew at an annual rate exceeding 10% while average annual rates of change for prices was less than 1%.”11

3.3 Relevance of the Pharmaceutical Trends Program

The literature review provided a few indications of the relevance of the Pharmaceutical Trends (PT) Program. The most recent example is the citing of statistics/information provided by the PMPRB in Ontario's 2012 Drummond Report. The fact that a high-profile research/investigative project like this one relied on PMPRB data provides some validation of the relevance of the program that produced it.

Perspectives gleaned from interviews from two specific categories of interviewees - patentees and F/P/T drug plan representatives were (not surprisingly) divergent.

Thirteen of the fourteen F/P/T interviewees thought the PMPRB's information products were relevant. Additional insights offered by F/P/T interviewees included the following:

- Over half of the F/P/T interviewees said the information and analysis provided by the PMPRB was well-aligned with their policy concerns.

- Some of the F/P/T interviewees were able to identify specific products they had found particularly useful. Four of them cited work done on generic prices, two cited work done on cost drivers, two noted that they found the NPDUIS data very useful for comparative analysis, and one found the PMPRB work done on wholesale markups to have been very useful.

- However, more than half of the F/P/T interviewees who thought the PMPRB's information products are relevant said that their relevance is reduced by lack of timeliness. A number of these noted that they often need to make decisions before the relevant PMPRB reports are available. As a result parallel research is often conducted by policy makers who then use PMPRB reports to support decisions already made rather than using the PMPRB research to directly inform decision-making. Concerns about timeliness (or lack thereof) of information products eroded their value and therefore reduced their relevance.

In contrast to F/P/T representatives, none of the eleven patentee interviewees expressed strong support during their interviews concerning the PMPRB's Pharmaceutical Trends Program, which as previously explained, is targeted at government policy-makers, not patentees. Reasons cited for the perceived lack of relevance included perceived inappropriateness over the reporting on patented generics and perceived inappropriateness of the legislatively mandated definition of R&D used by the PMPRB. As already noted the requirement to report on R&D expenditures and the definition of R&D are set out in the Patent Act and Patented Medicines Regulations and are not within the PMPRB's direct control.

Almost half of the interviewees in other categories indicated that the PMPRB information products are relevant. Overall, just under half of all interviewees felt the PT Program is relevant.

The picture that emerged from electronic survey results, which provide a more detailed breakdown of two categories of information products, is a little more enlightening. These results are described in the sections below.

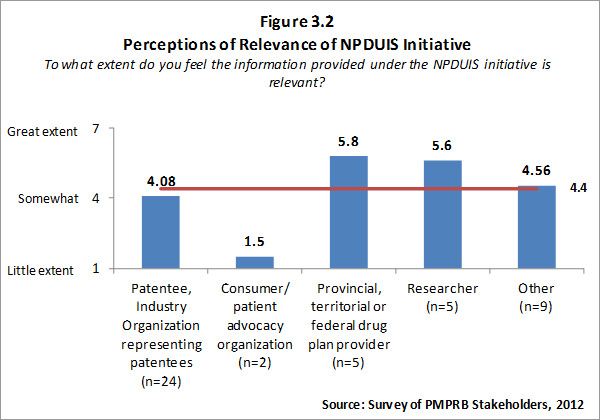

3.3.1 Perceived Relevance of NPDUIS

Of the 74 survey respondents, 45 (or 61 %) indicated familiarity with the analysis and research produced under the National Prescription Drug Utilization Information System (NPDUIS). Survey respondents were asked to rate the extent to which they feel the information provided under the NPDUIS initiative is relevant. Overall, respondents indicated they find the information relevant; however there was significant variation in the ratings provided across categories of respondents. Respondents representing F/P/T public drug plans and researcher/industry/think tank representatives rated the relevance of the information highly while consumer/patient advocacy representatives rated the information as being of little relevance to them. These results can be attributed to the fact that the NPDUIS program was created pursuant to an agreement by federal, provincial and territorial Ministers of Health, in order to meet their need for critical analyses of price, utilization and cost trends to inform policy-making. Representatives of F/P/T public drug plans comprise the NPDUIS Committee which provides advice and guidance to the PMPRB on research priorities and topics. Although the vast majority of NPDUIS reports are publicly available, they are not produced for general consumption. This is also reflected in the awareness of NPDUIS analysis and reporting among stakeholders responding to the survey. Survey results for this question are summarized in Figure 3.2 below.

