ISSN: 1495-0561

Catalogue number: H78E-PDF

PDF version (4.10 MB)

Statistical Highlights 2014

Regulatory Mandate

- 1,363 patented drug products for human use were reported to the PMPRB, including 103 new drug products.

Up to May 31, 2015:

- 5 Voluntary Compliance Undertakings were accepted.

- $2.79 million in excess revenues were offset by way of payment to the Government of Canada, in addition to price reductions.

- 1 Notice of Hearing was issued in the matter of the price of Soliris.

Reporting Mandate

Sales Trends:

- There were $13.7 billion in sales of patented drug products in Canada in 2014, an increase of 3.1% from 2013.

- 59.6% of the total drug sales in Canada were for patented drug products, a decrease from 60.7% in 2013.

Price Trends:

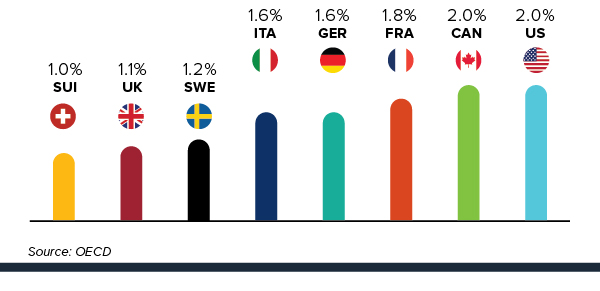

- Prices of patented drug products were stable, while the Consumer Price Index rose by 2.0%.

- Canadian prices were 3rd highest among the seven PMPRB comparator countries, lower than prices in Germany and the US.

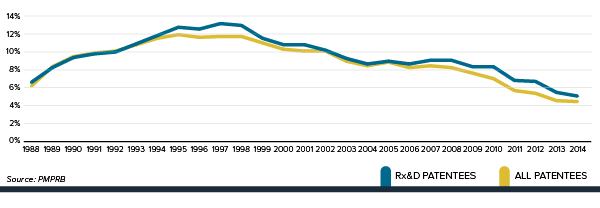

Research and Development (R&D):

- $739.2 million in total R&D expenditures were reported by patentees, a decrease of 1.8% over 2013.

- $658.7 million in R&D expenditures were reported by Rx&D members, an increase of 1.0% over 2013.

R&D-to-sales ratios decreased in 2014:

- 4.4% for all patentees, down from in 4.5% in 2013

- 5.0% for Rx&D members, down from 5.4% in 2013

Letter to the Minister

November 16, 2015

The Honourable Jane Philpott, MP

Minister of Health

House of Commons

Ottawa, Ontario

K1A 0A6

Dear Minister:

I have the pleasure to present to you, in accordance with sections 89 and 100 of the Patent Act, the Annual Report of the Patented Medicine Prices Review Board for the year ended December 31, 2014.

Yours very truly,

Mary Catherine Lindberg

Chairperson

Chairperson’s Message

I am pleased to present the PMPRB’s 2014 Annual Report. This year we have updated our format, adopting a more user-friendly design highlighting the PMPRB activities and emphasizing important trends.

As Canadians, we find ourselves facing tough questions of how best to ensure continuing access to cost-effective drugs. Our population is aging just as a wave of promising new high-cost drugs are entering the market, adding strain to already stretched health-care budgets and forcing payers to make increasingly difficult choices.

The Patented Medicine Prices Review Board (PMPRB), a consumer protection agency with a dual regulatory and reporting mandate, plays a unique role in this evolving landscape. The PMPRB’s regulatory mandate is to ensure that the prices of patented medicines sold in Canada are not excessive. Its reporting mandate is to provide stakeholders with information on the latest trends in pharmaceutical sales and pricing and on pharmaceutical research and development (R&D) spending in Canada.

In terms of its regulatory mandate, during the 2014 reporting period, the PMPRB entered into Voluntary Compliance Undertakings (VCUs) following investigations into the pricing of five patented medicines, resulting in $2.8 million in excess revenues being paid to the Government of Canada by pharmaceutical patentees. In 2014, the PMPRB also commenced a hearing into the price of the patented medicine Soliris, the first such proceeding since 2012.

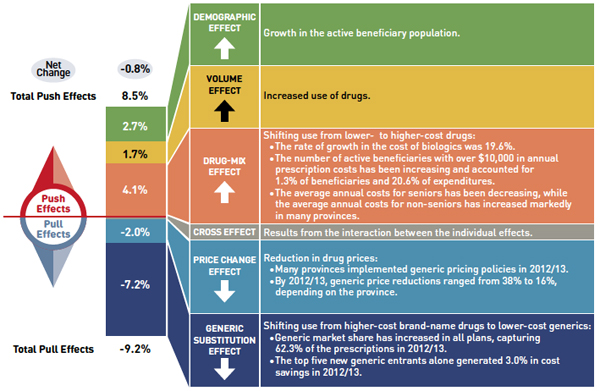

In terms of its reporting mandate, in addition to the publication of its Annual Report, in 2014, the PMPRB published the inaugural edition of its NPDUIS annual CompassRx report. This flagship report is the first of its kind to identify major drivers behind changes in prescription drug expenditures in public plans in Canada. The information contained in this report, along with other NPDUIS studies, will assist pharmaceutical payers and policy makers in making informed reimbursement and pricing choices. Through its unbiased reporting, the PMPRB is contributing to the broader discussion, preparing Canadians, from drug plan managers to consumers, for important decisions that lie ahead.

Canada and the European Union have reached a complete text of the Comprehensive Economic and Trade Agreement (CETA). Its implementation will require amendments to the Patent Act to provide pharmaceutical patentees with up to two years of additional market exclusivity. Such a change would come at a time of high drug prices and record low R&D, causing some to question the effectiveness of the PMPRB and whether a policy balance conceived over 25 years ago continues to serve its intended purpose. In light of these questions, in 2014 the Board initiated a year-long strategic planning process in an effort to chart a fresh course for the next quarter century that would see the PMPRB reaffirm its consumer protection origins. The strategic priorities that resulted from that effort are set out in the PMPRB’s 2015–2018 Strategic Plan. As I embark on my fifth and final year as Chairperson of the PMPRB, and tenth as a Board member, I am confident that the careful execution of these priorities in the coming years will enable the PMPRB to build on its prior successes and emerge from this period stronger and more effective than at any time in its almost three decade-long history.

Mary Catherine Lindberg

About the Patented Medicine Prices Review Board: Acting in the Interest of Canadians

The PMPRB was created in 1987 as the consumer protection “pillar” of Bill C-22, legislation which also strengthened the patent rights of pharmaceutical manufacturers in order to spur investment in research and development (R&D) in Canada.

The PMPRB protects consumers by regulating the price of patented drugs at the factory gate level and by keeping a vigilant eye on pricing trends and industry R&D. Through our reporting function, we serve as an objective, centralized source of information on pharmaceutical trends for policy makers, drug companies, private insurers and other stakeholders.

We are an Independent Agency

that administers provisions of Canada’s Patent Act related to patented medicines. As a member of the Health Portfolio, we contribute to a sustainable health-care system for all Canadians.

1,363 Patented Drug Products

1,363 patented drug products were reported to the PMPRB in 2014.

The Patented Medicine Prices Review Board (PMPRB) is an independent, quasi-judicial body established by Parliament in 1987 under the Patent Act (Act).

The PMPRB is a consumer protection agency with a dual regulatory and reporting mandate. Through its regulatory mandate, it ensures that the prices of patented medicines sold in Canada are not excessive. The PMPRB also reports on trends in pharmaceutical sales and pricing for all medicines and on research and development (R&D) spending by patentees. In particular, through the National Prescription Drug Utilization Information System (NPDUIS) initiative, the PMPRB provides pharmaceutical payers and policy makers with information to make rational, evidence-based reimbursement and pricing decisions.

Protecting Consumers in a Complex Marketplace

Figure description

Canadian consumers are symbolically represented by a graphic of a generic male and female in the centre of a segmented circle. Each segment of the circle represents an organization or category of organizations that are part of the Canadian pharmaceutical environment: Public Drug Plans; CIHI; Private Drug Plans; Industry Associations; Health Canada; Patentees; PMPRB; CADTH.

The PMPRB is part of the Health Portfolio, which includes Health Canada, the Public Health Agency of Canada, the Canadian Institutes of Health Research and the Canadian Food Inspection Agency. The Health Portfolio supports the Minister of Health in maintaining and improving the health of Canadians.

Although part of the Health Portfolio, because of its quasi-judicial responsibilities, the PMPRB carries out its mandate at arm's length from the Minister of Health, who is responsible for the sections of the Act pertaining to the PMPRB. It also operates independently of other bodies such as Health Canada, which approves drugs for marketing in Canada based on their safety, efficacy and quality; federal, provincial and territorial public drug plans, which approve the listing of drugs on their respective formularies for reimbursement purposes; and the Common Drug Review, administered by the Canadian Agency for Drugs and Technologies in Health, which recommends drugs that should qualify for reimbursement by participating public drug plans.

The PMPRB is composed of Board Staff, who are public servants responsible for carrying out the organization’s day to day work, and Board members, Governor-in-Council appointees who serve as panel members in the event of a dispute between Board Staff and a patentee over the price of a patented medicine.

Jurisdiction

Regulatory

The PMPRB regulates the "factory gate" prices for all patented drug products in Canadian markets; that is, the prices at which patentees (companies) sell their products to wholesalers, hospitals, pharmacies and other large distributers. The PMPRB has no jurisdiction over prices charged further along the supply chain, e.g., wholesale prices or retail prices charged by pharmacies, nor does it have the authority to regulate the prices of non-patented drugs.

The Board's jurisdiction is not limited to drug products for which the patent is on the active ingredient. Rather, the Board's jurisdiction also covers drugs for which the patents relate to, but are not limited to, the processes of manufacture, the delivery system or dosage form, the indication/use and any formulations.

Under the Act, patentees are required to inform the PMPRB of their intention to sell a new patented drug product. Upon the sale of a patented drug product, patentees are required to file price and sales information at introduction and, thereafter, until all patents pertaining have expired. Although patentees are not required to obtain approval of the price before a drug is sold, they are required to comply with the Act to ensure that the prices of patented drug products sold in Canada are not excessive.