3.3.2 Perceived Relevance of R&D Spending Data

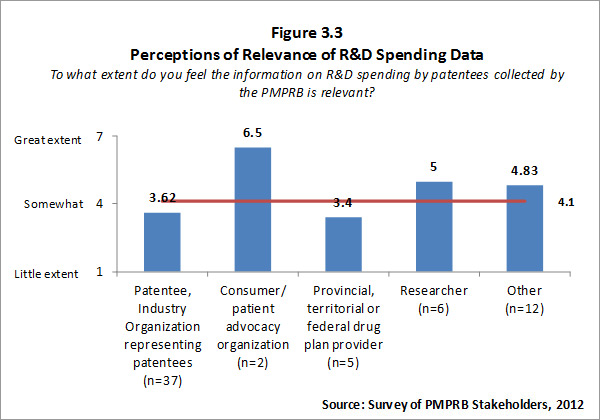

The PMPB is mandated to collect information on patentees' R&D spending in order to enable the tracking of the industry's R&D performance against the initial commitment of a 10% R&D-to-Sales ratio made with the adoption of the 1987 amendments to the Act.12

Of the 74 survey respondents, 62 (or 84%) indicated familiarity with PMPRB reporting of information on R&D spending by patentee. Patentees who indicated familiarity with R&D spending data rated the information as less than somewhat relevant while respondents representing consumer/patient advocacy groups and researcher/industry group/think tank rated the information as more than somewhat relevant. Survey results for this question are summarized in Figure 3.3 below.

Survey respondents who feel that PMPRB information on R&D spending by patentees is not relevant were asked to explain why they held this view. The most frequent explanations focused on the view that the current definition of R&D used by the PMPRB is outdated and/or inaccurate. The definition used by the PMPRB, as required by the Regulations, is the one used by Canada Revenue Agency for tax purposes in 1987. Some survey respondents and interviewees contended that the definition is no longer relevant because the pharmaceutical industry functions differently now than it did when the existing definition was set.13 For example, patentees are undertaking less direct basic research but providing research funding through other channels such as university research chairs – this is not reflected in the current definition of R&D. That said, the Government recently announced, in Budget 2012, that it intends to move to a more restrictive definition of R&D under the Canada Customs and Revenue Agency Scientific Research and Experimental Development (SR&ED) program in the near future.

3.4 Alignment with Priorities and Strategic Outcomes

3.4.1 Alignment with Federal Government Priorities

In the recent past, there have been numerous iterations of federal government priorities related to the technology and infrastructure of innovation; the provision of health care services generally and prescribed medicines in particular; and to the provision of information:

- From the National Pharmaceuticals Strategy14:

- "First Ministers agreed that no Canadian should suffer undue financial hardship in accessing needed drug therapies and that affordable access to drugs is fundamental to equitable health outcome for all our citizens.

- … the strategy should "enhance analysis of cost drivers and cost-effectiveness, including best prices in drug plan policies."

- From the First Minister's meeting on the future of Health Care 2004 A 10-Year Plan to Strengthen Health Care15 :

- “Affordable access to drugs is fundamental to equitable health outcomes for all our citizens".

- (federal priorities include) "Continued accountability and provision of information to make progress transparent to citizens"; and “…enhanced analysis of cost drivers and cost effectiveness."

- The 2007 Speech from the Throne included a focus on promoting innovation and growth in key sectors of the economy and stated that it will support, “Canadian researchers and innovators in developing new ideas and bringing them to the marketplace through Canada's Science and Technology Strategy.”

- From Mobilizing Science and Technology to Canada's Advantage16: “Canada has worked to increase the impact of federal S&T investments. In some cases, we have made new investments in regulatory activities, scientific research or infrastructure that is in the public interest".17

- From the 2010 Speech from the Throne: “It will ensure that families have the information they need to make informed choices and it will hold those who produce, import and sell goods in Canada accountable for the safety of Canadians”.

- From the 2011 Speech from the Throne:

- “Canadians want and expect their health care system to be there when they and their families need it most. Canadians want better results from the health care system, at the same time as an aging population is putting unprecedented pressure on the system's ability to deliver.”

- “Our Government is committed to respecting provincial jurisdiction and working with the provinces and territories to ensure that the health care system is sustainable and that there is accountability for results.”

- “Canadians rightly expect fairness and accountability in the full range of government institutions that serve them.”

Input from key interviewees was consistent with these documented indications of the appropriate alignment of both PMPRB programs with federal government priorities. This was particularly evident among the F/P/T representatives - the interviewee category one would expect to be most knowledgeable about federal versus provincial responsibilities. Most of these interviewees expressed comfort with the fit between the PMPRB programs and the legislative obligations of the federal government.

The PMPRB was designed to act as a counterbalance to the extension of patent protection power granted to industry. The creation of the Board occurred in the context of the then five pillars of pharmaceutical patent policy – intellectual property, relationship to industrial policy, multilateral relations, consumer protection and health of Canadians.

3.4.2 Alignment with PMPRB Strategic Outcomes

The Strategic Outcome for the PMPRB is two-pronged. It is that:

- Canadians are protected from excessive prices for patented drug products sold in Canada.

- Stakeholders are informed on pharmaceutical trends.

The Regulation Program, whose objective is to review the prices of patented drug products to ensure that they are not excessive, aligns with the first component of the PMPRB's Strategic Outcome. The Pharmaceutical Trends Program, whose objective is to report on pharmaceutical trends and on R&D spending by patentees; and to provide critical analyses of price, utilization and cost trends of prescription drugs, aligns with the second component of the Strategic Outcome.

None of the research gathered, through the literature/document review, interviews or survey, countermanded this very straightforward alignment between the PMPRB's programs and its Strategic Outcome.

3.4.3 Relationship to Agencies with Related Mandates

The PMPRB is a federal agency established by legislation with legislated reporting requirements. As such, its mandate is pan-Canadian. In contrast, CADTH is a voluntary F/P/T collaboration and CIHI is an independent (non-legislated) organization funded by the federal government.

Interviewees were asked if they thought the PMPRB programs either complement or duplicate the work of other organizations/levels of government. Of those who responded to this question, a significant majority indicated that they perceived some overlap but no duplication between the research/reporting work of the PMPRB and other groups like CIHI, CADTH, and provincial/territorial/federal formularies. Of these interviewees, several mentioned the need to continue and perhaps enhance cooperation and collaboration between the PMPRB and these other groups, because of the potential, so far largely avoided, for duplication in regard to the reporting and analysis function. (All seemed to agree that the regulatory function is unique). Quotes from a number of PMPRB interviewees explain the potential for duplication or perceptions of duplication:

- (Talking about groups like CIHI, CADTH and the CDR): “We look at the same data but with a different perspective”

- “We are dependent on national agencies like CDR and CADTH, and understand the intricacies of their separate but related mandates. I suspect that for other sectors like patentees, this is probably more confusing and that answers will be different.”

While the surmise above regarding patentees' perspectives was correct, the extent of the difference was less radical than might have been anticipated. Half of the patentees agreed with the majority of interviewees who thought there was some overlap but no duplication. Another breakdown of interviewee input in this regard is quite positive. Most F/P/T interviewees thought there was some overlap but no redundancy.

When discussing either perceived duplication or the potential for duplication in the reporting function, interviewees identified CIHI and provincial formulary research groups as the organizations with whom PMPRB work was most likely to be duplicative.

Although most interviewees' suggestions/comments focused on the Regulatory Program, a few interviewees suggested that the Pharmaceutical Trends Program could be transferred to another federal department or agency. The most frequently suggested alternative was transferring the PMPRB's research activities to the Canadian Institute for Health Information (CIHI). Although this was put forward as a suggestion by some interviewees, others specifically noted that the PMPRB has a legislated mandate to collect and report on R&D spending and pharmaceutical pricing trends and is well placed to conduct additional research related to the pharmaceutical industry.