Board Staff reviews the prices that patentees charge for each individual strength and form of a patented drug product. If Staff believes that the price of a patented medicine is excessive, it will first try to reach a consensual resolution with the patentee. Failing this, the Chairperson can hold a hearing on the matter. At the hearing, a panel composed of Board members acts as a neutral arbiter between Board Staff and the patentee. If a panel finds that the price of a patented medicine is excessive, it can order a reduction of the price to a non-excessive level. It can also order a patentee to offset any excess revenues and, in cases where the panel determines there has been a policy of excessive pricing, it can double the amount to be offset.

Reporting

The PMPRB reports annually to Parliament through the Minister of Health on its price review activities, the prices of patented medicines and price trends of all prescription drugs, and on the research and development (R&D) expenditures reported by pharmaceutical patentees, as required by the Act.

Through the National Prescription Drug Utilization Information System (NPDUIS) initiative, established by the federal, provincial and territorial (F/P/T) Ministers of Health in 2001, the PMPRB conducts critical analyses of price, utilization and cost trends for patented and non-patented prescription drugs. This program provides F/P/T governments and other interested stakeholders with a centralized, credible source of information on pharmaceutical trends.

Governance

The Board consists of up to five members who serve on a part-time basis. Board Members, including a Chairperson and a Vice-Chairperson, are appointed by the Governor-in-Council. The Chairperson is designated under the Act as the Chief Executive Officer of the PMPRB, with the authority and responsibility to supervise and direct its work.

The Members of the Board, including the Chairperson, are collectively responsible for the implementation of the applicable provisions of the Act. Together, they establish the guidelines, rules and other policies of the Board as provided by the Act and consult, as necessary, with stakeholders including the provincial and territorial Ministers of Health and representatives of consumer groups and the pharmaceutical industry.

Members of the Board

Chairperson

Mary Catherine Lindberg, BSP

Mary Catherine Lindberg was first appointed Member and Vice-Chairperson of the Board in June 2006. On May 19, 2010, Ms. Lindberg assumed the powers and functions of the Chairperson while the office was vacant. She was officially appointed Chairperson of the Board on March 3, 2011.

From 2002 to 2009, Ms. Lindberg was Executive Director of the Ontario Council of Academic Hospitals, an organization of 25 Academic Hospitals that are fully affiliated with a university and its Faculty of Medicine. Previously, she was the Assistant Deputy Minister, Health Services, with the Ontario Ministry of Health and Long-Term Care. Her responsibilities included the Ontario Health Insurance Plan (OHIP) and the Ontario Drug Programs.

Ms. Lindberg has a degree in pharmacy from the University of Saskatchewan and holds a pharmacist license in both Saskatchewan and Ontario.

Vice-Chairperson

Mitchell Levine, BSc, MSc, MD, FRCPC, FISPE, FACP

Dr. Mitchell Levine was appointed Member and Vice-Chairperson of the Board on March 3, 2011.

Dr. Levine is a professor in the Department of Clinical Epidemiology & Biostatistics and the Department of Medicine, Division of Clinical Pharmacology in the Faculty of Health Sciences at McMaster University in Hamilton, Ontario. He is also Director of the Centre for Evaluation of Medicines at St. Joseph's Healthcare in Hamilton.

Dr. Levine received his medical degree from the University of Calgary and did postgraduate medical training in Internal Medicine and in Clinical Pharmacology at the University of Toronto. He received an MSc degree in Clinical Epidemiology from McMaster University in 1988. He is a practicing consultant physician in Hamilton, Ontario.

Prior to his appointment to the Board, Dr. Levine had been a member of the PMPRB's Human Drug Advisory Panel. He presently acts, on an ad hoc basis, as a clinical pharmacology consultant to the Ontario Ministry of Health and Long-Term Care. He is the Editor-in-Chief of the Journal of Population Therapeutics And Clinical Pharmacology and the Canadian Journal of General Internal Medicine.

Members

Normand Tremblay, ASC, MSc, Adm.A., CMC

Normand Tremblay was appointed Member of the Board on May 31, 2012.

Mr. Tremblay teaches at the Université du Québec in the area of management, project management and innovation. He brings to the Board a vast experience and expertise in strategic and operational planning and organizational development. For over 20 years, Mr. Tremblay has been active in various areas of the business field, both nationally and internationally. He has also sat on investment committees and a number of administrative boards, including the National Research Council of Canada from 2007 to 2010.

Mr. Tremblay holds a master’s degree in project management (MSc) with a specialization in best practices in product development from the Université du Québec à Trois-Rivières as well as a certificate in business governance from Laval University (2009), and is a Certified Management Consultant. He is also a member of the Order of Certified Administrators of Québec.

Richard Bogoroch, LL.B.

Richard Bogoroch was appointed Member of the Board on December 13, 2012.

Richard M. Bogoroch is the founder and Managing Partner of Bogoroch & Associates LLP, the successor to Bogoroch and Associates, a Toronto-based law firm established in November 1999 that specializes in civil litigation. Bogoroch & Associates LLP concentrates on serious personal injury litigation, wrongful death litigation, medical malpractice litigation, products liability and disability claims litigation.

Mr. Bogoroch graduated from McGill University with a B.C.L. in 1978 and a LL.B in 1979. He was admitted to the Alberta Bar in 1980 and called to the Ontario Bar in 1983. Richard completed his articles at Thomson Rogers and in 1983 joined the firm upon his call to the Bar. In 1993, he was certified by The Law Society of Upper Canada as a Specialist in Civil Litigation. From 1987 to 1999, he was a partner at Thomson Rogers. Mr. Bogoroch is a past Director of the Ontario Centre for Advocacy Training and a past Director of the Advocates' Society. He is also a past Chairman of the Canadian Bar Association – Ontario Provincial Committee on the Judiciary. Mr. Bogoroch has lectured and written extensively on many aspects of personal injury litigation for Continuing Legal Education Programmes organized by The Advocates' Society, The Law Society of Upper Canada, the Ontario Bar Association, the Ontario Trial Lawyers Association, The Canadian Institute, Osgoode Hall Law School's Professional Development Programme, Insight and others. Since 1999 he has also been a guest instructor at the Intensive Trial Advocacy Workshop at Osgoode Hall Law School. From 2011 to 2014, he has chaired or co-chaired Osgoode Professional Development's annual programme on personal injury litigation. Since 2011, he has co-chaired the Advocates' Society "Tricks of the Trade Programme", its annual continuing legal education programme on personal injury litigation.

Mr. Bogoroch has been recognized by LEXPERT as a Leading Practitioner in Personal Injury Law and was listed in "Best Lawyers" for Personal Injury Litigation.

Carolyn Kobernick, B.C.L., LL.B.

Carolyn Kobernick was appointed Member of the Board on June 13, 2014.

Carolyn Kobernick is a lawyer and former career public servant. Prior to her retirement in 2013, Ms. Kobernick had been Assistant Deputy Minister of Public Law for the Department of Justice since 2006. As principal counsel to the Minister of Justice and Attorney General of Canada, Ms. Kobernick was instrumental in the development and delivery of policy for the Public Law sector. In addition to identifying key strategic, legal and operational matters, she tackled cross-cutting national issues as the liaison between the Department of Justice and other government organizations.

Ms. Kobernick joined the Department of Justice in 1980 where she practiced litigation and tax law at the Toronto Regional office. In 1991 she was appointed Senior General Counsel, Deputy Head, Business and Regulatory Law Portfolio, after working for over a decade in the legal services unit of the Correctional Service of Canada. In her role as Senior General Counsel, Ms. Kobernick was involved in complex policy and operational issues affecting the Government of Canada, including the Alaska Pipeline and Mackenzie Valley Pipeline files and the Sponsorship file.

During her career with the public service, Ms. Kobernick actively participated in many high-profile initiatives. She was Chair of the National Legal Advisory Committee and Departmental Champion for Aboriginal People and Gender Equity, and was appointed Senior Legal Advisor to the Government of Canada for the 2004 Gomery Inquiry.

Ms. Kobernick holds a B.C.L. and L.L.B. from McGill University and is a member of the bar of Ontario. In 2012 she obtained a Certificate in Adjudication for Administrative Agencies Boards and Tribunals from the Osgoode Hall Law School and The Society of Adjudicators and Regulators.

Organizational Structure and Staff

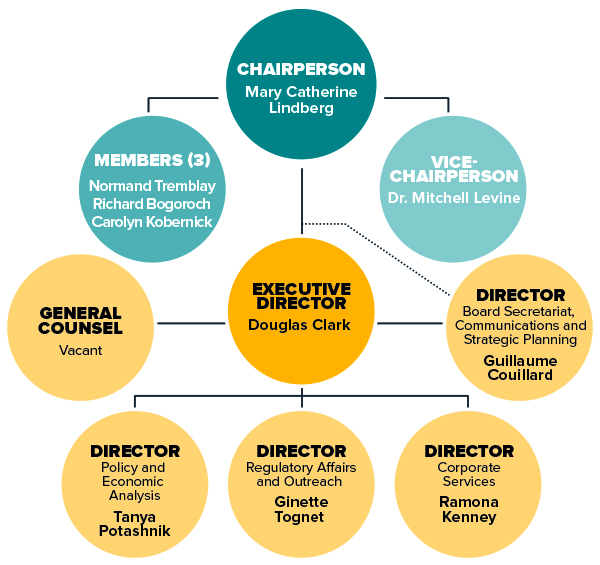

PMPRB Organizational Chart

Figure description

This organizational chart illustrates the high-level reporting structure within the PMPRB, and lists the current Board and Senior Staff members. Board: Chairperson—Mary Catherine Lindberg; Vice-Chairperson—Dr. Mitchell Levine; Members—Normand Tremblay, Richard Bogoroch, and Carolyn Kobernick. Senior Staff: Executive Director—Douglas Clark; General Counsel—position is vacant; Director Board Secretariat, Communications and Strategic Planning—Guillaume Couillard; Director Policy and Economic Analysis—Tanya Potashnik; Director Regulatory Affairs and Outreach—Ginette Tognet; Director Corporate Services—Ramona Kenney.

Executive Director

The Executive Director is responsible for advising the Board and for the leadership and management of the Staff.

Regulatory Affairs and Outreach

The Regulatory Affairs and Outreach Branch reviews the prices of patented drug products sold in Canada to ensure that they are not excessive; encourages patentees to comply voluntarily with the Board's Guidelines; implements related compliance policies; and investigates complaints into the prices of patented medicines. This Branch also informs and educates patentees on the Board's Guidelines and filing requirements.

Policy and Economic Analysis

The Policy and Economic Analysis Branch provides advice on PMPRB policy issues, including recommendations on possible changes to the Board's Guidelines. It conducts research and economic analysis on pharmaceutical trends, and provides information to support both compliance and enforcement. Through the NPDUIS initiative, it provides targeted analyses of drug price, utilization and cost trends to support public drug plan managers and other key decision makers in Canada.