3.5 Conclusions

3.5.1 The Regulation Program

Based on findings in this evaluation, changes in the patented drug environment have had an impact on the degree to which the Regulation Program continues to be relevant with respect to preventing excessive pricing for patented drugs sold in Canada:

- The emergence of generic drugs and implementation of aggressive cost-containment approaches in public formularies appears to have reduced the relevance of the Regulation Program for those covered by those drug plans. However, only 32% of patented medicine expenses are covered by public drug plans, implying that the approach of public formularies has NOT reduced the relevance of the Regulation Program for the majority of patented medicine expenses.

- The emergence of extremely expensive products for niche markets appears to have increased the need for and relevance of the Regulation Program.

Overall, there continues to be a need for a program to prevent excessive prices for pharmaceutical drugs in Canada. In that regard, the PMPRB's Regulation Program is responsive to the needs of Canadians since there is evidence that prices could be excessive in the absence of the PMPRB.

Based on the evaluators' assessment of evaluation findings described in this chapter, the Regulation Program is appropriate for delivery by a federal agency. The PMPRB was designed to act as a counterbalance to the extension of patent protection power granted to industry. It appears that the PMPRB continues to serve this role, one that could not be served by a non-federal entity. This evaluation found no evidence of duplication of roles with respect to the prevention of excessive pricing of patented pharmaceutical drugs in Canada.

The Regulation Program is well-aligned with both government-wide priorities and with PMPRB's Strategic Outcome as evidenced by findings from a review of federal and PMPRB documentation. Numerous references to health care, affordability and the need for innovation in Speeches from the Throne since 2007 reflect the alignment of PMPRB with the federal government's current priorities. The Regulation Program aligns precisely with one of the PMPRB's Strategic Outcomes, “Canadians and their health care system are protected from excessive pricing for patented drug products sold in Canada.”

3.5.2 The Pharmaceutical Trends Program

Based on the evaluators' assessment of evaluation findings described in this chapter, the PT Program continues to be relevant. However, this is a more qualified pronouncement than the assessment of the Regulation Program. This assessment reflects the fact that the PT Program is largely intended to meet the needs of F/P/T stakeholders. The factors most implicated in diminishing the relevance of the PT information products is a lack of timeliness in development/dissemination, and with respect to patentees, concern about the appropriateness of aspects of the program which are mandated by law (i.e. reporting on R&D expenditures). The PMPRB could improve the relevance of the PT Program by improving, where possible, the timeliness of the information, specifically for NPDUIS.

Under Section 88 of the Act pharmaceutical firms must report their research and development spending to the PMPRB. In addition Section 90 of the Act authorizes the Minister of Health to request that other inquiries be undertaken by the PMPRB. Given that both these sections of the Act continue to exist, the PMPRB's PT Program appears to continue to align with federal government needs and priorities with respect to research related to pharmaceutical pricing trends. Furthermore, the NPDUIS Steering Committee includes representatives from the provincial, territorial and federal government who provide input into the selection of NPDUIS research topics. This serves as a link between NPDUIS research and federal priorities related to pharmaceutical pricing trends research.

Findings from the evaluation indicate that the PT Program is well-aligned with one of the PMPRB's Strategic Outcomes, “Stakeholders are informed on pharmaceutical trends.” While there is the potential for duplication in regard to research work done by closely related agencies like CIHI and CADTH, that potential does not appear to have been realized. To date it appears that there is some overlap but little or no duplication in the efforts of the PMPRB and other federal research organizations.

2 Blockbuster drugs are commonly defined as extremely popular drugs that generate annual sales of at least $1 billion for a company. Examples of blockbuster drugs include Vioxx, Lipitor and Zoloft. Blockbuster drugs are commonly used to treat common medical problems like high cholesterol, diabetes, high blood pressure, asthma and cancer.

3 Bell C, GrillerD, Lawson J, Lovren D. (2010) Generic Drug Pricing and Access in Canada: What are the Implications? Toronto: Health Council of Canada. www.healthcouncilcanada.ca., page 4.