Corporate Services

The Corporate Services Branch provides advice and services relating to human resources management; facilities; health, safety and security; information technology; and information management. It is also responsible for financial planning and reporting, audit and evaluation, and liaising with federal central agencies on these topics.

Board Secretariat, Communications and Strategic Planning

The Board Secretariat, Communications and Strategic Planning Branch develops and manages the PMPRB's communications program, media relations, public enquiries and the formal complaints process; manages the Board's meeting and hearing processes, including the official record of proceedings; and coordinates activities pursuant to the administration of the Access to Information Act and the Privacy Act. It is also responsible for strategic planning and reporting.

General Counsel

The General Counsel advises the PMPRB on legal matters and leads the prosecution team in proceedings before the Board.

Budget

In 2014/15, the PMPRB had a budget of $10.927 million and an approved staff level of 73 full-time equivalent employees.

Table 1. Budget and Staffing

|

2013/14 |

2014/15 |

2015/16 |

| Budget |

$10.944 M |

$10.927 M |

$10.945 M |

| Salaries |

$6.920 M |

$6.903 M |

$6.937 M |

| Operating |

$1.554 M |

$1.554 M |

$1.538 M |

| Special Purpose Allotment* |

$2.470 M |

$2.470 M |

$2.470 M |

| Full Time Employees (FTEs) |

74 |

73 |

71 |

* The Special Purpose Allotment is reserved strictly for external costs of public hearings (legal counsel, expert witnesses, etc.). Any unspent funds are returned to the Consolidated Revenue Fund.

Communications and Outreach

The Communications Program is responsible for planning and managing the PMPRB's external and internal communications activities. One of its goals is to generate meaningful dialogue between government, industry stakeholders, Canadian consumers and the media on pharmaceutical issues, and to strengthen the PMPRB’s relationships with these groups.

To that end, the Communications Program is taking a more proactive approach to its media presence. Over the past year, this included a greater use of press releases and engagement with media outlets generally. In addition, the PMPRB revamped its website, increased its use of social media and developed new publication products targeting a more general audience. It continued to respond to public enquiries and inform the public through publishing updates of Board proceedings and decisions, and research results.

The PMPRB is committed to ensuring that industry stakeholders are consulted and informed of changes in the operating environment and are promptly advised of any updates to the regulatory process. Over the past year, the Regulatory Affairs and Outreach Branch continued to provide regular outreach sessions for patentees, reorganized the web pages relevant to patentees and created its first instructional video.

Publications

The PMPRB is a reliable, impartial source of comprehensive information on drug prices and trends. In addition to regular publications, such as the Annual Report and the quarterly NEWSletter, the PMPRB publishes the results of analytical studies including NPDUIS research papers.

This year, the PMPRB committed to publishing an Analysis Brief in conjunction with the release of each new NPDUIS report to highlight the main findings of the study for a more general audience. The PMPRB also organized a researchers’ forum with academics and policy experts to discuss current research into pharmaceutical use in Canada and emerging areas for future study.

Regulating Prices of Patented Medicines: Continued Vigilance Necessary

With the population aging and using more prescription drugs—and sometimes more expensive types of drugs—Canada’s spending on pharmaceuticals is expected to increase significantly in the years to come. Medical advancements have introduced many innovative new drugs to the Canadian marketplace to improve existing treatments and to treat conditions that previously had no pharmaceutical therapy. These include high-cost orphan drugs, biologics and cancer drugs. The PMPRB plays an important role in regulating the prices of new and existing patented drug products to ensure the sustainability of the Canadian health-care system.

2% of New Drugs were Breakthrough Drugs

Since 2010, approximately 2% of new drugs reported to the PMPRB were catagorized as breakthrough drugs.

A breakthrough drug product is defined as the first drug product to be sold in Canada that effectively treats a particular illness or effectively addresses a particular indication.

61 Investigations

In 2014, there were 61 investigations into excessive drug pricing.

As a result of PMPRB investigations, five Voluntary Compliance Undertakings were accepted (up to May 31, 2015), with over $2.7 million in excess revenues offset by way of payment to the Government of Canada.

Notice of Hearing

Pending Hearing on the Patented Medicine Soliris

In January 2015, a Notice of Hearing was issued to determine whether the patented medicine Soliris, a high-cost “orphan” drug, is excessively priced in Canada. Proceedings are ongoing.

The PMPRB protects the interests of Canadian consumers by ensuring that the prices of patented medicines sold in Canada are not excessive. It does this by reviewing the prices that patentees charge for individual patented drug products to wholesalers, hospitals and pharmacies and by taking action against patentees to reduce prices and pay back excess revenues where appropriate.

Reporting Requirements

Patentees are required by law to file information pertaining to the sale of their drug products in Canada. The Patent Act (Act) along with the Patented Medicines Regulations (Regulations) set out the filing requirements, and Board Staff reviews the pricing information on an ongoing basis to ensure that the prices are not excessive until all patents pertaining have expired.

There are several factors used for determining whether a drug product is excessively priced, as outlined in section 85 of the Act. The Compendium of Policies, Guidelines and Procedures (Guidelines) details the price tests used by Board Staff to determine whether the price charged by a patentee falls within the maximum allowable price. The Guidelines were developed in consultation with stakeholders including the provincial and territorial Ministers of Health, consumer groups, and the pharmaceutical industry. When an investigation determines that there is a problem with the price of a patented drug product, the patentee is offered the opportunity to voluntarily lower its price and/or refund its excess revenues through a Voluntary Compliance Undertaking (VCU). If the patentee disagrees with the results of the investigation and chooses not to submit a VCU, the Chairperson of the Board may issue a Notice of Hearing (NOH). After hearing the evidence, if the Board finds that the price is excessive, it can issue an Order to reduce the price and/or refund the excess revenues. A patentee also has the option of submitting a VCU to resolve the matter after the NOH has issued. Copies of the Act, the Regulations, the Guidelines and the Patentee’s Guide to Reporting are posted on the PMPRB’s website.

Failure to Report

The PMPRB relies on the patentees’ full and timely disclosure of any and all patented drug products being sold in Canada to which a patent pertains. In 2014, 9 drug products were reported to the PMPRB for the first time even though they were patented and sold prior to 2014. Table 2 lists the drug products that were patented and sold in Canada prior to being reported to the PMPRB.

Table 2. Failure to Report the Sale of Patented Drugs

| Currently Sold By |

Brand Name |

Generic Name |

Year Medicine Came Under

PMPRB's Jurisdiction |

| Sigma-Tau Pharmaceuticals Inc. |

Carnitor IV |

Levocarnitine |

2001 |

| Pfizer Canada Inc. |

Cytosar (3 DINs) |

Cytarabine |

2003 |

| Paladin Labs Inc. |

Metadol (3 DINs) |

Methadone hydrochloride |

2010 |

| Otuska Canada Pharmaceutical Inc. |

Samsca (2 DINs) |

Tolvaptan |

2011 |

Failure to File Price and Sales Data (Form 2)

Failure to file refers to the complete or partial failure of a patentee to comply with the regulatory filing requirements outlined in the Act and the Regulations. There were no Board Orders issued for failure to file in 2014.

Scientific Review

Human Drug Advisory Panel

All new patented drug products reported to the PMPRB are subject to a scientific evaluation as part of the price review process. The Human Drug Advisory Panel (HDAP) was established by the Board to provide independent expertise and advice to Board Staff. The Human Drug Advisory Panel conducts a review when a patentee makes a claim regarding therapeutic improvement. Panel members review and evaluate the appropriate scientific information available, including any submission by a patentee with respect to the proposed level of therapeutic improvement, the selection of drug products to be used for comparison purposes and comparable dosage regimens.

Price Review

The PMPRB reviews the average price of each strength of an individual dosage form of each patented medicine. In most cases, this unit is consistent with the Drug Identification Number (DIN) assigned by Health Canada at the time the drug is approved for sale in Canada.

New Patented Drug Products Reported to the PMPRB in 2014

For the purpose of this report, a new patented drug product in 2014 is defined as any patented drug product first sold in Canada, or previously sold but first patented, between December 1, 2013, and November 30, 2014.

There were 103 new patented drug products for human use reported as sold in 2014. Some are one or more strengths of a new active substance and others are new presentations of existing medicines. Of the 103 new patented drug products, 4 (3.9%) were being sold in Canada prior to the issuance of the Canadian patent that brought them under the PMPRB’s jurisdiction. The table below shows the year of first sale for these drug products.

Table 3. Number of New Patented Drug Products for Human Use in 2014 by Year First Sold

| Year First Sold |

Number of Drug Products |

| 2014 |

99 |

| 2013 |

1 |

| 2011 |

1 |

| 2008 |

1 |

| 2006 |

1 |

| Total |

103 |

The list of New Patented Medicines Reported to the PMPRB is available on the website under Regulating Prices. This list includes information on the status of the review (e.g., whether the medicine is under review, within the Guidelines, under investigation, or subject to a VCU or Notice of Hearing).

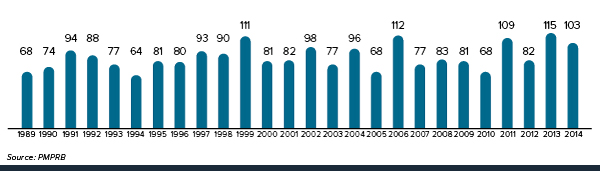

Figure 1 illustrates the number of new patented drug products for human use reported to the PMPRB from 1989 to 2014.

Figure 1. New Patented Drug Products for Human Use

Figure description

This is a bar graph depicting the number of new patented drug products for human use reported to the Patented Medicine Prices Review Board by year. In 1989, 68 patented drug products for human use were reported to the PMPRB. In 1990: 74; 1991: 94; 1992: 88; 1993: 77; 1994: 64; 1995: 81; 1996: 80; 1997: 93; 1998: 90; 1999: 111; 2000: 81; 2001: 82; 2002: 98; 2003: 77; 2004: 96; 2005: 68; 2006: 112; 2007: 77; 2008: 83; 2009: 81; 2010: 68; 2011: 109; 2012: 82; 2013: 115; 2014: 103.

Of the 103 new patented drug products:

- the prices of 77 had been reviewed as of March 31, 2015:

- 68 were found to be within the Guidelines

- 1 was at a level that appeared to exceed the Guidelines by an amount that did not trigger the investigation criteria

- 8 were priced at levels that appeared to exceed the Guidelines and investigations were commenced

For a complete list of the 103 new patented drug products and their price review status, see Appendix 2.