4 Federal/Provincial/Territorial Ministerial Task Force on the National Pharmaceuticals Strategy. (2006). National Pharmaceuticals Strategy Progress Report Ottawa: Publications Health Canada. Retrieved from http://www.hc-sc.gc.ca/hcs-sss/alt_formats/hpb-dgps/pdf/pubs/2006-nps-snpp/2006-nps-snpp-eng.pdf, page 8.

5 Canadian Institute for Health Information (CIHI). (2012) Drug Expenditure in Canada, 1985 to 2011. Ottawa: CIHI. Retrieved from https://secure.cihi.ca/free_products/DEIC_1985_2011_EN.pdf

6 OECD. (2008). Pharmaceutical Pricing Policies in a Global Market. E. Docteur, V. Paris, and P. Moise. Page 11.

7 Federal/Provincial/Territorial Ministerial Task Force on the National Pharmaceuticals Strategy. (2006). National Pharmaceuticals Strategy Progress Report Ottawa: Publications Health Canada. Retrieved from http://www.hc-sc.gc.ca/hcs-sss/alt_formats/hpb-dgps/pdf/pubs/2006-nps-snpp/2006-nps-snpp-eng.pdf, page 6.

8 Bell C, Griller D, Lawson J, Lovren D. (2010) Generic Drug Pricing and Access in Canada: What are the Implications? Toronto: Health Council of Canada. www.healthcouncilcanada.ca., page 4.

9 Patented Medicine Prices Review Board. (1997). Impact of Federal Regulation of Patented Drug Prices. Patented Medicine Prices Review Board. Ottawa.

10 OECD. (2008). Pharmaceutical Pricing Policies in a Global Market. E. Docteur, V. Paris, and P. Moise. Page 11.

11 Patented Medicine Prices Review Board. (2011) Annual Report 2010. Ottawa: Patented Medicine Prices Review Board. www.pmprb-cepmb.gc.ca, page 16.

12 As published in the Regulatory Impact Assessment Statement (RIAS) of the Patented Medicines Regulations, 1988, published in the Canada Gazette, Part II, Vol. 122, No. 20 – SOR/DORS/88-474

13 The PMPRB 2010 Annual Report noted that the PMPRB was participating as a member of a working group examining mechanisms for capturing and reporting on research and development investments by Rx&D and its member companies.

14 Federal/Provincial/Territorial Ministerial Task Force on the National Pharmaceuticals Strategy. (2006). National Pharmaceuticals Strategy Progress Report Ottawa: Publications Health Canada. Retrieved from http://www.hc-sc.gc.ca/hcs-sss/alt_formats/hpb-dgps/pdf/pubs/2006-nps-snpp/2006-nps-snpp-eng.pdf.

15 Health Canada. Health Care System First Minister's Meeting on the Future of Health Care 2004 A 10-Year Plan to Strengthen Health Care. Retrieved from http://www.hc-sc.gc.ca/hcs-sss/delivery-prestation/fptcollab/2004-fmm-rpm/index-eng.php

16 Public Works and Government Services. (June 2009). Mobilizing Science and Technology to Canada's Advantage Progress Report 2009. Ottawa: Publishing and Depository Services Public Works and Government Services http://ic.gc.ca/epublications.

17 Public Works and Government Services Mobilizing Science and Technology to Canada's Advantage Progress Report 2009. Ottawa: Publishing and Depository Services Public Works and Government Services http://ic.gc.ca/epublications.

4. Achievement of Outcomes - Regulation Program

This chapter addresses the achievement of program outcomes for the Patented Medicine Prices Regulation Program.

4.1 Knowledge and Awareness of Guidelines and Related Policies

The immediate outcome of the Regulation Program is that “Patentees have enhanced knowledge and awareness of the Act, Regulations, policies and Guidelines and consequences of non-compliance.” The degree of success the PMPRB has achieved in working toward this outcome is explored below.