Price Review of Existing Patented Drug Products for Human Use in 2014

For the purpose of this report, existing patented drug products include all patented drug products that were first sold and reported to the PMPRB prior to December 1, 2013.

At the time of this report, there were 1,260 existing patented drug products:

- 970 were priced within the Guidelines

- 226 exceeded the Guidelines by an amount that did not trigger the investigation criteria

- 53 were the subject of investigations:

- 6 were opened as the result of introductory pricing in 2012

- 7 were opened as the result of introductory pricing in 2013

- 40 were opened on the basis of year-over-year prices

- 8 were under review

- 2 drug products were the subject of Voluntary Compliance Undertakings

- 1 drug product is the subject of a hearing

- 1 additional drug product remains the subject of a hearing although no longer patented in 2014

A summary of the status of the price review of the new and existing patented drug products for human use in 2014 is provided in Table 4.

Table 4. Patented Drug Products for Human Use Sold in 2014—Status of Price Review as of March 31, 2015

|

New Drug Products Introduced in 2014 |

Existing Drug Products |

Total |

| Total |

103 |

1,260 |

1,363 |

| Within Guidelines |

68 |

970 |

1,038 |

| Under Review |

26 |

8 |

34 |

| Does Not Trigger Investigation |

1 |

226 |

227 |

| Under Investigation |

8 |

53 |

61 |

| Voluntary Compliance Undertakings |

0 |

2 |

2 |

| Price Hearings |

0 |

1 |

1 |

Update From the 2013 Annual Report

- Reviews of all drug products for human use reported as Under Review in the 2013 Annual Report have been completed.

- 44 of the 66 investigations reported in the 2013 Annual Report resulted in one of the following:

- the closure of the investigation where it was concluded that the price was within the Guidelines

- a Voluntary Compliance Undertaking (VCU) by the patentee to reduce the price and offset excess revenues through a payment and/or a reduction in the price of another patented drug product (see Voluntary Compliance Undertakings)

- a public hearing to determine whether the price was excessive, including any remedial Order determined by the Board (see Hearings)

Patented Over-the-Counter Drug Products and Patented Drug Products For Veterinary Use

Board Staff reviews the price of a patented over-the-counter drug product or a patented veterinary product when a complaint has been received. No complaints were received in 2014.

Enquiries and Formal Complaints

The PMPRB received several enquiries in 2014 regarding its regulatory activities and the compliance status of patented and non-patented drug products. Board Staff was able to confirm that the patented medicines in question were within the Guidelines. Had the price of the patented drug products been outside the Guidelines, Board Staff would have initiated an investigation.

If the price of a drug product is found to be outside the Guidelines, the patentee may submit a VCU for the Chairperson’s approval or the Chairperson may determine that it is in the public interest to hold a public hearing. Once a determination has been made in either case, the outcome is reported on the PMPRB website.

Voluntary Compliance Undertakings and Hearings

Voluntary Compliance Undertakings

A VCU is a written undertaking by a patentee to adjust its price to conform to the Board's Guidelines. Under the Guidelines, patentees are given an opportunity to submit a VCU when Board Staff concludes, following an investigation, that the price set forth by the patentee for a patented drug product sold in Canada appears to have exceeded the Guidelines. A VCU can also be submitted by a patentee after a Notice of Hearing is issued.

In 2014, four VCUs were accepted. In addition to price reductions for certain drug products, excess revenues totaling $2,728,804.38 were offset by way of payments to the Government of Canada.

In 2015, to date, one VCU was approved by the Chairperson in the Crixivan matter.

Patentees are to ensure that the prices of their patented drug products are within the Board’s Guidelines during all periods in which the drug products are under the PMPRB’s jurisdiction.

Table 5. Voluntary Compliance Undertakings in 2014 up to May 31, 2015

| Patented Drug Product |

Therapeutic Use |

Patentee |

Date of Approval |

Price Reduction |

Payment to the Government |

| VCUs in 2014 |

| Gonal F (3 drug products) |

Stimulation of multiple follicular development in ovulatory patients undergoing Assisted Reproductive Technologies (ART) |

EMD Inc. |

June |

blank |

$1,667,002.48 |

| Lamisil (1 drug product) |

Treatment of fungal infections of the skin and nails |

Novartis Pharmaceuticals Canada Inc. |

June |

blank |

$425,034.25 |

| Lodalis (1 drug product) |

Reduction of cholesterol blood level |

Valeant Canada LP |

September |

blank |

$63,119.56 |

| Gelnique (1 drug product) |

Treatment of overactive bladder |

Actavis Specialty Pharmaceutical Co. |

November |

✔ |

$573,648.09 |

| Total |

|

|

|

|

$2,728,804.38 |

| VCUs in 2015, up to May 31 |

| Crixivan (1 drug product) |

Treatment of HIV infection |

Merck Canada Inc. |

April |

blank |

$58,917.68 |

| Overall total |

|

|

|

|

$2,787,722.06 |

Hearings

In the event that the price of a patented medicine appears to be excessive, the Board can hold a public hearing. If it finds that the price is excessive, it may issue an order to reduce the price and to offset revenues received as a result of the excessive price. Board decisions may be subject to judicial review in the Federal Court of Canada.

In January 2015, the Patented Medicine Prices Review Board announced it would hold a public hearing in the matter of the price of the patented medicine Soliris, and Alexion Pharmaceuticals Inc., the pharmaceutical company that holds the patent for Soliris and sells the medicine in Canada. Soliris is the first and only treatment for patients with Paroxysmal Nocturnal Hemoglobinuria—a rate and life-threatening blood disorder. The purpose of this hearing will be to determine whether the medicine has been or is being sold in any market in Canada at a price that, in the Board's opinion, is or was excessive; and, if so, what order, if any, should be made to remedy the excessive pricing.

Two other matters remain before the Board: Apotex Inc. and Apo-Salvent CFC Free. The outcome of these matters will be examined in light of the Federal Court decisions into three other matters: ratio-Salbutamol HFA, ratiopharm and Sandoz on the Board’s jurisdiction. Those decisions are under review in the Federal Court of Appeal.

Table 6. Status of Board Proceedings in 2014 up to May 31, 2015

| Patented Drug Product |

Therapeutic Use |

Patentee |

Issuance of Notice of Hearing |

Status |

| Apo-Salvent CFC-Free |

Asthma |

Apotex Inc. |

July 8, 2008 |

Ongoing |

| ratio-Salbutamol HFA |

Asthma |

ratiopharm Inc.

(now Teva Canada) |

July 18, 2008 |

Judicial review heard by the Federal Court: Nov. 4–6, 2013; decision issued May 27, 2014

Notice of Appeal filed at the Federal Court of Appeal: June 25, 2014 |

| Soliris |

Paroxysmal nocturnal hemoglobinuria

Atypical hemolytic uremic syndrome |

Alexion Pharmaceuticals Inc. |

January 20, 2015 |

Ongoing

Notice of Hearing issued:

January 22, 2015 |

Blank

| Patentee |

Issue |

Date of Notice of Application |

Status |

| Apotex Inc. |

Failure to file (jurisdiction) |

March 3, 2008 |

Ongoing |

ratiopharm Inc.

(now Teva Canada) |

Failure to file

( jurisdiction) |

August 28, 2008 |

Judicial review heard by the Federal Court Nov. 4–6, 2013; decision issued May 27, 2014

Notice of Appeal filed at the Federal Court of Appeal: June 25, 2014 |

| Sandoz Canada Inc. |

Failure to file ( jurisdiction) |

March 8, 2010 |

Judicial review heard by the Federal Court: Nov. 19–20, 2013; decision issued: May 27, 2014

Notice of Appeal filed at the Federal Court of Appeal: June 25, 2014 |

Summary

Excess revenues totalling $2,787,722.06 were offset by way of payments to the Government of Canada through VCUs and Board Orders in 2014 up to May 31, 2015.

Since 1993, a total of 100 VCUs have been approved and 27 public hearings initiated. These measures resulted in price reductions and the offset of excess revenues by way of additional price reductions and/or payments to the Government of Canada. Over $149 million has been collected through VCUs and Board Orders by way of payments to the Government of Canada and/or to customers such as hospitals and clinics.

Matters Before the Federal Court of Appeal

Three Board decisions had been subject to judicial review by the Federal Court: ratio-Salbutamol HFA (T-1058-11; T-1825-11); ratiopharm Inc. (now Teva Canada) (T-1252-11); and Sandoz Canada Inc. (T-1616-12). The Court heard these matters in November 2013 and released its decisions on May 27, 2014. The Federal Court allowed the applications for judicial review and referred the matters back to the Board with a direction that it find that ratiopharm Inc. and Sandoz Canada Inc. are not patentees. Notices of Appeal for these decisions (ratiopharm Inc. (now Teva Canada) (A-303-14) and Sandoz (A-302-14)) were filed with the Federal Court of Appeal by the Attorney General on June 25, 2014.

Key Pharmaceutical Trends: Drug Sales are on the Rise

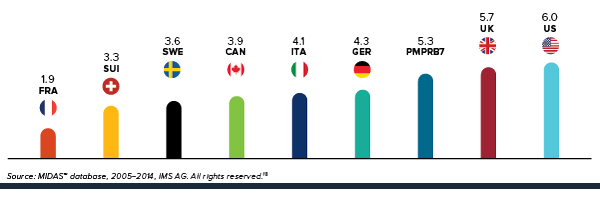

Overall spending on pharmaceuticals is influenced by many factors, including price, utilization, the market entry of newer, more expensive drugs, and older drugs “going generic”. In 2014, sales of patented drugs increased by 3.1% and Canadian prices remained third highest among the PMPRB’s comparator countries (PMPRB7).

3rd Highest Ranking in Patented Drug Prices

Patented drug prices in Canada remain the third highest among the comparator countries.

For the second year in a row, Canadian prices are higher than those in France, the UK, Italy, Sweden and Switzerland.

The Average Increase in Patented Drug Prices was Less Than the CPI

In 2014, the increase in patented drug prices was less than the rate of inflation, as measured by the consumer price index (CPI), and therefore, did not contribute to sales growth.

30.8% of Sales in 2014

Antineoplastics and immunomodulating agents had the greatest impact on sales growth in 2014.

Chemotherapy drugs and drugs that affect the immune system accounted for 30.8% of sales in 2014, an increase of 7.4% from last year.

6% Higher Prices

Canadian patented drug prices are 6% higher than the international median when US prices are excluded.

Although Canadian patented drug prices are below the international median price of the PMPRB comparator countries, if US prices are excluded from the international average, Canadian prices are, on average, 6% higher.

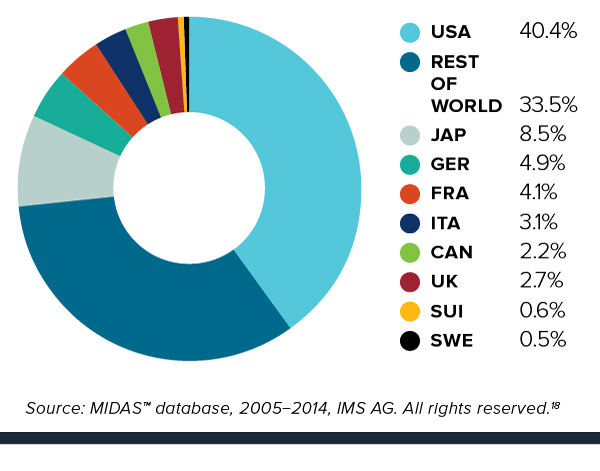

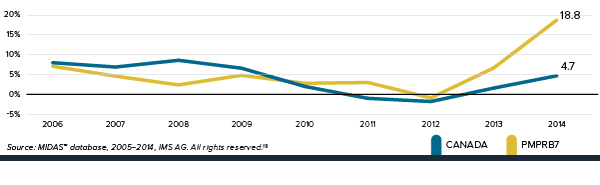

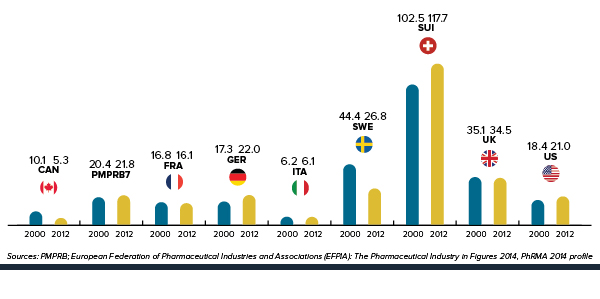

184.43% Increase in Total Drug Expenditures

Since 2000, growth in drug expenditures in Canada has outpaced the growth in all comparator countries.

Canadian drug expenditures increased by 184.43% between 2000 and 2012. This rate of growth was higher than that of all of the PMPRB comparator countries – even the US.

The PMPRB is responsible for reporting on trends in pharmaceutical sales and pricing for all medicines and for reporting research and development spending by patentees. In addition, the PMPRB undertakes studies and conducts analysis on a variety of topics related to pharmaceutical pricing and costs.

Trends in Sales of Patented Drug Products

Patentees are required under the Patented Medicines Regulations (Regulations) to submit detailed information on their sales of patented drug products, including quantities sold and net revenues received for each product by class of customer in each province/territory. The PMPRB uses this information to analyze trends in sales, prices and utilization of patented drug products.Footnote 1 This section provides key statistical results from this analysis.

Sales and Prices

Canadians spend much more today on patented drug products than they did a decade ago, but it is important to understand that an increase in drug spending does not in itself imply rising drug prices. For example, the PMPRB's Annual Reports from 1995 through 2003 noted that sales of patented drug products grew at annual rates consistently exceeding 10%, while average annual rates of change for prices were less than 1%. In these instances, sales growth was driven by changes in the volume and composition of drug utilization.

A variety of factors can produce such changes. These include:

- increases in total population

- changes in the demographic composition of the population (for example, shifts in the age distribution toward older persons with more health problems)

- increases in the incidence of health problems requiring drug therapy

- changes in the prescribing practices of physicians (for example, a shift away from older, less expensive drug products to newer, more expensive medications, or a shift toward higher, more frequent dosages)

- increases in the use of drug therapy instead of other forms of treatment

- the use of new drug products to treat conditions for which no effective treatment existed previously

Sales Trends

Table 7 reports patentees' total sales of patented drug products in Canada for 1990 through 2014. In 2014, sales of patented drug products increased to $13.7 billion from $13.3 billion in 2013, an increase of 3.1%. By comparison, the annual growth in sales was 27.0% in 1999 and remained in double-digits until 2003.

The last column of Table 7 gives sales of patented drug products as a share of overall drug sales. This share rose from 43.2% in 1990 to a peak of 72.7% in 2003. It declined over the 2003 to 2009 period, but has been quite stable since. That is, sales of non-patented brand and generic drug products have generally grown at similar rates as the sales of patented drug products in recent years.

Table 7. Sales of Patented Drug Products, 1990–2014

| Year |

Patented Drug Products:

Sales ($Billions) |

Patented Drug Products:

Change (%) |

Sales of Patented Drug Products

as a Share of all Drug Sales (%)* |

| 2014 |

13.7 |

3.1 |

59.6 |

| 2013 |

13.3 |

4.1 |

60.7 |

| 2012 |

12.8 |

-0.1 |

59.3 |

| 2011 |

12.8 |

3.1 |

58.6 |

| 2010 |

12.4 |

-4.3 |

56.0 |

| 2009 |

12.9 |

2.4 |

59.2 |

| 2008 |

12.6 |

2.4 |

61.7 |

| 2007 |

12.3 |

3.4 |

63.2 |

| 2006 |

11.9 |

3.5 |

67.8 |

| 2005 |

11.5 |

4.5 |

70.6 |

| 2004 |

11.0 |

7.8 |

72.2 |

| 2003 |

10.2 |

14.3 |

72.7 |

| 2002 |

8.9 |

17.5 |

67.4 |

| 2001 |

7.6 |

18.9 |

65.0 |

| 2000 |

6.3 |

16.7 |

63.0 |

| 1999 |

5.4 |

27.0 |

61.0 |

| 1998 |

4.3 |

18.9 |

55.1 |

| 1997 |

3.7 |

22.6 |

52.3 |

| 1996 |

3.0 |

12.8 |

45.0 |

| 1995 |

2.6 |

10.8 |

43.9 |

| 1994 |

2.4 |

-2.1 |

40.7 |

| 1993 |

2.4 |

9.4 |

44.4 |

| 1992 |

2.2 |

14.0 |

43.8 |

| 1991 |

2.0 |

13.1 |

43.2 |

| 1990 |

1.7 |

– |

43.2 |

* The denominator in this ratio comprises sales of patented, non-patented brand and generic drug products. Starting with the estimate for 2005, this value is derived from data contained in the IMS AG MIDAS™ database. In previous years, IMS data were used to calculate sales of generic drug products only, while sales of non-patented brand products were estimated from data submitted by patentees. This approach was abandoned because of anomalies related to year-to-year changes in the set of companies reporting to the PMPRB. Ratios reported for years before 2005 likely overstate the patented share, but by only a small amount. This small bias in no way invalidates the strong upward trend evinced by the results for the years 1990 through 2003.

Sources: PMPRB; MIDAS™ database, 2005–2014, IMS AG. All rights reserved.Footnote 2

Drivers of Sales Growth

Table 8 decomposes the sales growth that occurred between 2013 and 2014 into distinct elements reflecting the impacts of:

- previously patented drug products that have gone off-patent or left the Canadian market (“exiting drug effect”)

- patented drug products introduced to the Canadian market in 2014 (“new drug effect”)

- changes in prices among patented drug products with sales in Canada in both 2013 and 2014 (“price effect”)

- differences in the quantities of such drug products sold in the two years (“volume effect”)

- interactions of price and quantity changes (“cross effect”)

The first row of Table 8 gives these impacts as dollar amounts. The second row expresses the impacts as proportions of the overall change in sales between 2013 and 2014. For the sake of comparison, the third row provides average year-over-year proportionate impacts for 2010 through 2014.Footnote 3

The results in this table show that the increase in total sales that occurred between 2013 and 2014 was the result of two factors: increases in the quantity of existing drug products sold, and strong sales for new drugs, which offset a relatively large exiting drug effect.

Table 8. Decomposition of Changes in Sales of Patented Drug Products

|

Total Change |

Exiting Drug Effect |

New Drug Effect |

Price Effect |

Volume Effect |

Cross Effect |

Sales impact, 2014/2013

($millions) |

381.78 |

-344.14 |

351.61 |

-0.60 |

389.19 |

-14.32 |

Proportion of total change,

2014/2013 (%) |

100.00 |

-90.14 |

92.09 |

-0.15 |

101.94 |

-3.75 |

Average proportion of total change,

2010–2013 (%) |

100.00 |

-165.33 |

215.80 |

34.67 |

30.79 |

-15.93 |

Source: PMPRB

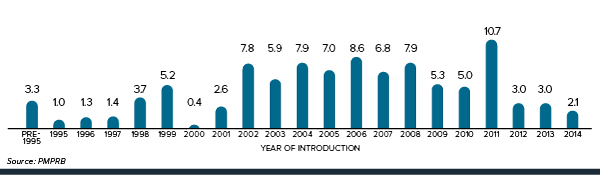

Figure 2 breaks down 2014 sales of patented drug products according to the year in which the product was first sold in Canada. Throughout the latter part of the 1990s and early 2000s, sales growth was largely driven by a succession of new “blockbuster” products that ultimately achieved very high sales volumes. Despite the recent patent expiries (“patent cliff”), these products still accounted for a considerable share of patented drug sales in 2014. Since mid-2000s, changes in the Canadian pharmaceutical environment, along with a reduction in the rate of introduction of new high-volume products, has resulted in dampened growth.

Figure 2. Share of 2014 (%) Sales of Patented Drug Products by Year of Introduction

Figure description

This is a bar graph depicting the share of 2014 sales, in percent, of patented drug products by the year in which the product was first sold in Canada. Drugs introduced before 1995 comprised 3.3% of the share of sales in 2014. In 1995: 1.0; 1996: 1.3; 1997: 1.4; 1998: 3.7; 1999: 5.2; 2000: 0.4; 2001: 2.6; 2002: 7.8; 2003: 5.9; 2004: 7.9; 2005: 7.0; 2006: 8.6; 2007: 6.8; 2008: 7.9; 2009: 5.3; 2010: 5.0; 2011: 10.7; 2012: 3.0; 2013: 3.0; 2014: 2.1.