The Board's Guidelines were revised in 2010. As part of the process of revising the Guidelines the PMPRB consulted extensively with stakeholders. The PMPRB has also undertaken on-going efforts at ensuring that patentees are aware of the Guidelines and related policies in order to understand their legal requirements for reporting and complying with the Guidelines and related policies.

Since 2007 PMPRB has participated in or held 13 outreach events including seminars, outreach sessions, and more recently webinars. These outreach events have been generally well attended by patentees and consultants who work with patentees, with attendance ranging from 114 patentees and consultants at outreach sessions in Toronto and Montreal in October 2009 to 37 participants in a webinar held on DIP methodology in April 2011. Table 4.1 summarizes the total number of stakeholder consultations held by the PMPRB over the past four years.

Table 4.1 Number of Stakeholder Consultations, 2008-09 to 2011-12

| |

2008-09 |

2009-10 |

2010-11 |

2011-12 |

| Number of stakeholder consultations held |

34 |

25 |

5 |

25 |

Source: PMPRB Performance Measurement Data, 2012.

As part of implementing its new performance measurement strategy developed in January 2010, the PMPRB has recently implemented feedback forms for outreach events held with patentees and consultants. Thus far feedback forms have been collected from four outreach sessions – Montreal and Toronto in March 2011 and Montreal and Toronto in February 2012. For all four of these sessions, the feedback from participants was almost entirely positive with the vast majority of participants indicating that the session answered their questions on the Guidelines and related topics.

In addition to making in-person presentations to patentees and stakeholders on various aspects of the Guidelines and related policies, the PMPRB has published 10 articles in its newsletter clarifying the Guidelines and the processes followed by Board staff when reviewing the price of a patented drug. Some examples of articles aimed at clarifying the Board's Guidelines and related policies include: Clarification of Offset of Excess Revenue (October 2010); Block 5 Foreign Price Verification (January 2011); Back Out Methodology (July 211); Backing-Out Formulas for Foreign Price Verification (January 2012).

Survey findings indicate that a large proportion (79 per cent) of patentees and organizations representing patentees are satisfied with the PMPRB's efforts to provide them with information on the legislative framework, Board Guidelines and policies. Those respondents who indicated that they felt PMPRB efforts have been insufficient were asked to explain their perspectives. Most of them focused on a need for the PMPRB to increase communication. One of these respondents explained that the Guidelines are complex and require good understanding and there are numerous grey areas that are open to interpretation that require clarification.

Likewise almost all patentees and organizations representing patentees who were interviewed for this evaluation indicated that PMPRB efforts have contributed to patentees' understanding of their obligations under the Patent Act. In fact a number of patentees noted that the relationship between patentees and the PMPRB has improved significantly in the past year or two with some describing what they see as a “regime change” at the PMPRB, which features considerably more open communication between patentees and PMPRB staff. Although most patentees interviewed are satisfied with PMPRB efforts with respect to communication with patentees, a few noted some generalized dissatisfaction, another few noted that there remain some grey areas with respect to application of the Guidelines and one interviewee commented that the website has been reorganized too frequently, making it difficult to find things on the website.

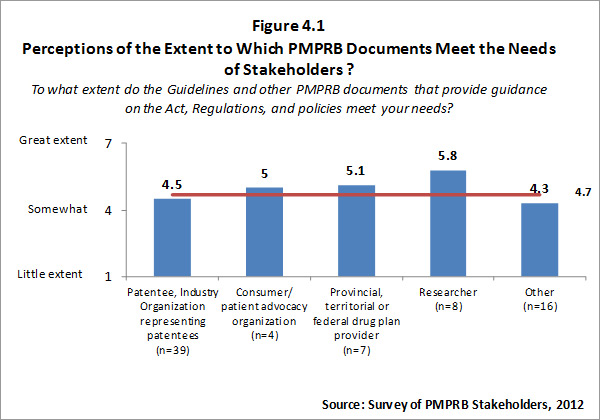

Although all categories of survey respondents find the Guidelines and other PMPRB documents intended to provide guidance on the Act, Regulations, and policies meet their needs at least to some degree, the extent to which survey respondents feel these documents meet their needs is variable. Patentees and organizations representing patentees and respondents in the “other” category tend to rate the extent to which documents provided by the PMPRB meet their needs as lower than other categories of respondents. Survey results for this question are summarized in the Figure 4.1 below.