Sales by Therapeutic Class

The PMPRB classifies drug products according to the World Health Organization’s (WHO) Anatomical Therapeutic Chemical (ATC) system when it conducts analyses at the level of therapeutic class. This is a hierarchical system that classifies drug products according to their principal therapeutic use and chemical composition. At its first level of aggregation (Level 1), the ATC system classifies drug products according to the element of human anatomy with which they are primarily associated.

Table 9 breaks out sales of patented drug products in Canada in 2014 by major therapeutic class, defined by ATC Level 1. The table gives the 2014 sales for each class, the share of the total sales this represents and the rate at which sales grew relative to 2013. Values in the last column represent the component of overall sales growth attributable to drug products in the corresponding therapeutic class.Footnote 4 By this measure, antineoplastics and immunomodulating agents made the largest positive contribution to sales growth. Lower sales of both general antiinfectives for systemic use and antiparasitic products and nervous system drugs also had a significant impact on overall expenditure.

Table 9. Sales of Patented Drug Products by Major Therapeutic Class, 2014

| Therapeutic Class |

2014 Sales

($millions) |

Share: 2014 Sales (%) |

Growth: 2014/2013 ($millions) |

Growth: 2014/2013 (%) |

Impact on Change in Expenditure (%) |

| A: Alimentary tract and metabolism |

1,505.5 |

11.0 |

116.2 |

8.4 |

28.5 |

| B: Blood and blood forming organs |

784.9 |

5.7 |

4.2 |

0.5 |

1.0 |

| C: Cardiovascular system |

911.6 |

6.6 |

-37.1 |

-3.9 |

-9.1 |

| D: Dermatologicals |

109.7 |

0.8 |

-20.3 |

-15.6 |

-5.0 |

| G: Genito-urinary system and sex hormones |

506.1 |

3.7 |

-8.3 |

-1.6 |

-2.0 |

| H: Systemic hormonal preparations |

62.4 |

0.5 |

-0.8 |

-1.2 |

-0.2 |

J: General antiinfectives for systemic use; and

P: Antiparasitic products* |

1,256.8 |

9.1 |

-160.2 |

-11.3 |

-39.2 |

| L: Antineoplastics and immunomodulating agents |

4,225.8 |

30.8 |

290.6 |

7.4 |

71.2 |

| M: Musculo-skeletal system |

452.1 |

3.3 |

28.1 |

6.6 |

6.9 |

| N: Nervous system |

1,694.1 |

12.3 |

-141.7 |

-7.7 |

-34.7 |

| R: Respiratory system |

1,164.5 |

8.5 |

-10.1 |

-0.9 |

-2.5 |

| S: Sensory organs |

723.1 |

5.3 |

79.3 |

12.3 |

19.4 |

| V: Various |

343.3 |

2.5 |

268.2 |

357.1 |

65.7 |

| All therapeutic classes |

13,739.8 |

100.0† |

408.2 |

3.1 |

100.0† |

* These groups have been combined for reasons of confidentiality.

† Values in this column may not add to 100.0 due to rounding.

Source: PMPRB

Price Trends

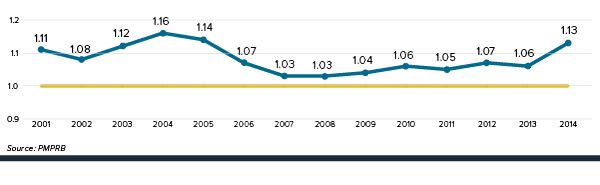

The PMPRB uses the Patented Medicines Price Index (PMPI) to monitor trends in prices of patented drug products. The PMPI measures the average year-over-year change in the ex-factory prices of patented drug products sold in Canada. The index is constructed using a formula that takes a sales-weighted average of price changes observed at the level of individual drug products.Footnote 5 This is similar to the approach Statistics Canada uses to construct the Consumer Price Index (CPI). The PMPI is based on an average transaction price and sales information for a six-month period submitted by patentees.

It is important to understand the conceptual relationship between the PMPI and drug costs. The PMPI does not measure changes in the utilization of patented drug products; a quantity index, the , is calculated for this purpose (see Utilization of Patented Drug Products). The PMPI does not measure the cost impact of changes in prescribing patterns or the introduction of new medicines. By design, the PMPI isolates the component of sales growth attributable to changes in prices.

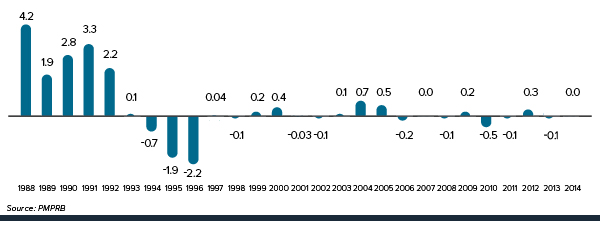

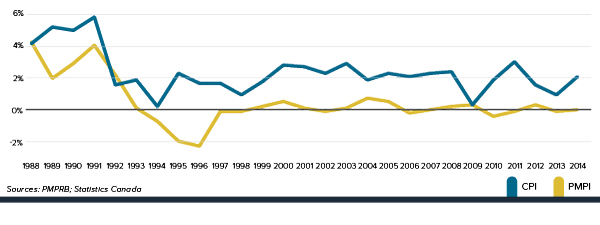

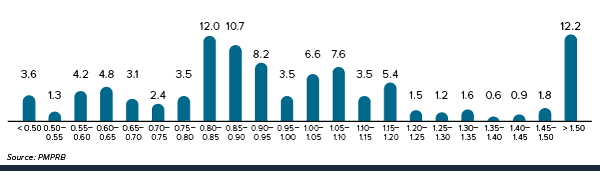

Figure 3 provides year-over-year changes in the PMPI for the years 1988 through 2014. As measured by the PMPI, prices of patented drug products were virtually unchanged from 2013 to 2014.

Figure 3. Annual Rates of Change (%), Patented Medicines Price Index (PMPI), 1988–2014

Figure description

This is a bar graph depicting the year-over-year changes, in percent, in the Patented Medicines Price Index (PMPI) for the years 1988 through 2014. In 1988, the rate of change in the PMPI was 4.2. 1989: 1.9; 1990: 2.8; 1991: 3.3; 1992: 2.2; 1993: 0.1; 1994: -0.7; 1995: -1.9; 1996: -2.2; 1997: 0.04; 1998: -0.1; 1999: 0.2; 2000: 0.4; 2001: -0.03; 2002: -0.1; 2003: 0.1; 2004: 0.7; 2005: 0.5; 2006: -0.2; 2007: 0.0; 2008: -0.1; 2009: 0.2; 2010: -0.5; 2011: -0.1; 2012: 0.3; 2013: -0.1; 2014: 0.0.

The Patent Act requires the PMPRB to consider changes in the CPI, among other factors, in determining whether the price of a patented drug product is excessive. Figure 4 plots year-over-year rates of change in the PMPI against corresponding changes in the CPI. General price inflation, as measured by the CPI, has exceeded the average increase in patented drug prices almost every year since 1988. In 2014, the CPI rose by 2.0%, while the PMPI was on average unchanged from 2013 to 2014 at 0.0%.

Figure 4. Annual Rate of Change, Patented Medicines Price Index (PMPI) and Consumer Price Index (CPI), 1988-2014

Figure description

This is a line graph depicting the year-over-year rates of change in the Patented Medicines Price Index (PMPI) against corresponding changes in the Consumer Price Index (CPI), in percent. In 1988, the rate of change in the PMPI was 0.041. The rate of change in the CPI was 0.04. 1989: PMPI 0.019, CPI 0.05; 1990: PMPI 0.028, CPI 0.048; 1991: PMPI 0.039, CPI 0.056; 1992: PMPI 0.021, CPI 0.015; 1993: PMPI 0.001, CPI 0.018; 1994: PMPI -0.007, CPI 0.002; 1995: PMPI -0.019, CPI 0.022; 1996: PMPI -0.022, CPI 0.015; 1997: PMPI -0.001, CPI 0.017; 1998: PMPI -0.001, CPI 0.009; 1999: PMPI 0.002, CPI 0.017; 2000: PMPI 0.005, CPI 0.027; 2001: PMPI 0.1, CPI, 2.6; 2002: PMPI -0.012, CPI 0.023; 2003: PMPI 0.001, CPI 0.028; 2004: PMPI 0.007, CPI 0.018; 2005: PMPI 0.005, CPI 0.022; 2006: PMPI -0.002, CPI 0.020; 2007: PMPI 0.000, CPI 0.022; 2008: PMPI 0.002, CPI 0.023; 2009: PMPI 0.003, CPI 0.003; 2010: PMPI -0.004, CPI 0.018; 2011: PMPI -0.001, CPI 0.029; 2012: PMPI 0.003, CPI 0.015; 2013: PMPI -0.001, CPI 0.009; 2014: PMPI 0.000, CPI 0.020.

It is not surprising that the PMPI has seldom kept pace with the CPI. The PMPRB's Guidelines allow the price of a patented drug product to rise by no more than the CPI over any three-year period. (The Guidelines also impose a cap on year-over-year price increases equal to one and one-half times the current year rate of CPI inflation.) This effectively establishes CPI inflation as an upper bound on the amount by which individual prices may rise over any three-year period.Footnote 6 Increases in the PMPI normally do not reach this upper bound because many patentees do not raise their prices by the full amount permitted under the Guidelines, or choose to reduce their prices.

Price Change by Therapeutic Class

Table 10 provides average rates of price change among patented drug products at the level of major therapeutic classes. Results in this table were obtained by applying the PMPI methodology to data segregated by their ATC Level 1 class. The last column provides a decomposition of overall PMPI change, with each entry representing the component of the overall change attributable to drug products in the corresponding therapeutic class. By this measure, the unchanged PMPI (0.0%) reflects a general state of price stability across therapeutic classes. Note that all of the therapeutic classes saw an average rate of price change below the rate of CPI inflation.Footnote 7

Table 10. Change in the Patented Medicines Price Index (PMPI), by Major Therapeutic Class, 2014

| Therapeutic Class |

Share: 2014 Sales (%) |

Price Change: 2013 to 2014 (%) |

Contribution: Change in PMPI (%) |

| A: Alimentary tract and metabolism |

11.0 |

-0.9 |

-0.1 |

| B: Blood and blood forming organs |

5.7 |

-1.9 |

-0.1 |

| C: Cardiovascular system |

6.6 |

0.1 |

0.0 |

| D: Dermatologicals |

0.8 |

-0.3 |

0.0 |

| G: Genito-urinary system and sex hormones |

3.7 |

1.1 |

0.0 |

| H: Systemic hormonal preparations |

0.5 |

0.6 |

0.0 |

J: General antiinfectives for systemic use; and

P: Antiparasitic products* |

9.1 |

1.0 |

0.1 |

| L: Antineoplastics and immunomodulating agents |

30.8 |

0.3 |

0.1 |

| M: Musculo-skeletal system |

3.3 |

0.6 |

0.0 |

| N: Nervous system |

12.3 |

-0.1 |

0.0 |

| R: Respiratory system |

8.5 |

0.0 |

0.0 |

| S: Sensory organs |

5.3 |

-0.2 |

0.0 |

| V: Various |

2.5 |

-3.1 |

-0.1 |

| All therapeutic classes |

100.0† |

0.0 |

0.0 |

* These groups have been combined for reasons of confidentiality.

† Values in this column may not add to 100.0 due to rounding.

Source: PMPRB

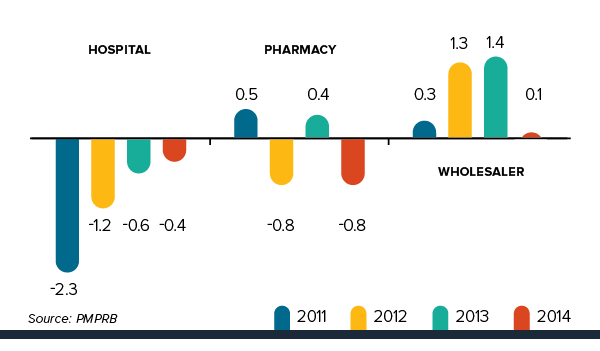

Price Change by Class of Customer

Figure 5 presents average rates of price change by class of customer.Footnote 8 These results were obtained by applying the PMPI methodology separately to sales data for hospital, pharmacy and wholesale customers.Footnote 9 The 2014 rates of price change for these classes were, respectively, -0.4%, -0.8% and 0.1%.

Figure 5. Annual Rate of Change (%), Patented Medicine Price Index (PMPI), by Class of Customer, 2011–2014

Figure description

This is a bar graph depicting average rates of price change by class of customer, in percent. In 2011, the average rate of price change for hospitals was -2.3. For pharmacies, it was 0.5. For wholesalers, it was 0.3. 2012: Hospital -1.2, Pharmacy -0.8, Wholesaler 1.3; 2013: Hospital -0.6, Pharmacy 0.4, Wholesaler 1.4; 2014: Hospital -0.4, Pharmacy -0.8, Wholesaler 0.1.

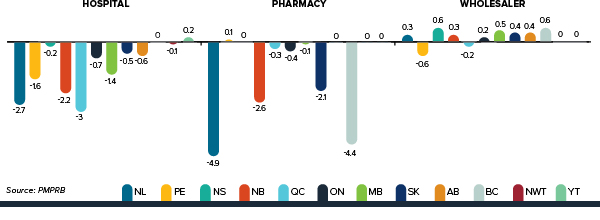

Price Change by Province/Territory

Figure 6 presents average annual rates of price change by province/territory, obtained by applying the PMPI methodology to sales data segregated by the province/territory in which the sale occurred. These results indicate that, between 2013 and 2014, prices of patented drug products in PEI fell on average. The largest average price increase occurred in Nova Scotia (0.4%).

Figure 6. Annual Rate of Price Change, by Province/Territory* and Class of Customer†, 2014

*Values for Nunavut are included in the Northwest Territories (NWT).

†Results for “All” in Figure 6 does not include the class of customer “other”.

Figure description

This is a bar graph depicting average annual rates of price change by province/territory and class of customer in between 2013 and 2014.

For hospitals:

- Newfoundland -2.7

- PEI -1.6

- Nova Scotia -0.2

- New Brunswick -2.2

- Quebec -3.0

- Ontario -0.7

- Manitoba -1.4

- Saskatchewan -0.5

- Alberta -0.6

- British Columbia 0.0

- Northwest Territories -0.1

- Yukon 0.2

For pharmacies:

- Newfoundland -4.9

- PEI 0.1

- Nova Scotia 0.0

- New Brunswick -2.6

- Quebec -0.3

- Ontario -0.4

- Manitoba -0.1

- Saskatchewan -2.1

- Alberta 0.0

- British Columbia -4.4

- Northwest Territories 0.0

- Yukon 0.0

For wholesalers:

- Newfoundland 0.3

- PEI -0.6

- Nova Scotia 0.6

- New Brunswick 0.3

- Quebec -0.2

- Ontario 0.2

- Manitoba 0.5

- Saskatchewan 0.4

- Alberta 0.4

- British Columbia 0.6

- Northwest Territories 0.0

- Yukon Territories 0.0.

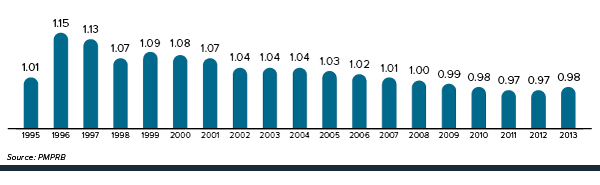

Price Behaviour after Introduction

Does the price of a typical patented drug product change much in the years after it enters the Canadian market? To answer this question, Figure 7 provides the average ratio of the 2014 price to introductory price (the price at which the drug product was sold in its first year on the Canadian market).

Figure 7. Average Ratio of 2014 Price to Introductory Price, by Year of Introduction

Figure description

This is a bar graph that depicts the average ratio of the 2014 price of a typical patented drug product to the introductory price (the price at which the drug product was sold in its first year on the Canadian market).

In 1995, the average ratio between the 2014 price to the introductory price is 1.01. In 1996, 1.15; 1997, 1.13; 1998, 1.07; 1999, 1.09; 2000, 1.08; 2001, 1.07; 2002, 1.04; 2003, 1.04; 2004, 1.04; 2005, 1.03; 2006, 1.02; 2007, 1.01; 2008, 1.00; 2009, 0.99; 2010, 0.98; 2011, 0.97; 2012, 0.97; 2013, 0.98.

The results in Figure 7 imply no consistent tendency for prices to either rise or fall substantially after introduction, with the average 2014 price of a typical patented drug product being within a few percentage points of its introductory price.Footnote 10 For example, the prices of products introduced a decade ago are only 4% higher in 2014.

Price Change by Country

In accordance with the Act and the Regulations, patentees must report publicly available prices of patented drug products for seven foreign comparator countries (“PMPRB7”): France, Germany, Italy, Sweden, Switzerland, the United Kingdom and the United States.

The PMPRB uses this information to:

- conduct international price comparison tests (as specified in its Guidelines)

- compare the Canadian prices of patented drug products to those prevailing in other countries

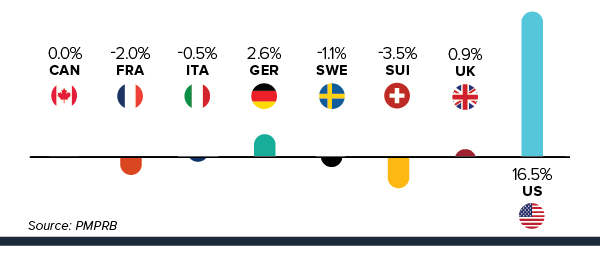

Figure 8 gives the average annual rates of price change for Canada and each of the seven comparator countries. These results were obtained by applying the PMPI methodology (with weights based on Canadian sales patterns) to the international price data that patentees have submitted to the PMPRB. Note that results for the United States are based on prices that incorporate prices from the US Federal Supply Schedule (FSS).Footnote 11

Figure 8. Annual Average Rates of Price Change, Canada and Comparator Countries, 2014

Figure description

This is a bar graph depicting the average annual rates of price change for Canada and each of the seven comparator countries, in percent. In Canada, the average annual rate of price change was 0.0. France, -2.0; Italy, -0.5; Germany, 2.6; Sweden, -1.1; Switzerland, -3.5; UK, 0.9; US, 16.5.

The results in Figure 8 indicate that in 2014, the United States saw prices rise at an average rate of 16.5%. The United Kingdom and Germany saw more modest average price increases, while prices in France, Italy, Switzerland and Sweden declined.

The foreign market results are based on publicly available ex-factory gate price information (generally for the retail customer class) submitted by patentees to the PMPRB. The Canadian rate of change, however, is based on the actual average transaction prices and is net of rebates and discounts provided by manufacturers to their direct customers.

Comparison of Canadian Prices to Foreign Prices

Tables 11 and 12 provide detailed statistics comparing the foreign prices of patented drug products to their Canadian prices. Each table provides two sets of average price ratios. These are differentiated according to the method by which foreign prices were converted to their Canadian dollar equivalents. The tables also give the numbers of drug products (DINs) and the volume of sales encompassed by each reported price ratio.Footnote 12

The average price ratios given in Tables 11 and 12 are sales-weighted arithmetic means of price ratios obtained for individual drug products, with weights based on Canadian sales patterns. Average price ratios constructed in this way provide exact answers to questions of the following type:

How much more/less would Canadians have paid for the patented drug products they purchased in 2014 had they paid Country X prices rather than Canadian prices?

For example, Table 11 states that the 2014 average French-to-Canadian price ratio was 0.75. This means Canadians would have paid 25% less for the patented drug products they purchased in 2014 had they bought these products at French prices.

For many years, the PMPRB has reported average foreign-to-Canadian price ratios with foreign prices converted to their Canadian dollar equivalents by means of market exchange rates. (More exactly, the 36-month moving averages of market rates the PMPRB normally uses in applying its Guidelines.) Table 11 also reports foreign-to-Canadian price ratios with currency conversion at purchasing power parity (PPP). The PPP between any two countries measures their relative costs of living expressed in units of their own currencies. In practice, cost of living is determined by pricing out a standard “basket” of goods and services at the prices prevailing in each country.

Because PPPs are designed to represent relative costs of living, they offer a simple way to account for differences in overall national price levels when comparing individual prices, incomes and other monetary values across countries. When applied to the calculation of average foreign-to-Canadian price ratios they produce statistics answering questions of this type:

How much more/less consumption of other goods and services would Canadians have sacrificed for the patented drug products they purchased in 2014 had they lived in Country X?

Questions of this type cannot be answered by simply comparing drug prices. Rather, one must first calculate what each price represents in terms of goods and services foregone. PPPs are designed for such purposes.