Those respondents who indicated that they do not feel the Guidelines and other PMPRB documents meet their needs were asked to explain why. Responses provided focused on the lack of clarity of the Guidelines, and the need for interpretation of the Guidelines.

Survey results indicate that a large proportion (92%) of patentees and organizations representing patentees feel they have sufficient knowledge and awareness of the Act, the Regulations and Guidelines to enable them to comply. Patentees and organizations representing patentees who were interviewed for this evaluation were likewise satisfied that information and guidance from the PMPRB meets their needs. However, interviewees noted some gaps or shortcomings. The most frequently cited gap relates to the selection of comparator drugs, particularly for new drugs without obvious comparators. One interviewee noted a lack of clarity with respect to the Human Drug Advisory Panel (HDAP) decision-making and a desire on the part of patentees to have access to more detailed reports of summaries of deliberations/decisions (not just for their own medicines).

4.2 Compliance with the Act, Regulations and the Guidelines

One of the intermediate outcomes of the Regulation Program is that “Patentees comply with the Act, Regulations and Guidelines” The degree of success the PMPRB has achieved in working toward this outcome is explored below.

4.2.1 Trends in Compliance with Guidelines

Patentees are required by law to file information pertaining to the sale of their drug products in Canada. The Patent Act and the Patented Medicines Regulations set out the filing requirements, and Board staff reviews the pricing information on an on-going basis to ensure that prices are not excessive. Patentees are required to file information at introduction and then twice a year until the patent expires.

The number of patented drugs that fell within the Guidelines, the number not in compliance with the Guidelines and the number outside the Guidelines but which did not trigger an investigation are summarized in Table 4.2.

Table 4.2 Number of Drugs Not in Compliance with Guidelines (Price), 2007 to 2011

| |

2007 |

2008 |

2009 |

2010 |

2011 |

| Number of Patented Drug prices within the Guidelines (prices not excessive) |

1,022 |

1,092 |

1,053 |

954 |

1,079 |

| Number of Patented Drug prices outside the Guidelines – (but did not trigger the investigation criteria)18 |

N/A |

N/A |

N/A |

135 |

134 |

| Number of Patented Drug prices that are the subject of an Investigation or a Hearing19 |

125 |

134 |

93 |

222 |

70 |

Source: PMPRB Performance Measurement Data, 2012.

The extent to which Form 2 and Form 3 filings are complete and accurate and submitted within the established timeframe is, in part, reflective of the extent to which patentees are aware of and understand their obligations under the Guidelines and the Act.

The submission of price and sales data (Form 2 filing) is required on a semi-annual basis (January 30th and June 30th). Where companies fail to file, a letter is sent by the PMPRB to the president of the company providing the company with an additional seven days to comply. A Board Order is issued to companies that do not subsequently file their Form 2. According to senior staff at the PMPRB, there is a relatively high rate of turnover in employees who are responsible for Form 2 filing at pharmaceutical companies and so failures to file are often the result of inexperienced staff.

The PMPRB has an internal system whereby Form 2 fillings are submitted electronically. The Form 2 filings submitted are run through an electronic verification system that checks whether the format of the components of Form 2 is as required. If the filing contains no errors the data is automatically entered into the PMPRB database. Where an error is contained in the Form 2 filing, an automated message is sent to the patentee requesting corrections.

There have been no Board Orders issued in the last five years for total failure to file Form 2. PMPRB staff report that since 2009 the number of Form 2 filings containing no errors has been increasing with 67% of reports submitted in 2009 containing no errors and 80% of reports submitted in 2011 containing no errors.

Under subsection 89(3) of the Act, the PMPRB is required to report the identity of patentees that fail to file information (through Form 3) on their revenue from sales of drugs (including revenue from sales of non-patented drugs and from licensing agreements) and research and development expenditure in Canada related to medicines. Under the Act a patentee that does not file complete information would also be considered to be in “failure to file” status. The PMPRB has not reported an incident of failure to file since the one reported in 2008. The number of Failures to File Form 2 and Form 3 are summarized in Table 4.3 below.