Bilateral Comparisons

Table 11 provides bilateral comparisons of prices in each of the PMPRB’s seven comparator countries to corresponding Canadian prices. Focusing on the results with currency conversion at market exchange rates, it appears that, as in previous years, Canadian prices were typically within the range of prices observed among the comparator countries. Prices in France, Italy, United Kingdom, Sweden and Switzerland were appreciably lower than Canadian prices, while those in Germany were higher. As in previous years, prices reported for the United States were much higher than prices in Canada or any other comparator country.

Table 11. Average Foreign-to-Canadian Price Ratios, Bilateral Comparisons, 2014

At Market Exchange Rates

|

Canada |

France |

Italy |

Germany |

Sweden |

Switzerland |

United Kingdom |

United States |

| Average price ratio 2014 |

1.00 |

0.75 |

0.87 |

1.14 |

0.96 |

0.97 |

0.86 |

2.47 |

| Average price ratio 2013 |

1.00 |

0.72 |

0.79 |

1.04 |

0.90 |

0.95 |

0.77 |

2.07 |

At Purchasing Power Parities

|

Canada |

France |

Italy |

Germany |

Sweden |

Switzerland |

United Kingdom |

United States |

| Average price ratio 2014 |

1.00 |

0.82 |

1.05 |

1.32 |

0.88 |

0.80 |

0.93 |

2.97 |

| Average price ratio 2013 |

1.00 |

0.78 |

0.97 |

1.23 |

0.85 |

0.78 |

0.86 |

2.53 |

| Number of patented drug products 2014 |

1,345 |

772 |

849 |

974 |

940 |

900 |

946 |

1,100 |

| Sales ($millions) |

13,739.82 |

10,009.96 |

10,949.53 |

11,992.04 |

11,606.85 |

11,500.61 |

11,637.63 |

12,763.82 |

Source: PMPRB

It is important to note that it is not always possible to find a matching foreign price for each and every patented drug product sold in Canada. Table 11 displays how often an international price comparison was available for each of the comparator countries. For example, out of 1,345 patented drug products under the PMPRB's jurisdiction in 2014, a publicly available ex-factory gate price for France was available only 58% of the time, whereas for the US the number was 82%, by far the highest. Given the integrated nature of the Canadian and US supply chain, it is not uncommon for the US to be the only other country for which a comparator price to a product sold in Canada is available, in which case it is deemed to constitute the international median price as per the PMPRB's methodology.

Average price ratios obtained with currency conversion at PPPs tell the same story. When international differences in cost of living are accounted for, it appears Canadians incurred a larger consumption cost for the patented drug products they purchased in 2014 than did residents of every other comparator country except Italy, Germany and the United States.

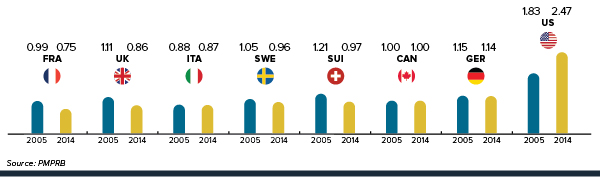

Figure 9 puts these results in historical perspective. In 2005, Canadian prices were, on average, approximately equal to or below corresponding prices in all comparators other than Italy. By 2014, Canadian prices were decidedly above prices in the United Kingdom, France and Italy, and somewhat higher than prices in Sweden and Switzerland.

Figure 9. Average Foreign-to-Canadian Price Ratios: 2005, 2014

Figure description

This is a bar graph depicting the average foreign-to-Canadian price ratios in 2005 and 2014.

- France — 2005: 0.99, 2014: 0.75

- United Kingdom — 2005: 1.11, 2014: 0.86

- Italy — 2005: 0.88, 2014: 0.87

- Sweden — 2005: 1.05, 2014: 0.96

- Switzerland — 2005: 1.21, 2014: 0.97

- Canada — 2005: 1.00, 2014: 1.00

- Germany — 2005: 1.15, 2014: 1.14

- United States — 2005: 1.83, 2014: 2.47

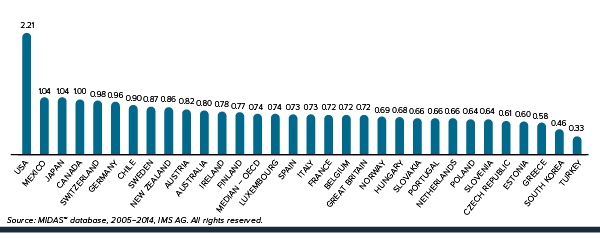

If the patented medicine is being sold in one or more of the comparator countries (PMPRB7), the patentee must report the publicly available ex-factory prices to the PMPRB for each class of customer.Footnote 13 In order to assess how Canada compares to a basket of countries beyond the PMPRB7, Figure 10 uses Canadian and international prices reported in the IMS AG MIDAS™ database at the ex-factory manufacturer level, reflecting all sales to the pharmacy and hospital sectors.

The international price comparisons reported in Figure 10 provide a bilateral price comparison using all countries in the Organisation for Economic Co-operation and Development (OECD) available in MIDAS™. The average foreign-to-Canadian price ratios are constructed using exactly the same approach employed to produce the ratios presented in Figure 9. These are Canadian sales-weighted arithmetic averages of the corresponding foreign-to-Canadian price ratios for individual drugs.Footnote 14 As shown below, Canadian prices are on average approximately 26% above the median of the OECD and are fourth highest among the 31 countries.

Figure 10. Average Foreign-to-Canadian Price Ratios, Patented Drugs, OECD, 2014

Figure description

This is a bar graph depicting the average foreign-to-Canadian price ratios of patented drugs in 2014 for OECD countries, using Canadian and international prices reported in the IMS AG MIDAS™ database. United States: 2.21; Mexico: 1.04; Japan: 1.04; Canada: 1.00; Switzerland: 0.98; Germany: 0.96; Chile: 0.90; Sweden: 0.87; New Zealand: 0.86; Austria: 0.82; Australia: 0.80; Ireland: 0.78; Finland: 0.77; median for the OECD: 0.74; Luxembourg: 0.74; Spain: 0.73; Italy: 0.73, France: 0.72; Belgium: 0.72; Great Britain: 0.72; Norway: 0.69; Hungary: 0.68; Slovakia: 0.66; Portugal: 0.66; Netherlands: 0.66; Poland: 0.64; Slovenia: 0.64; Czech Republic: 0.61; Estonia: 0.60; Greece: 0.58; South Korea: 0.46; Turkey: 0.33.

Multilateral Price Comparisons

Table 12 provides average foreign-to-Canadian price ratios using several multilateral measures of foreign prices. The median international price (MIP) is the median of prices observed among the seven comparator countries. Other multilateral price ratios compare the minimum, maximum and simple mean of foreign prices to their Canadian counterparts.

Table 12. Average Foreign-to-Canadian Price Ratios, Multilateral Comparisons, 2014

|

Median |

Minimum |

Maximum |

Mean |

| Average price ratio at market exchange rates |

1.13 |

0.82 |

2.48 |

1.31 |

| Average price ratio at purchasing power parities |

1.19 |

0.93 |

2.95 |

1.45 |

| Number of patented drug products |

1,262 |

1,262 |

1,262 |

1,262 |

| Sales ($millions) |

13,448.29 |

13,448.29 |

13,448.29 |

13,448.29 |

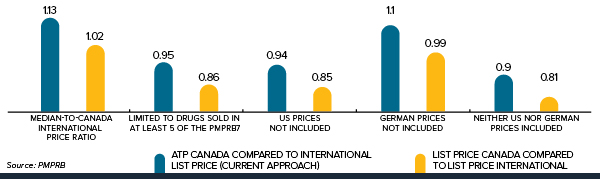

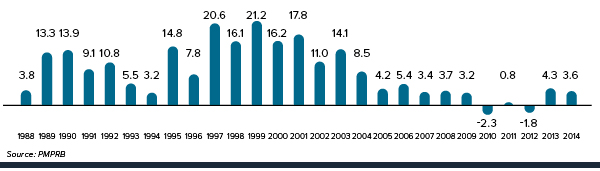

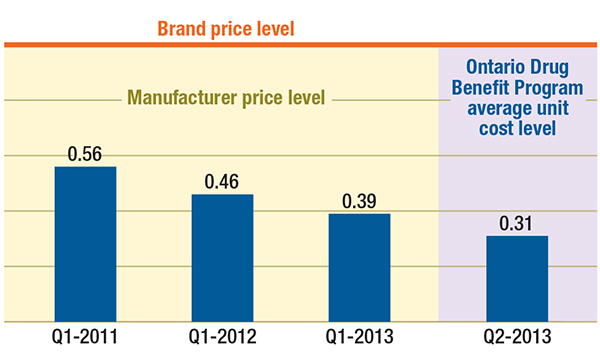

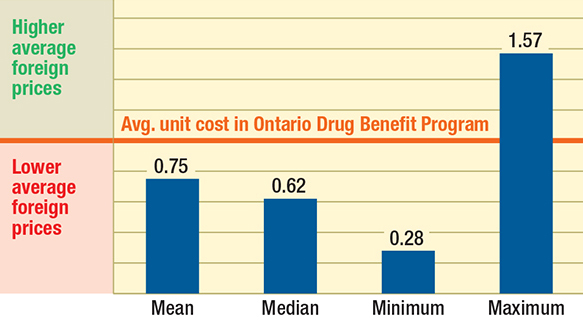

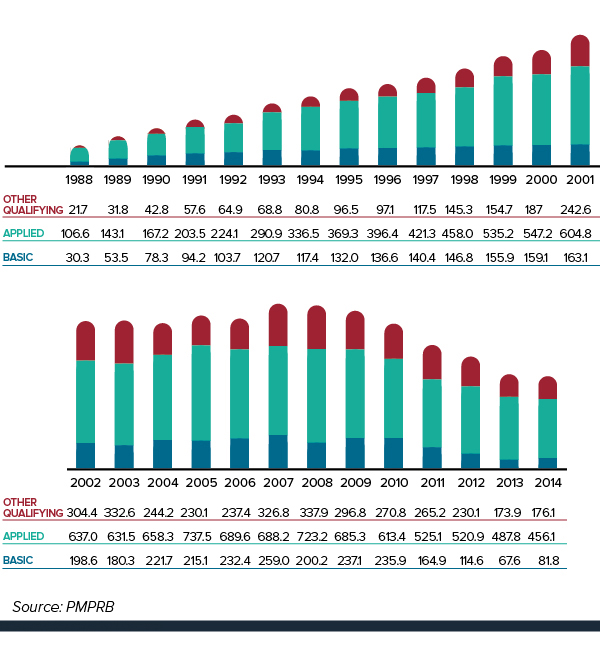

Source: PMPRB