Table 4.3 Number of Failures to File (Form 2) and Failures to File (Form 3), 2008 to 2011

| Year |

Companies Reporting |

Form 2 – Failures to File |

Form 3 – Failures to File |

| 2008 |

82 |

0 |

1 |

| 2009 |

81 |

0 |

0 |

| 2010 |

82 |

0 |

0 |

| 2011 |

79 |

0 |

0 |

Source: PMPRB Performance Measurement Data, 2012.

Overall the data strongly support the view that the level of compliance among patentees is very high.

4.2.2 Investigations and Voluntary Compliance Undertakings (VCUs)

Board staff reviews the prices of all patented drug products sold in Canada. When it finds that the price of a patented drug appears to exceed the Guidelines, and the circumstances meet the criteria for commencing an investigation, Board staff conducts an investigation to assess if the price may in fact be considered excessive. Thus, the number of investigations can be viewed not only as an indicator of compliance, but also of knowledge/awareness - the higher the number the more likely it is that there is a knowledge gap regarding the Guidelines, the lower the number the more likely it is that the Guidelines are well-understood. The number of investigations opened and on-going has been steadily decreasing while the number of investigations completed has increased since 2007. Increased funds provided to the PMPRB to reduce backlogs and provide increased outreach thus appear to have had the intended results. The number of investigations undertaken by the PMPRB since 2007 is summarized in the Table 4.4 below.

Table 4.4 Number of Investigations, 2007 to 2011

| |

2007 |

2008 |

2009 |

2010 |

2011 |

| Opened and On-going |

103 |

125 |

109 |

87 |

68 |

| Completed |

27 |

36 |

73 |

81 |

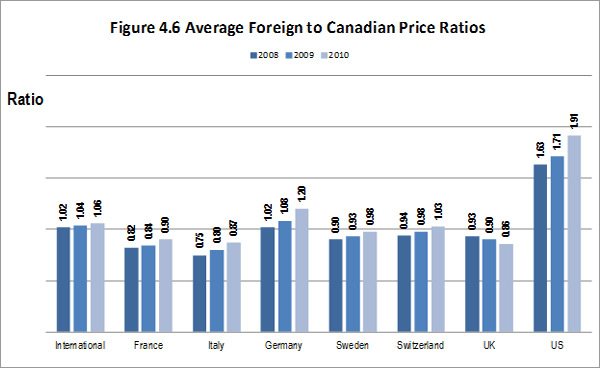

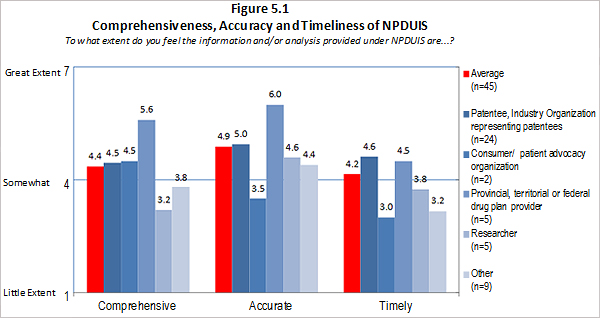

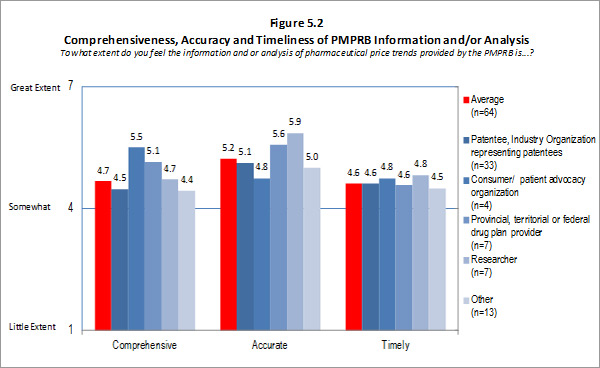

90 |